EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

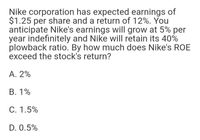

Transcribed Image Text:Nike corporation has expected earnings of

$1.25 per share and a return of 12%. You

anticipate Nike's earnings will grow at 5% per

year indefinitely and Nike will retain its 40%

plowback ratio. By how much does Nike's ROE

exceed the stock's return?

A. 2%

B. 1%

C. 1.5%

D. 0.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculation of gL and EPS Spencer Suppliess stock is currently selling for 60 a share. The firm is expected to earn 5.40 per share this year and to pay a year-end dividend of 3.60. a. If investors require a 9% return, what rate of growth must be expected for Spencer? b. If Spencer reinvests earnings in projects with average returns equal to the stocks expected rate of return, then what will be next years EPS? [Hint: gL = ROE Retention ratio.)arrow_forwardA company currently pays a dividend of $2 per share (D0 = $2). It is estimated that the company’s dividend will grow at a rate of 20% per year for the next 2 years and then at a constant rate of 7% thereafter. The company’s stock has a beta of 1.2, the risk-free rate is 7.5%, and the market risk premium is 4%. What is your estimate of the stock’s current price?arrow_forwardConroy Consulting Corporation (CCC) has a current dividend of D0 = $2.5. Shareholders require a 12% rate of return. Although the dividend has been growing at a rate of 30% per year in recent years, this growth rate is expected to last only for another 2 years (g0,1 = g1,2 = 30%). After Year 2, the growth rate will stabilize at gL = 7%. What is CCC’s stock worth today? What is the expected stock price at Year 1? What is the Year 1 expected (1) dividend yield, (2) capital gains yield, and (3) total return? What is its expected dividend yield for the second year? The expected capital gains yield? The expected total return?arrow_forward

- A company will produce $3.00 in earnings per share at the end of the year. Reinvested earnings can produce a 14% return on equity. What is the PVGO if the company decides on a 30.0% plowback policy? Assume that investors have a 9.0% required rate of return. a. $10.42 b. $12.56 c. $13.86 d. $15.56arrow_forwardIf the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to increase 4% per year, what will the stock price be next year if the required return is 15%? Select one: O a. $12.29 O b. $11.82 O c. $31.25 O d. $12.78 O e. $23.11arrow_forwardCanPro Co. is expecting that its dividend for this coming year will be $1.2 a share and that all future dividends are expected to increase by 3 percent annually. What is the required return of this stock if the current market price of the stock is $17? a. 11.00% b. 9.67% c. 11.74% d. 10.06%arrow_forward

- Albright Motors is expected to pay a year- end dividend of $3.00 a share (D1 = $3.00). The stock currently sells for $30 a share. The required (and expected) rate of return on the stock is 16 percent. If the dividend is expected to grow at a constant rate, g, what is g? a. 7.00% b. 13.00% C. 10.05% d. 5.33% e. 6.00%arrow_forward3D printing Corp paid a dividend yesterday of $1 per share. The dividend is expected to grow at 29.00% per year for 2 years and then the growth rate will slow to 2.90% per year forever. If the required rate of return is 7.40%, then what is the current stock price? (Pls use formulas) a. $34.11 b.$36.63 c. 27.62 d.$35.63 e. $33.36arrow_forwardBeta Company last year's EPS was $2.60, and its expected EPS is $2 80 next year. The company's earning growth rate is expected to be 5% AOP PAXT YEAP 16 THP, Asuming the industry average P/E ratio of 7. The company's stock price is estimated to be (hint use the information provided, choose a stock valuation approach) O $18.20 O $19.11 O $20.50 O $10 00arrow_forward

- Etling Inc.'s dividend is expected to grow at 8% for the next two years and then at 3% forever. If the current dividend is $3 and the required return is 15%, what is the price of the stock? Select one: O a. $26.00 Ob. $28.17 OC. $25.54 O d. $27.58 e. $25.10 Barrow_forwardConnolly Co.'s expected year-end dividend is D₁ = $2.75, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future. What is Connolly's expected stock price in 7 years, i.e., what is P7? Select the correct answer. a. $64.97 b. $63.05 O c. $63.53 d. $64.01 O e. $64.49arrow_forwardTarget Corporation (TGT) just paid a $3.14 dividend, and it is expected to grow at 6.25% for the next 3 years. After 3 years the dividend is expected to grow at the rate of 2.95% indefinitely. If the required return is 7.12%, what is the stock’s value today? A. $61.67 B. $70.95 C. $84.97 D. $98.04arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning