ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

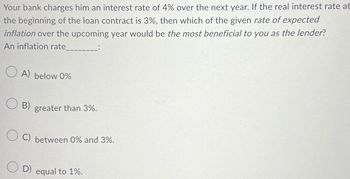

Transcribed Image Text:Your bank charges him an interest rate of 4% over the next year. If the real interest rate at

the beginning of the loan contract is 3%, then which of the given rate of expected

inflation over the upcoming year would be the most beneficial to you as the lender?

An inflation rate

OA) below 0%

B) greater than 3%.

OC) between 0% and 3%.

D) equal to 1%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q.6 plz help me.arrow_forwardm 14:41 Use the table below to calculate the inflation rate. Year 1 2 3 Price of the Market Basket $1,868 $1,952 $2,065 Using Year 1 as a base year, what is the inflation rate in Year 2? W Multiple Choice O 4.20 percent 104.50 percent O 5.79 percent 4.50 percent zoom 73 82,244 A MacBook Pro N @ # $ % & 1 2 3 4 5 6 7 8arrow_forward! Required information If the inflation rate is 5% per year, how many years will it take for the cost of an item to double, if the price increases only by the inflation rate? Obtain the answer using an equation. The number of years it will take for the cost of an item to double isarrow_forward

- A labor union wants the union members' real wages to go up by 3.5% for the coming year. How much of an increase in wages should the union ask for, given that the inflation rate is expected to be 5.3% for the coming year? A. 3.5% OB. 8.8% C. 1.8% OD. 15.0%arrow_forwardSuppose you start saving for retirement when you are 31 years old. You invest $5,200 the first year and increase this amount by 4% each year to match inflation for a total of 25 years. The interest rate is 9% per year. 1. How much will you have in account immediately after making the last deposit at age 55 OA. $1,174,047 OB. $71,848 OC. $578,420 O D. $619,553 www 2. How much will you have, if the interest rate was only 4% per year (instead of 9%)? OA. $125,000 B. $303,117 OC. $333,230 OD. $346,559arrow_forwardQuestion 2 The GDP deflator in year 4 is 120 and the GDP deflator in year 5 is 130. The rate of inflation between years 4 and 5 is O -10%. O 7.7%. O 8.33%. O 10%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education