Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:K

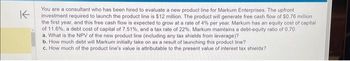

You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront

investment required to launch the product line is $12 million. The product will generate free cash flow of $0.76 million

the first year, and this free cash flow is expected to grow at a rate of 4% per year. Markum has an equity cost of capital

of 11.6%, a debt cost of capital of 7.51%, and a tax rate of 22 %. Markum maintains a debt-equity ratio of 0.70.

a. What is the NPV of the new product line (including any tax shields from leverage)?

b. How much debt will Markum initially take on as a result of launching this product line?.

c. How much of the product line's value is attributable to the present value of interest tax shields?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is considering a project that will generate perpetual after-tax cash flows of $16,000 per year beginning next year. The project has the same risk as the firm's overall operations and must be financed externally. Equity flotation costs 14 percent and debt issues cost 6 percent on an after-tax basis. The firm's D/E ratio is 0.6. What is the most the firm can pay for the project and still earn its required return? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar. Maximum the firm can payarrow_forwardBetter Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.3 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $583,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year’s forecast sales. The firm estimates production costs equal to $1.10 per trap and believes that the traps can be sold for $5 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 40%, and the required rate of return on the project is 12%. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.6 0.8 0.9 0.9 0.8 0.6 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV?arrow_forwardTannen Industries is considering an expansion. The necessary equipment would be purchased for $12 million, and the expansion would require an additional $3 million investment in net operating working capital. The tax rate is 40%. What is the initial investment outlay? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value.$arrow_forward

- Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $6.6 million. The equipment will be depreciated straight-line over 6 years, but, in fact, it can be sold after 6 years for $643,000. The firm believes that working capital at each date must be maintained at a level of 15% of next year’s forecast sales. The firm estimates production costs equal to $1.90 per trap and believes that the traps can be sold for $6 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm’s tax bracket is 40%, and the required rate of return on the project is 12%. Year: 0 1 2 3 4 5 6 Thereafter Sales (millions of traps) 0 0.4 0.5 0.7 0.7 0.5 0.3 0 Suppose the firm can cut its requirements for working capital in half by using better inventory control systems. By how much will this increase project NPV? (Do not round your intermediate…arrow_forwardalbot Industries is considering launching a new product. The new manufacturing equipment will cost $18 million, and production and sales will require an initial $5 million investment in net operating working capital. The company's tax rate is 25%. Enter your answers as a positive values. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answers to two decimal places. What is the initial investment outlay? $ million The company spent and expensed $150,000 on research related to the new project last year. What is the initial investment outlay? $ million Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.8 million after taxes and real estate commissions. What is the initial investment outlay? $ millionarrow_forwardYou are thinking of making an investment in a new factory. The factory will generate revenues of $1,960,000 per year for as long as you maintain it. You expect that the maintenance costs will start at $90,160 per year and will increase 5% per year thereafter. Assume that all revenue and maintenance costs occur at the end of the year. You intend to run the factory as long as it continues to make a positive cash flow (as long as the cash generated by the plant exceeds the maintenance costs). The factory can be built and become operational immediately and the interest rate is 6% per year. a. What is the present value of the revenues? - b. What is the present value of the maintenance costs? c. If the plant costs $19,600,000 to build, should you invest in the factory? EIERarrow_forward

- GBATT has a capital need of $100 million to fund its operations. GBATT has an equity investor that has made an investment in the common stock of GBATT for 60% of this amount but there is the anticipation is that they will earn a 15% return on this investment through capital returns and dividends. This level of anticipated return takes into account the anticipated risk in the investment. With this amount of capital support, GBATT was able to find a lender who will provide the balance of the capital needed at an interest rate of 10% with such debt to be paid out over 10 years. Such lender will require GBATT to fully collateralize its buildings in support of its bond payments. What is the cost of capital in this example?arrow_forwardA manufacturing company is considerign the purchase of new machinery to increase its production capacity. The company has identified a new machine that costs $500,000 and is expected to increase production by 20%. The company expects to sell the additional products for $600,000, resulting in a net profit of $100,000. The company can finance the purchase through a bank loan with an interest rate of 5% over a five year term. What is the expected return on investment (ROI) for the purchase of the new machinery 5% 10% 20% 25%arrow_forwardYou are a consultant who was hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $10 million. The product will generate free cash flow of $750,000 the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of capital of 11.3%, a debt cost capital of 4.33%, and a tax rate of 25%. Markum maintains a debt-equity ratio of 0.50. How much debt will Markum initially take on as a result of launching this product line? a) $2.34 million b) $4.29 million c) $3.70 million d) $2.94 million e) None of the answers is correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education