Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

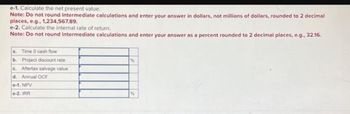

Transcribed Image Text:e-1. Calculate the net present value.

Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal

places, e.g., 1,234,567.89.

e-2. Calculate the internal rate of return.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Time 0 cash flow

b. Project discount rate

c. Aftertax salvage value

d. Annual OCF

e-1. NPV

e-2. IRR

%

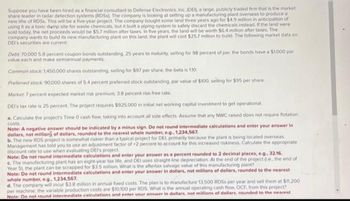

Transcribed Image Text:Suppose you have been hired as a financial consultant to Defense Electronics, Inc. (DEI), a large, publicly traded firm that is the market

share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a

new line of RDSs. This will be a five-year project. The company bought some land three years ago for $4.9 million in anticipation of

using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were

sold today, the net proceeds would be $5.7 million after taxes. In five years, the land will be worth $6.4 million after taxes. The

company wants to build its new manufacturing plant on this land; the plant will cost $25.7 million to build. The following market data on

DEI's securities are current

Debt: 70,000 5.8 percent coupon bonds outstanding, 25 years to maturity, selling for 98 percent of par, the bonds have a $1,000 par

value each and make semiannual payments.

Common stock: 1,450,000 shares outstanding, selling for $97 per share, the beta is 1.10.

Preferred stock: 90,000 shares of 5.4 percent preferred stock outstanding, par value of $100, selling for $95 per share.

Market: 7 percent expected market risk premium; 3.8 percent risk-free rate.

DEI's tax rate is 25 percent. The project requires $925,000 in initial net working capital investment to get operational

a. Calculate the project's Time 0 cash flow, taking into account all side effects. Assume that any NWC raised does not require flotation

costs.

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.

b. The new RDS project is somewhat riskier than a typical project for DEI, primarily because the plant is being located overseas.

Management has told you to use an adjustment factor of +2 percent to account for this increased riskiness. Calculate the appropriate

discount rate to use when evaluating DEI's project.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

c. The manufacturing plant has an eight-year tax life, and DEI uses straight-line depreciation. At the end of the project (.e., the end of

Year 5), the plant can be scrapped for $3.5 million. What is the aftertax salvage value of this manufacturing plant?

Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest

whole number, e.g., 1,234,567.

d. The company will incur $3.8 million in annual fixed costs. The plan is to manufacture 13,500 RDSS per year and sell them at $11.200

per machine, the variable production costs are $10,100 per RDS. What is the annual operating cash flow, OCF, from this project?

Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars. rounded to the nearest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $11 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $69 million, and the expected cash inflows would be $23 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $24 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ million IRR: % Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forwardSuppose you have been hired as a financial consultant to Defense Electronics, Inc. (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. The company bought some land three years ago for $4.9 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $5.7 million. In five years, the aftertax value of the land will be $6.1 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $32.32 million to build. The following market data on DEI's securities is current: Debt: 234,000 7.4 percent coupon bonds outstanding, 25 years to maturity, selling for 109 percent of par; the…arrow_forwardRoyal Dutch Shell PLC (ticker RDS) is a large, multinational oil company. The firm is preparing to purchase a semi-submersible oil production platform for $18 million. Additionally, it is going to cost $1,7 million t move the platform to the Mars oil-field and secure it in location. While preparing the oil field for production, an additional $2.7 million dollars will be spent on research, geological surveys, and training If this acquisition is going to be fully depreciated over 5 years using straight-line depreciation, what are the yearly depreciation expenses in this case? OA. $4.14 million OB. $3.94 million OC. $360 million OD. $4.48 millionarrow_forward

- Suppose you have been hired as a financial consultant to Defense Electronics, Incorporated (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSs). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. The company bought some land three years ago for $4.6 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $7.7 million on an aftertax basis. In five years, the aftertax value of the land will be $8.1 million, but the company expects to keep the land for a future project. The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $29.8 million to build. The following market data on DEI’s securities are current: Debt: 185,000 bonds with a coupon rate of 7.7 percent outstanding, 25…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $9.66 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $57 million, and the expected cash inflows would be $19 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $20 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ IRR: % million Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 15%. Should this project be undertaken? 1. The project should not be undertaken under the "no mitigation" assumption. 2. The project should be undertaken only under the " no mitigation" assumption. 3. The project should not be undertaken under the "mitigation" assumption. 4. Even when mitigation is considered the project has a positive NPV, so it should be undertaken. 5. Even when mitigation is considered the project has a…arrow_forward

- Baghibenarrow_forwardam. 137.arrow_forwardAn electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $269.87 million, and the expected cash inflows would be $90 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $93.62 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 16%. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not…arrow_forward

- Vijayarrow_forwardSuppose you have been hired as a financial consultant to Defense Electronics, Incorporated (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSS. This will be a five-year project. The company bought some land three years ago for $7.2 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be $7.66 million after taxes. In five years, the land will be worth $7.96 million after taxes. The company wants to build its new manufacturing plant on this land; the plant will cost $13.24 million to build. The following market data on DEI's securities are current: Debt: Common stock: Preferred stock: Market: 91,200 6.9 percent coupon bonds outstanding, 23 years to maturity, selling for 94.4 percent of par; the…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year o to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ million IRR: Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education