Essentials of Economics (MindTap Course List)

8th Edition

ISBN: 9781337091992

Author: N. Gregory Mankiw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Don’t need explanation

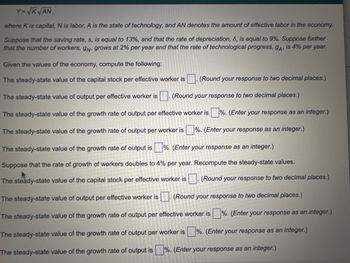

Transcribed Image Text:Y=√K √AN,

where K is capital, N is labor, A is the state of technology, and AN denotes the amount of effective labor in the economy.

Suppose that the saving rate, s, is equal to 13%, and that the rate of depreciation, 6, is equal to 9%. Suppose further

that the number of workers, gn, grows at 2% per year and that the rate of technological progress, 9A, is 4% per year.

Given the values of the economy, compute the following:

The steady-state value of the capital stock per effective worker is. (Round your response to two decimal places.)

The steady-state value of output per effective worker is. (Round your response to two decimal places.)

The steady-state value of the growth rate of output per effective worker is%. (Enter your response as an integer.)

The steady-state value of the growth rate of output per worker is%. (Enter your response as an integer.)

The steady-state value of the growth rate of output is%. (Enter your response as an integer.)

Suppose that the rate of growth of workers doubles to 4% per year. Recompute the steady-state values.

The steady-state value of the capital stock per effective worker is. (Round your response to two decimal places.)

The steady-state value of output per effective worker is. (Round your response to two decimal places.)

The steady-state value of the growth rate of output per effective worker is%. (Enter your response as an integer.)

The steady-state value of the growth rate of output per worker is%. (Enter your response as an integer.)

The steady-state value of the growth rate of output is%. (Enter your response as an integer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How is the concept of technology, as defined with the aggregate production function, different from our everyday use of the word?arrow_forwardLogarithms are especially useful for comparing series with two divergent scales since 10 percent growth always looks the same, regardless of the starting level. When absolute levels matter, the raw data are more appropriate, but when growth rates are whats important, log scales are better.arrow_forwardWould the following events usually lead to capital deepening? Why or why not? A weak economy in which businesses become reluctant to make long-term investments in physical capital. A rise in international trade. A trend in which many more adults participate in continuing education courses through their employers and at colleges and universities.arrow_forward

- For a high-income economy like the United States, what aggregate production function elements are most important in bringing about growth in GDP per capita? What about a middle-income country such as Brazil? A low-income country such as Niger?arrow_forwardAn economy starts off with a GDP per capital of 12,000 euros. How large will the GDP per capita be if it grows at an annual rate of 3 for 10 years? 3 for 30 years? 6 for 30 years?arrow_forwardWhat are the advantages of backwardness for economic growth?arrow_forward

- Over the past 50 years, many countries have experienced an annual growth rate in real GDP per capita greater than that of the United States. Some examples are China, Japan, South Korea, and Taiwan. Does that mean the United States is regressing relative to other countries? Does that mean these countries will eventually overtake the United States in terms of the growth rate of real GDP per capita? Explain.arrow_forwardList the areas where government policy can help economic growth.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning