Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

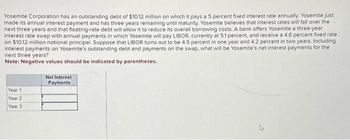

Transcribed Image Text:Yosemite Corporation has an outstanding debt of $10.12 million on which it pays a 5 percent fixed interest rate annually. Yosemite Just

made its annual interest payment and has three years remaining until maturity. Yosemite believes that interest rates will fall over the

next three years and that floating-rate debt will allow it to reduce its overall borrowing costs. A bank offers Yosemite a three-year

interest rate swap with annual payments in which Yosemite will pay LIBOR, currently at 5.1 percent, and receive a 4.6 percent fixed rate

on $10.12 million notional principal. Suppose that LIBOR turns out to be 4.5 percent in one year and 4.2 percent in two years. Including

interest payments on Yosemite's outstanding debt and payments on the swap, what will be Yosemite's net interest payments for the

next three years?

Note: Negative values should be indicated by parentheses.

Year 11

Year 2

Year 3

Net Interest

Payments

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that Sonic Foundry Corporation has a contractual debt outstanding. Sonic has available two means of settlement. It can either make immediate payment of $2,673,000, or it can make annual payments of $347,100 for 15 years, each payment due on the last day of the year. Click here to view factor tables. Which method of payment do you recommend, assuming an expected effective interest rate of 10% during the future period? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Present value of annual payments Recommended payment method Annual Payments 44arrow_forward(Related to Checkpoint 18.2) (Estimating the cost of bank credit) Paymaster Enterprises has arranged to finance its seasonal working-capital needs with a short-term bank loan. The loan will carry a rate of 14 percent per annum with interest paid in advance (discounted). In addition, Paymaster must maintain a minimum demand deposit with the bank of 10 percent of the loan balance throughout the term of the loan. If Paymaster plans to borrow $90,000 for a period of 6 months, what is the annualized cost of the bank loan? The annualized cost of the bank loan is %. (Round to two decimal places.)arrow_forwardTaggart Transcontinental currently has a bank loan outstanding that requires it to make three annual payments at the end of the next three years of $1,000,000 each. The bank has offered to allow Taggart Transcontinental to skip making the next two payments in lieu of making one large payment at the end of the loan's term in three years. If the interest rate on the loan is 6%, then the final payment that the bank will require to make Taggart Transcontinental indifferent between the two forms of payments is closest to:arrow_forward

- BroadStreet Bank has just been given a $10,000,000, 5 year CD deposit by the local municipality. The bank has agreed to pay 8%, compounded annually on this deposit. The bank wishes to choose one debt investment to cover this deposit, so that they have earnings from this investment to just cover the interest and CD principal when it comes due in 5 years. They are looking at the following 3 possibilities for investment BondMaturityCouponYTM Duration 0.00% 8.00%5.00 7.90% 8.00%5.00 17.15% 8.00%5.00 Show that each of three investment will cover the future payout required by the CD, even if market rates increase or drop by 2 % by the end of 5 years 567 123arrow_forwardThe Bellwood Company is financed entirely with equity. The company is considering a loan of $4.2 million. The loan will be repaid in equal principal installments over the next two years and has an interest rate of 8 percent. The company's tax rate is 21 percent. According to MM Proposition I with taxes, what would be the increase in the value of the company after the loan? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Increase in the valuearrow_forwardA bank is negotiating a loan. The loan can either be paid off as a lump sum of $140,000 at the end of five years, or as equal annual payments at the end of each of the next five years. If the interest rate on the loan is 10%, what annual payments should be made so that both forms of payment are equivalent? A.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education