FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

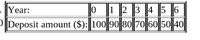

Granny Gums has established a scholarship at the Martin College of Dentistry. She will make deposits into an endowment account that pays 12% per year based on the following schedule.If the first scholarship is to be awarded 1 year after the first deposit is made and thereafter the award will be given indefinitely, what is the scholarship amount?

Transcribed Image Text:Year:

1 2 3 4 5 ||6

P|Deposit amount ($): 100 90 80 70 60 50 40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q) A donor wishes to endow a scholarship to a certain university in the name of a certain professor. The scholarship is to provide $80,000 per year for first 10 years and $100,000 per year for the following 90 years. If the university expects to be able to earn 10% per year compounded continuously on the endowment, how much must the donor give now if the first scholarship is to be given 3 years from now? Solve it early but correctly. Handwriting or typed answer only not in excel work.arrow_forwardA professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,246.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 8.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter,…arrow_forwardAssume you are working with the foundation to fund a scholarship in your name. Currently, the foundation can earn a 5 percent return on any donations. A. How much money would you need to donate to fund a scholarship that pays $25,000 every year forever, starting one year from now? B. How much money would you need to donate if the foundation could increase their return to 7 percent on any donations?arrow_forward

- Your grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $10,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit$200,000 (rounded to the nearest whole dollar) so that you can fund the scholarship forever, assuming that the account will earn 6.00% per annum every year.arrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $32,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 10 percent, how much must the donor contribute today to fully fund the scholarship? Note: Negative value should be indicated by a parenthesis. > Answer is complete but not entirely correct. $(240,421) X Contributionarrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forward

- Jeremiah Wood wants to set up a fund to pay for his daughter's education. In order to pay her expenses, he will need $22,000 in four years, $23,400 in five years, $24,600 in six years, and $26,100 in seven years. If he can put money into a fund that pays 5 percent interest, what lump-sum payment must Jeremiah place in the fund today to meet his college funding goals? Round the answer to the nearest cent. Round PV-factor to three decimal places.arrow_forwardA professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,295.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 9.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter,…arrow_forward. James decided to fund a school in Orange County in perpetuity. The first payment will be made three years from today (at the end of year three) and will be $5,320. Each year after that, the school will receive payment from James annually. The payment will increase at a rate of 3% per year after the first payment. If the annual interest rate is 9%, what is the present value of this endowment?arrow_forward

- Sam wants to donate $1,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of j4-3.81% p.a. effective and the first scholarship will be first awarded 2.5 years after the date of the donation. (b) Assume that the fund's earnings rate rate has changed from 4-3.81% p.a. to j4-3.56% p.a. one year before the first scholarship payment. How much does Sam need to add to the fund at that time (one year before the first scholarship payment) to ensure that scholarship amount will be unchanged (rounded to two decimal places)? Question 9Answer a. 78309.64 b. 74276.05 C. 71226.96 d. 75395.75arrow_forwardMike wants to donate $5,000,000 to establish a fund to provide an annual scholarship in perpetuity. The fund will earn an interest rate of 4.47% p.a. compounded half-yearly (2=4.47% p.a.) and the first scholarship will be first awarded 3.5 years after the date of the donation. (b) Assume that two years after the donation, Mike needs to withdraw $1,000,000 from the fund and use the remaining amount to provide an annual scholarship in perpetuity. The time of the first scholarship will be unchanged (3.5 years after the date of the donation). What is the new annual scholarship amount (rounded to two decimal places)? a. 101959.37 O b. 206197.54 O c. 203631.53 O d. 207511.86arrow_forwardTHIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you would like to make a donation to your university. This donation will go into the school's endowment pool and the returns generated from the donation will support the salary of a new professor in the business school on a perpetual basis. The university expects to earn returns of 5.5% on its endowment pool. You may assume that any distributions to support the salary will be made annually. Part A) You can make a donation today (t=0) in the amount of $2,500,000. The first cash flow distribution from your donation to cover the professor's salary will take place in one year (at t=1). Which of the following is closest to the annual salary payment that can be made as a result of your donation? A. $137,500 B. $454,545 C. $2,500,000 D. $100,000 Part B) After further discussions, the university determines that the employment agreement with the new professor will call for annual salary increases of 2%. Given this…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education