Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

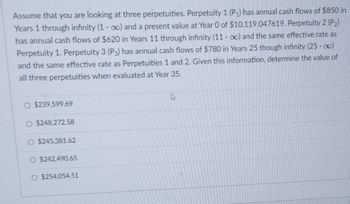

Transcribed Image Text:Assume that you are looking at three perpetuities. Perpetuity 1 (P₁) has annual cash flows of $850 in

Years 1 through infinity (1-x) and a present value at Year 0 of $10.119.047619. Perpetuity 2 (P₂)

has annual cash flows of $620 in Years 11 through infinity (11 - oo) and the same effective rate as

Perpetuity 1. Perpetuity 3 (P3) has annual cash flows of $780 in Years 25 though infinity (25 - 0)

and the same effective rate as Perpetuities 1 and 2. Given this information, determine the value of

all three perpetuities when evaluated at Year 35.

$239.599.69

O $248,272.58

$245,381.62

O$242,490.65

O $254,054.51

Expert Solution

arrow_forward

Step 1

Step 1

A perpetuity is a type of investment that pays forever. In the world of finance, perpetuity refers to an endless succession of identical financial flows.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider an inheritance that pays the beneficiary an annuity of $750 that begins immediately (an annuity due) and then annually in year 1 through year 19 (for a total of 20 years) with one exception the payment in year 14, and only 14, is not $750 but $0. Using an interest rate of 3%, determine the present value of this cash flow stream.arrow_forwardBelow is a table for the present value of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Below is a table for the present value of an annuity of $1 at compound interest. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables above, if an investment is made now for $20,000 that will generate a cash inflow of $7,000 a year for the next 4 years, what would be the present value of the investment cash inflows, assuming an earnings rate of 12%? a. $3,969 b. $22,190 c. $21,259 d. $20,352arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 1 2 3 4 0.893 0.797 0.712 0.636 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 5 1 2 3 6% 4 0.943 0.890 0.840 0.792 0.747 6% 0.943 1.833 2.673 10% 3.465 4.212 0.909 0.826 0.751 0.683 0.621 10% 0.909 1.736 12% 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 5 Using the tables provided, the internal rate of return of an investment of $227,460 that would generate an annual cash inflow of $60,000 for the next 5 years a. cannot be determined from the data given b. is 12% O c. is 6% O d. is 10%arrow_forward

- Following is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 1.833 1.736 1.690 2.673 2.487 2.402 4 3.465 3.170 3.037 4.212 3.791 3.605 Using the tables provided, the present value of $13,265.00 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, is O a. $47,820 Ob. $40,286 Oc. $31,863 Od. $13,265arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $3,000 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, is Group of answer choices $1,908 $7,206 $10,815 $9,111arrow_forwardPLEASE, WRITE THE SOLUTION ON PAPER, EXPLAINING THE ENTIRE PROCESS, STEP BY STEParrow_forward

- Assume that an annuity has an annual cash flow of $375 in Years 11 through 20 (10 cash flows). Also assume that the nominal annual interest rate that is appropriate for this annuity is 9 percent (compounded daily, and using a 365-day basis year). Given this information, determine the value o this annuity at Year 0. $ 838.62 $1,205.43 $960.89 $1,083.16 O $716.35arrow_forwardIn the information given int he following case, determine the number of years that the given oridinay annuity cash flows must continue inorder to provide the rate of return on the intial amount. Initial amount: $26,800 Annual Cash Flow: $6,561 Rate of Return: 6%arrow_forwardThe present value of an annuity due is determined on the last day of the first annuity period. on the first day of the last annuity period. on the last day of the last annuity period. on the date of the first cash flow in the series.arrow_forward

- Consider an inheritance that pays the beneficiary an annuity of $500 that begins immediately (an annuity due) and then annually in year 1 through year 17 (for a total of 18 years) with one exception - the payment in year 12, and only 12, is not $500 but $0. Using an interest rate of 3%, determine the present value of this cash flow stream.arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $6,453 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, isarrow_forwardNumber of years to provide a given return In the information given in following case, determine the number of years that the given oridinary annuity cash flows must continue in order to provide the rate of return on the initial amount. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Initial amount $112,100 Annual cash flow $25,622 Rate of return C 5% The number of investment years, n, is years. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education