FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

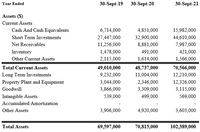

You are a Corporate Credit Analyst for your bank. A new corporate customer in the manufacturing sector approached your bank for a large credit facility in the sum of $20 million for production equipment and warehousing. The customer submitted the following financials to you.

List two strengths and two weaknesses of the borrower in relation to credit.

Transcribed Image Text:Year Ended

30-Sept-19

30-Sept-20

30-Sept-21

Assets ($)

Current Assets

Cash And Cash Equivalents

6,714,000

4,851,000

15,982,000

Short Term Investments

27,447,000

32,900,000

44,610,000

Net Receivables

11,256,000

8,881,000

7,987,000

Inventory

1,478,000

491,000

421,000

Other Current Assets

2,115,000

1,614,000

1,566,000

Total Current Assets

49,010,000

48,737,000

70,566,000

Long Term Investments

9,232,000

11,004,000

12,210,000

Property Plant and Equipment

3,044,000

2,346,000

12,326,000

Goodwill

3,866,000

3,309,000

3,115,000

Intangible Assets

539,000

499,000

569,000

Accumulated Amortization

Other Assets

3,906,000

4,920,000

3,603,000

Total Assets

69,597,000

70,815,000

102,389,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Lydex Company Comparative Balance Sheet This Year Last Year $ 940,000 0 Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: Common stock, $75 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Lydex Company 2,620,000 3,580,000 250,000 7,390,000 9,480,000 $ 16,870,000 $ 3,990,000 3,660,000 7,650,000 7,500,000 1,720,000 9,220,000 $ 16,870,000 $ 1,180,000 300,000 1,720,000…arrow_forwardCommercial bank A lends £1,000 to Mr B, who withdraws the money in cash to buy equipment for his shop, and then repays the loan over six months. After he has finished repaying, total "bank money" is the same as before the loan was made. Select one: O True O Falsearrow_forwardSantana Rey has consulted with her local banker and is considering financing an expansion of her business by obtaining a long-term bank loan. Selected account balances at March 31, 2020, for Business Solutions follow. Total assets . $120,268 Total liabilities . $875 Total equity $119,393 Required 1. The bank has offered a long-term secured note to Business Solutions. The bank’s loan procedures require that a client’s debt-to-equity ratio not exceed 0.8. As of March 31, 2020, what is the maximum amount that Business Solutions could borrow from this bank? 2. If Business Solutions borrows the maximum amount allowed from the bank, what percentage of assets would be financed (a) by debt and (b) by equity? 3. What are some factors Santana Rey should consider before borrowing the funds?arrow_forward

- I need help filling out the excel template with this given information. Kate has just completed her first year of Kate's Cards. She has been preparing monthly income statements and balance sheets, so she knows that her company has been profitable and that there is cash in the bank. She has not, however, prepared a statement of cash flows. Kate's provides you with the year-end income statement and balance sheet and asks that you construct an statement of cash flows for Kate's Cards.Additional information:1. There were no disposals of equipment during the year2. Dividends in the amount of $1,300 were paid in cash during the year.3. Prepaid expenses relate to operating expenses.Requireda. Construct an statement of cash flows for Kate's Cards for the year-ended August 31, 2019, using the indirect method. Hint: Since this was Kate's first year of operations, the beginning balance sheet account balances were zero.b. Construct an statement of cash flows for Kate's Cards for the year ended…arrow_forwardA bank loan approved for the business that has been paid into the bank account will have the following impact on the accounting equation. Group of answer choices Increase equity and increase asset Decrease an asset and decrease a liability Decrease an asset and decrease stockholders’ equity Increase an asset and increase a liabilityarrow_forwardThe company takes out a $1,000,000 loan from the bank. Provide the journal entry that would be necessary to record the transaction.arrow_forward

- Flo Choi owns a small business and manages its accounting. Her company just finished a year in which a large amount of borrowed funds was invested in a new building addition as well as in equipment and fixture additions. Choi’s banker requires her to submit semiannual financial statements so he can monitor the financial health of her business. He has warned her that if profit margins erode, he might raise the interest rate on the borrowed funds to reflect the increased loan risk from the bank’s point of view. Choi knows profit margin is likely to decline this year. As she prepares year-end adjusting entries, she decides to apply the following depreciation rule: All asset additions are considered to be in use on the first day of the following quarter. (The previous rule assumed assets are in use on the first day of the month nearest to the purchase date.) Discuss the following: Identify decisions that managers like Choi must make in applying depreciation methods. Is Choi’s rule an…arrow_forwardJon Fulkerson a credit analyst at the True Credit bank, has received a credit application from Seether LLC, a private company. An abbreviation portion of the financial information provided by the company is shown below: Total Assets:$78000 EBIT:$8600 Net Working Capital:$3900 Book value of total equity:$23000 Accumulated retained earnings:$15000 Total Liabilities:$5500 What is the z-score for this company? 2. Which is the following statement about firms will have the most control over the selling price of its produce? A.Customized wine producer B. A low-end mobile phone producer C.A small-scale petrol station outlet D.A retail outlet E. A grape growerarrow_forwardThe Pizza and Coffee Company is owned and operated by Patty Patterson who commenced the business eight years ago. The company is now faced with financial challenges and is therefore in need of financial assistance from Ready Cash a local bank. You and your group members are the accounting associates supporting the credit request to Ready Cash and they are requesting a full set of financial statements to ensure that granting the loan would be financially feasible. Yourhead of finance has furnished you with the latest trial balance for The Pizza and Coffee The company, along with other information relevant to the year under review and you are tasked to prepare the documents requested by Ready Cash. Below is the trial balance which was extracted from the books of the business on December 31, 2020, the end of the company’s financial year. you are required to collaborate and analyse the problem at hand then apply the accrual basis of accounting in the preparation of the company’s financial…arrow_forward

- Listed below are a few transactions and events of Melbourn Company. Melbourn Company guarantees the $100,000 debt of a supplier. It is not probable that the supplier will default on the debt. A disgruntled employee is suing Melbourn Company. Legal advisers believe that the company will probably need to pay damages, but the amount cannot be reasonably estimated. Indicate the proper financial reporting for each case.arrow_forwardYou have recently been hired by Davis & Company, a small public accounting firm. One of the firm’s partners, Alice Davis, has asked you to deal with a disgruntled client, Mr. Sean Pitt, owner of the city’s largest hardware store. Mr. Pitt is applying to a local bank for a substantial loan to remodel his store. The bank requires accrual based financial statements but Mr. Pitt has always kept the company’s records on a cash basis. He does not see the purpose of accrual based statements. His most recent outburst went something like this: “After all, I collect cash from customers, pay my bills in cash, and I am going to pay the bank loan with cash. And, I already show my building and equipment as assets and depreciate them. I just don’t understand the problem.Mr. Pitt has relented and agrees to provide you with the information necessary to convert his cash basis financial statements to accrual basis statements. He provides you with the following transaction information for the fiscal…arrow_forwardYou are a Corporate Credit Analyst for your bank. A new corporate customer in the manufacturing sector approached your bank for a large credit facility in the sum of $20 million for production equipment and warehousing. The customer submitted the following financials to you. The cash position increased from $6.7 million in 2019 to $16 million in 2021. Does this signal a strengthening of the liquidity position of the firm? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education