FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

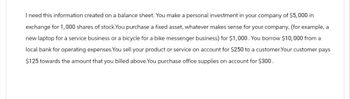

Transcribed Image Text:I need this information created on a balance sheet. You make a personal investment in your company of $5,000 in

exchange for 1,000 shares of stock. You purchase a fixed asset, whatever makes sense for your company, (for example, a

new laptop for a service business or a bicycle for a bike messenger business) for $1,000. You borrow $10,000 from a

local bank for operating expenses.You sell your product or service on account for $250 to a customer.Your customer pays

$125 towards the amount that you billed above. You purchase office supplies on account for $300.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I work this problem in excel? You have been offered $3,000 in 4 years for providing $2,000 today into a business venture with a friend. If interest rates are 10%, is this a good investment for you?arrow_forwardAssume you wrote up a proposal requesting $5000 for charity. The money would be used to buy food that volunteers (employees from the company) would distribute to the homeless on Saturday. The proposal is approved and you receive the money. However, the CEO comes to you and asks, "What will be the return on the investment?" How would you reply?arrow_forwardImagine that you have worked every summer for the last four years in order to save money to buy a car. You have $23,000 deposited in a savings account at your local bank. One day, you turn on the news and discover that the stock market is crashing and people are rushing to banks to withdraw all of their money. Your best course of action is to:arrow_forward

- Ima Broake is trying to expand her small business, Ima Fun Caterer. She has taken out a $10,000 loan for kitchen equipment and her company is currently worth $15,000. As her accountant, she has asked you about whether she can take on a new loan that the bank says she must have at least 25% equity in her business to obtain. The best response that you can give Ima is:arrow_forwardYou are the chief financial officer (CFO) of Gaga Enterprises, an edgy fashion design firm. Your firm needs $11 million to expand production. How do you think the process of raising this money will vary if you raise it with the help of a financial institution versus raising it directly in the financial markets? ... The process of raising the money will vary if you raise it with the help of a financial institution versus raising it directly in the financial markets. Select all the statements below which support this statement: (Select all the answers that apply.) A. Raising the money directly in the financial markets will allow the Gaga Enterprises CFO to avoid the investment bank's commissions and thus raise more money at a lower cost per dollar raised. B. The investment banking institution will allow the Gaga Enterprises CFO to raise more money at a lower cost per dollar raised. C. Financial institutions, such as investment banks, provide expertise in the acquisition of funds. D.…arrow_forwardHorace is trying to start a business. He knows several accredited investors who he knows will help him jumpstart his business. What constraints on investments for new businesses apply here? Investors may invest a combined $50 million within a 12-month period. Investors' allowable investment depends on the accredited or non-accredited status. Investors may invest no more than $1 million combined for the first year of the business.arrow_forward

- THE INFORMATION FOR PROBLEMS 17-20 ARE THE SAME. HOWEVER, EACH QUESTIONS ASKS YOU TO DO SOMETIHNG ELSE WITH THE INFORMATION. Today is December 31, 2018. Today, we started the Hilo Tourism Company. To start the business, the owners have invested $25,000 into the business from their own pocket. In addition, the company borrowed $15,000 at a 10 percent simple interest rate. Thus, the company has $40,000 to work with. The company will use $10,000 of this money for operating cash. The company will use the remaining money to purchase a tourism van for $30,000 on December 31st. The company will pay interest only on the loan. The Hilo Tourism Company will contract our services to Royal Cruise Line who has agreed to pay us $160,000 in the year 2019 for providing tours to high-class customers from the Hilo dock to the Volcano. All sales are cash sales. Hilo Tourism Company will have the following expenses in the year 2019. The van will wear out by $5,000 per year. Insurance will cost $12,000 per…arrow_forwardBruce is considering the purchase of a restaurant named Hard Rock Hollywood. The restaurant is listed for sale at $1,030,000. With the help of his accountant, Bruce projects the net cash flows (cash inflows less cash outflows) from the restaurant to be the following amounts over the next 10 years: Years Amount 1-6 $ 83,000 (each year) 7 93,000 8 103,000 9 113,000 10 123,000 Bruce expects to sell the restaurant after 10 years for an estimated $1,130,000. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to 2 decimal places.)Required:1-a. Calculate the total present value of the net cash flows if Bruce wants to make at least 10% annually on his investment. (Assume all cash flows occur at the end of each year.) 1-b. Should he purchase the restaurant?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education