Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

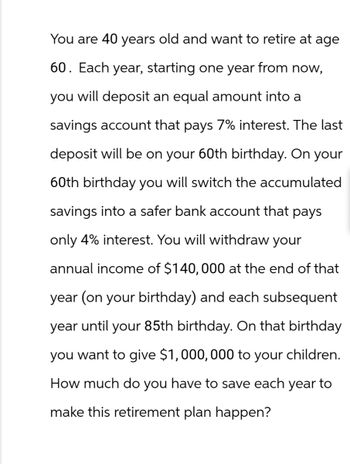

Transcribed Image Text:You are 40 years old and want to retire at age

60. Each year, starting one year from now,

you will deposit an equal amount into a

savings account that pays 7% interest. The last

deposit will be on your 60th birthday. On your

60th birthday you will switch the accumulated

savings into a safer bank account that pays

only 4% interest. You will withdraw your

annual income of $140, 000 at the end of that

year (on your birthday) and each subsequent

year until your 85th birthday. On that birthday

you want to give $1,000,000 to your children.

How much do you have to save each year to

make this retirement plan happen?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have just taken out a mortgage on a $250,000 home that requires monthly payments over the next 25 years. In addition, you want to retire at the end of 25 years. You start contributing $450 at the end of each month into a dedicated retirement account and your employer contributes matching funds into that same account. The final payment into the account will be made on the day you begin retirement. The APR on the mortgage is 4.3 percent and funds deposited into the retirement account also earn an annual 4.3 percent return. If you want to retire with $1 million in retirement savings, how much additional funds will be needed to achieve this retirement objective? (Ignore closing costs, taxes and inflation.) a. $516,670.25 b. $537,283.41 c. $718,390.00 d. $758,335.72 e. $859,195.00arrow_forwardYou are investing in a retirement account and plan to deposit $5,000 per year into the account for the next 20 years, starting from today. The account offers an annual interest rate of 6%. How much money will you have in your retirement account at the end of the 20-year period?arrow_forwardYou want to retire at age 65. You decide to make a deposit to yourself at the end of each year into an account paying 14%, compounded annually. Assuming you are now 25 and can spare $1,300 per year, how much will you have when you retire at age 65? (Give your answer to the nearest cent.)arrow_forward

- You annually invest $2,000 in an individual retirement account (IRA) starting at the age of 30 and make the contributions for 15 years. Your twin sister does the same starting at age 35 and makes the contributions for 25 years. Both of you earn 7 percent annually on your investment. What amounts will you and your sister have at age 60? Use Appendix A and Appendix C to answer the question. Round your answers to the nearest dollar.Amount on your account: $ Amount on your sister's account: $ Who has the larger amount at age 60?-Select-You haveYour sister hasItem 3 the larger amount.arrow_forwardYou decide to make monthly payments into a retirement fund earning 4.75% compounded monthly. Note: Payments are made at the end of each period. Use this information for the questions below. Use the Saving for Retirement information above to answer this question. If your monthly payments are $147, how much will you have in your retirement fund after 40 years? $_________. Round to the nearest dollar.arrow_forwardYou are saving for retirement. To live comfortably, you decide you will need to save $3,000,000 by the time you are 65. Today is your 30th birthday, and you decide, starting today and continuing on every birthday up to and including your 65th birthday, that you will put the same amount into a savings account. If the interest rate is 6%, how much must you set aside each year to make sure that you will have $3,000,000 in the account on your 65th birthday? The amount to deposit each year is $ (Round to the nearest cent.)arrow_forward

- To prepare for retirement, you are going to deposit money into a pension plan account every month for the next 25 years. The pension plan has a 6.96% annual rate that compounds monthly. How much money will be in the account after 25 years if for the next 25 years you deposit $465.86 into the pension plan every month? First find the interest rate per period to four decimal places: i = Next find the total number of deposits: n = Finally, find the total amount of money in the account after 25 years: FV =arrow_forwardYou want to retire at age 65. You decide to make a deposit to yourself at the end of each year into an account paying 3%, compounded annually. Assuming you are now 25 and can spare $1,400 per year, how much will you have when you retire at age 65? (Round your answer to the nearest cent.)_____$arrow_forwardYou have decided to start a savings plan for your retirement. You plan to make an annual deposit of $50,000 each year for the next 6 years. The first deposit to be made one year from today. The bank pays a nominal interest rate of 5% annually. How much your savings account with the bank be if you leave the money in the bank to be withdrawn all in 19 years from today? Round to the nearest $0.01. DO NOT use the $sign. Do not use commas to separate thousands. For example if you obtain $1,433.728 then enter 1433.73; if you obtain $432 then enter 432.00 Your Answer: Answerarrow_forward

- Assume you are now 21 years old and will start working as soon as you graduate from college. You plan to start saving for your retirement on your 25th birthday and retire on your 65th birthday. After retirement, you expect to live at least until you are 85. You wish to be able to withdraw $38,000 (in today's dollars) every year from the time of your retirement until you are 85 years old (i.e., for 20 years). The average inflation rate is likely to be 5 percent. Problem 6.42(a) X Your answer is incorrect. Calculate the lump sum you need to have accumulated at age 65 to be able to draw the desired income. Assume that the annual return on your investments is likely to be 10 percent. (Round answer to 2 decimal places, e.g. 15.25. Round intermediate value to 3 decimal places, e.g. 359400.312. Do not round factor values.) Lump sum amount accumulated at age 65 $ 10463.384arrow_forwardYou plan to place $1,200 per year into a Roth IRA. You expect to earn 6% APR and you will place this amount into the account for 35 years. How much will you have in the account in 35 years? Round to the nearest $1,000.arrow_forwardYou are saving for retirement. To live comfortably, you decide you will need to save $2,500,000 by the time you are 65. Today is your 32nd birthday, and you decide, starting today and continuing on every birthday up to and including your 65th birthday, that you will put the same amount into a savings account. If the interest rate is 7%, how much must you set aside each year to make sure that you will have $ 2,500,000 in the account on your 65th birthday? The amount to deposit each year must be $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education