Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

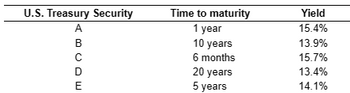

Transcribed Image Text:U.S. Treasury Security

ABCDE

Time to maturity

1 year

10 years

6 months

20 years

5 years

Yield

15.4%

13.9%

15.7%

13.4%

14.1%

Transcribed Image Text:Yield curve A firm wishing to evaluate interest rate behavior has gathered yield data on five U.S. Treasury securities, each having a different maturity and all measured at the same point in time. The summarized data follow:

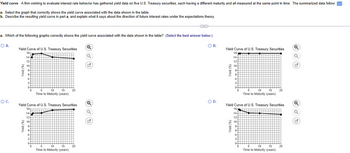

a. Select the graph that correctly shows the yield curve associated with the data shown in the table.

b. Describe the resulting yield curve in part a, and explain what it says about the direction of future interest rates under the expectations theory.

a. Which of the following graphs correctly shows the yield curve associated with the data shown in the table? (Select the best answer below.)

O A.

O C.

Yield Curve of U.S. Treasury Securities

16

14-

12-

10-

Yield (%)

8-

*

Yield (%)

6-

9

4

4

2+

to

Yield Curve of U.S. Treasury Securities

16

ute

▬▬▬▬▬▬

14-

12+

10-

8+

C

6-

5

10

15

Time to Maturity (years)

4

2+

0-

0

20

5

10

15

Time to Maturity (years)

20

Q

Q

Q

C

✔

O B.

O D.

Yield Curve of U.S. Treasury Securities

16-

14-

12-

10-

8-

9.

Yield (%)

6-

Yield (%)

9

4-

7

2-

0-

▬▬▬▬▬

4

2-

0+

0

5

10 15

Time to Maturity (years)

Yield Curve of U.S. Treasury Securities

16-

14

12-

10-

8-

6-

20

5

10 15

Time to Maturity (years)

20

Q

Q

✔

Q

Q

✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A normal yield curve a.has an upward slope b.is a sign of a coming recession c.indicates that the interest rate will decrease in the future d.All of the above.arrow_forwardYou are given the following partial covariance and correlation tables from historical data: Securities J K Market Securities J K Market 1.24 1.11 1.17 1.03 Covariance Matrix K 0.90 J 0.0020480 0.0021600 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. Correlation Matrix K 0.60 1.00 0.90 1.00 0.60 0.80 Market 0.0020480 0.0021600 Market 0.80 0.90 1.00 Ston sharing Hidel lines Wearrow_forwardi. What are the assumptions underlying the CAPM? ii. What is meant by the market portfolio?iii. Sketch the capital market line and the efficient frontier when borrowing and lending rates are equal. Label the axes and important points of your sketch. iv. Do the same for the Security Market Line v. Would you expect firms with high operating leverage to have higher betas?Explain!arrow_forward

- Which asset below is generally the most suitable benchmark measure of the risk-free return? Treasury bills Small stocks Long-term government bonds Non-investment grade bonds Common stocksarrow_forward1. What is the most accurate measure of interest rates? a) Current Yield b) Nominal Interest Rate c) Simple Interest Rate d) Yield to Maturityarrow_forwardBased on the information in the yellow shaded areas: a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML?arrow_forward

- Calculate the required rate of return for an asset that has a beta of 1.01, given a risk-free rate of %3.4 and a market return of %9.1 . b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to %11.6, what is the required rate of return for the same asset? a. The required rate of return for the asset is enter your response here%. (Round to two decimal places.) Part 2 b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to 11.6%, the required rate of return for the same asset is enter your response here%. (Round to two decimal places.)arrow_forwardWhat-if forecasting provides information regarding how much net interest income changes when interest rates are assumed to increase/decrease by various amounts. Select one: True Falsearrow_forwardWith regard to interest rate sensitivity measures and bonds: Group of answer choices C. Convexity attempts to capture the sensitivity of a bond’s duration to changes in interest rates. D. Both B & C B. Duration is related to yield approximation and convexity is related to price. A. Convexity is related to yield approximation and duration is related to pricearrow_forward

- What is the term for the type of interest rates that constitute the yield curve? What do these interest rates represent?arrow_forwardSolve this practice problem in the 2 pictures belowarrow_forwardCurrent yield is used to determine Seleccione una: a. A portion of the yield on an investment b. The payout of a bond investment c. The amount of money a bond investor will earn d. The coupon rate of a bond investmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education