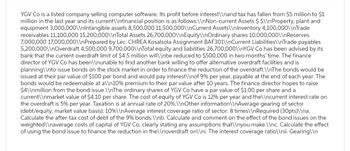

YGV Co is a listed company selling computer software. Its profit before interest\\nand tax has fallen from $5 million to $1 million in the last year and its current\\nfinancial position is as follows:\\nNon-current Assets $ $\\nProperty, plant and equipment 3,000,000\\nIntangible assets 8,500,000 11,500,000\\nCurrent Assets\\nInventory 4,100,000\\nTrade receivables 11,100,000 15,200,000\\nTotal Assets 26,700,000\\nEquity\\nOrdinary shares 10,000,000\\n Reserves 7,000,000 17,000,000\\nPrepared by Lec. CHREA Kosalsola Assignment BAF301\\nCurrent Liabilities\\nTrade payables 5,200,000\\nOverdraft 4,500,000 9,700,000\\nTotal equity and liabilities 26,700,000\\nYGV Co has been advised by its bank that the current overdraft limit of $4.5 million will\\nbe reduced to $500,000 in two months' time. The finance director of YGV Co has been\\nunable to find another bank willing to offer alternative overdraft facilities and is planning\\nto issue bonds on the stock market in order to finance the reduction of the overdraft.\\nThe bonds would be issued at their par value of $100 per bond and would pay interest\ \nof 9% per year, payable at the end of each year. The bonds would be redeemable at a\\n10% premium to their par value after 10 years. The finance director hopes to raise $4\\nmillion from the bond issue.\\nThe ordinary shares of YGV Co have a par value of $1.00 per share and a current\\nmarket value of $4.10 per share. The cost of equity of YGV Co is 12% per year and the\\ncurrent interest rate on the overdraft is 5% per year. Taxation is at annual rate of 20%.\\nOther information\\nAverage gearing of sector (debt/equity, market value basis): 10%\\nAverage interest coverage ratio of sector: 8 times\\nRequired (30pts)\\na. Calculate the after-tax cost of debt of the 9% bonds.\\nb. Calculate and comment on the effect of the bond issues on the weighted\\naverage costs of capital of YGV Co, clearly stating any assumptions that\\nyou make.\\nc. Calculate the effect of using the bond issue to finance the reduction in the\\noverdraft on\\ni. The interest coverage ratio\\nii. Gearing\\n

YGV Co is a listed company selling computer software. Its profit before interest\\nand tax has fallen from $5 million to $1 million in the last year and its current\\nfinancial position is as follows:\\nNon-current Assets $ $\\nProperty, plant and equipment 3,000,000\\nIntangible assets 8,500,000 11,500,000\\nCurrent Assets\\nInventory 4,100,000\\nTrade receivables 11,100,000 15,200,000\\nTotal Assets 26,700,000\\nEquity\\nOrdinary shares 10,000,000\\n Reserves 7,000,000 17,000,000\\nPrepared by Lec. CHREA Kosalsola Assignment BAF301\\nCurrent Liabilities\\nTrade payables 5,200,000\\nOverdraft 4,500,000 9,700,000\\nTotal equity and liabilities 26,700,000\\nYGV Co has been advised by its bank that the current overdraft limit of $4.5 million will\\nbe reduced to $500,000 in two months' time. The finance director of YGV Co has been\\nunable to find another bank willing to offer alternative overdraft facilities and is planning\\nto issue bonds on the stock market in order to finance the reduction of the overdraft.\\nThe bonds would be issued at their par value of $100 per bond and would pay interest\ \nof 9% per year, payable at the end of each year. The bonds would be redeemable at a\\n10% premium to their par value after 10 years. The finance director hopes to raise $4\\nmillion from the bond issue.\\nThe ordinary shares of YGV Co have a par value of $1.00 per share and a current\\nmarket value of $4.10 per share. The cost of equity of YGV Co is 12% per year and the\\ncurrent interest rate on the overdraft is 5% per year. Taxation is at annual rate of 20%.\\nOther information\\nAverage gearing of sector (debt/equity, market value basis): 10%\\nAverage interest coverage ratio of sector: 8 times\\nRequired (30pts)\\na. Calculate the after-tax cost of debt of the 9% bonds.\\nb. Calculate and comment on the effect of the bond issues on the weighted\\naverage costs of capital of YGV Co, clearly stating any assumptions that\\nyou make.\\nc. Calculate the effect of using the bond issue to finance the reduction in the\\noverdraft on\\ni. The interest coverage ratio\\nii. Gearing\\n

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Please provide the data in proper format as language is not legible. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:YGV Co is a listed company selling computer software. Its profit before interest\\nand tax has fallen from $5 million to $1

million in the last year and its current\\nfinancial position is as follows:\\nNon-current Assets $ $\\nProperty, plant and

equipment 3,000,000\\nIntangible assets 8,500,000 11,500,000\\nCurrent Assets\\nInventory 4,100,000\\nTrade

receivables 11,100,000 15,200,000\\nTotal Assets 26,700,000\\nEquity\\nOrdinary shares 10,000,000\\n Reserves

7,000,000 17,000,000\\nPrepared by Lec. CHREA Kosalsola Assignment BAF301\\nCurrent Liabilities\\nTrade payables

5,200,000\\nOverdraft 4,500,000 9,700,000\\nTotal equity and liabilities 26,700,000\\nYGV Co has been advised by its

bank that the current overdraft limit of $4.5 million will\\nbe reduced to $500,000 in two months' time. The finance

director of YGV Co has been\\nunable to find another bank willing to offer alternative overdraft facilities and is

planning\\nto issue bonds on the stock market in order to finance the reduction of the overdraft.\\nThe bonds would be

issued at their par value of $100 per bond and would pay interest\ \nof 9% per year, payable at the end of each year. The

bonds would be redeemable at a\\n10% premium to their par value after 10 years. The finance director hopes to raise

$4\\nmillion from the bond issue.\\nThe ordinary shares of YGV Co have a par value of $1.00 per share and a

current\\nmarket value of $4.10 per share. The cost of equity of YGV Co is 12% per year and the\\ncurrent interest rate on

the overdraft is 5% per year. Taxation is at annual rate of 20%.\\nOther information\\nAverage gearing of sector

(debt/equity, market value basis): 10%\\nAverage interest coverage ratio of sector: 8 times\\nRequired (30pts)\\na.

Calculate the after-tax cost of debt of the 9% bonds.\\nb. Calculate and comment on the effect of the bond issues on the

weighted\\naverage costs of capital of YGV Co, clearly stating any assumptions that\\nyou make.\\nc. Calculate the effect

of using the bond issue to finance the reduction in the\\noverdraft on\\ni. The interest coverage ratio\\nii. Gearing\\n

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning