Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

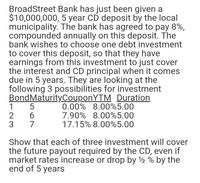

Transcribed Image Text:BroadStreet Bank has just been given a

$10,000,000, 5 year CD deposit by the local

municipality. The bank has agreed to pay 8%,

compounded annually on this deposit. The

bank wishes to choose one debt investment

to cover this deposit, so that they have

earnings from this investment to just cover

the interest and CD principal when it comes

due in 5 years. They are looking at the

following 3 possibilities for investment

BondMaturityCouponYTM Duration

0.00% 8.00%5.00

7.90% 8.00%5.00

17.15% 8.00%5.00

Show that each of three investment will cover

the future payout required by the CD, even if

market rates increase or drop by 2 % by the

end of 5 years

567

123

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Toyota S murang auto finance company is prepared to offer you a loan of $38,000 to buy a new Toyota Corolla. The repayments are at the end of every year for a period of 7 years. If the interest rate on the loan is 12%, perform loan amortization calculation that will allow you to determine the amount of the loan outstanding after making the second installment. PV of ordinary annuity-= C/r x [1-1(1+r)n]arrow_forward2. Using tab 2 in the template, create the amortization spreadsheet and answer the following questions for a $700,000 10-year adjustable-rate mortgage (ARM) loan that is fully-amortizing and has monthly payments. A teaser rate of 4.4% applies to the mortgage payments and amortization during the first 2 years of the loan. After the second , the annual interest rate on the loan is equal to the going rate on an index + a margin of 2.7%, subject to an annual interest rate cap of 2.5% and a lifetime interest rate cap of 5.8% over the initial teaser rate. Expectations for the beginning-of-year values for the appropriate index are as follows: year, Year Index 3451 3.1% 4.7% 6.5% 6 2.5% 7 2.9% 8 5.1% 9 6.6% 10 6.0% a) Based on these expectations and conditions, what would be the actual (contract) interest rates applied to the mortgage payment during years 1 through 10? b) What would be the APR on this loan, if held until maturity – assuming up-front points of 2.0%? c) What is the outstanding…arrow_forward(Loan Amortization Problem) Your company is planning to borrow $2,500,000. This will be a six-year, 2 percent per year, annual payment, fully amortized term loan. The first payment will be made one year from today. What fraction of the total annual payment made at the end of year three will represent repayment of principal? [Hint: you need only complete the first three rows of the amortization schedule to answer this question.] Step By Step please, as if writing down the solution on a sheet of paper.arrow_forward

- D3) Finance Calculate the loan risk associated with a $4 million, five-year loan to a BBB-rated corporation in the computer parts industry that has a duration of 5.8 years. The cost of funds for the bank is 8 per cent. Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 4.0 per cent. The current market rate for loans in this industry is 11 per cent.arrow_forwardTeal and Associates needs to borrow $55,000. The best loan they can find is one at 13% that must be repaid in monthly installments over the next 5- years. How much are the monthly payments? (a) State the type. sinking fund future value ordinary annuity amortization present value (b) Answer the question. (Round your answer to the nearest cent.) $ %24arrow_forwardGive typing answer with explanation and conclusion Assume you want to borrow $300,000 and have been presented with two options. The first option is a fully amortizing loan with an interest rate of 3% and $4000 of origination fees and points. The second option is an interest only loan with an interest rate of 4% and $5000 of origination fees and points. Both loans are for 30 years and have monthly payments. Further assume that if the borrower chooses the interest only loan, any money saved on the monthly payment can be invested with a projected return of 7%. Also assume that the proceeds from the investment will first be used to pay off any remaining balance on the loan. How much money will the investor have left at the end of 30 years after repaying the loan? Group of answer choices None, the investor will owe $12,373.42 $323,060.72 $22,063.08 $30,750.78arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education