Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

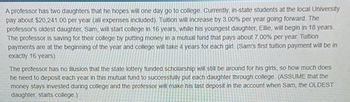

Transcribed Image Text:A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University

pay about $20,241.00 per year (all expenses included). Tuition will increase by 3.00% per year going forward. The

professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years.

The professor is saving for their college by putting money in a mutual fund that pays about 7.00% per year. Tuition

payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in

exactly 16 years)

The professor has no usion that the state lottery funded scholarship will still be around for his girls, so how much does

he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the

money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST

daughter, starts college.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,246.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 8.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter,…arrow_forwardSheldon Cooper and Amy Fowler are married and live in Pasadena, California. They have as a new investment goal to create a college fund for their newborn daughter. They estimate that they will need $195,000 in 18 years. Assuming that the Cooper-Fowler family could obtain a return of 5 percent, how much would they need to invest annually to reach their goal? Use Appendix A-3 or the Garman/Forgue companion website. Round your answer to the nearest dollar. Round Future Value of a Series of Equal Amounts in intermediate calculations to four decimal places.arrow_forwardYour daughter needs to be able to draw $50,000 a year from her college savings fund (you started from birth) to pay for college expenses to obtain a medical degree (assume she spends 4 years for bachelor, 4 years for med school, then additional 2 years as resident and yearly spending will be consistent from year to year). At start of her college career, she intends to invest her savings in government securities that should return 5.5% a year compuounded continuously. a. Obtain the equation for dP/dt and then find the genearl solution of P(t) with, as yet undetermined, initial value P_0. b. How large must your daughter's initial college savings be so that she can continue drawing her $50,000 income until she becomes a doctor?arrow_forward

- Alex wants to provide funding in the event of his death for his daughter Ellie, age 8, to attend four years of college, starting at age 18. The current annual cost of tuition is $20,000. Assume inflation of 6.5% and after-tax earnings of 7%. If Alex wants to have enough life insurance to assure adequate funds for Ellie when she begins college (should he die today), approximately how much insurance should he have for this need alone? (Round your answer to the nearest dollar.) A)$113,764 B)$75,806 C)$75,451 D)$79,441arrow_forwardJohn and Jane have been saving to pay for their daughter Macy's college education. Macy just turned 9 at (t-0), md she will be entering college 9 years from now (at t-9). College tuition and expenses are currently $20,000 a year, but they are expected to increase at a rate of 6% a year. Tuition and other costs will be due at the end of years 9, 10, 11 and 12. To fund the tuition, John and Jane plan to save $15,000 in their college savings account today (att0). Additionally. they plan to save $5,000 in cach of the next 3 years (at t-1, 2, and 3). Then they plan to make S equal annnal contributions in each of the following years, t How large must the annual payments att-4, 5, 6, 7 and 8 be to cover Macy's anticipated college conts? 4, 5, 6, 7 and 8. They expeet their investment account to cam 10%. $10,817.03 $14,993.59 $12,127.51 $9,422.02 $13,323.61arrow_forwardSuzy wants to retire in 30 years. She expects to live 25 years after retirement. She prepares a savings plan to meet the objectives: First, after retirement she would like to be able to withdraw $20,000 per month. The first withdrawal will occur at the end of the first month after retirement. Second, she would like to leave her daughter a $500,000 inheritance. Lastly, she wants to set up a fund that will pay $5000 per month forever to her favorite charity after she dies. These payments will begin one month after she dies. All the monies earn 10% annual rate compounded monthly. How much will she have to save per month to meet these objectives? She wishes to make her first deposit from now and the last deposit on the day she retires.arrow_forward

- Your grandfather wants to establish a scholarship in his father’s name at a local university and has stipulated that you will administer it. As you’ve committed to fund a $10,000 scholarship every year beginning one year from tomorrow, you’ll want to set aside the money for the scholarship immediately. At tomorrow’s meeting with your grandfather and the bank’s representative, you will need to deposit$200,000 (rounded to the nearest whole dollar) so that you can fund the scholarship forever, assuming that the account will earn 6.00% per annum every year.arrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $32,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 10 percent, how much must the donor contribute today to fully fund the scholarship? Note: Negative value should be indicated by a parenthesis. > Answer is complete but not entirely correct. $(240,421) X Contributionarrow_forwardA wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forward

- Francis wants to start a foundation that will pay its beneficiaries $64,000 per year forever, with the first cash flow occurring one year from today. If the funds will be invested to earn 7% per year, how much must Frank donate today? Enter your answer as a positive number rounded to the nearest penny.arrow_forwardJeremiah Wood wants to set up a fund to pay for his daughter's education. In order to pay her expenses, he will need $22,000 in four years, $23,400 in five years, $24,600 in six years, and $26,100 in seven years. If he can put money into a fund that pays 5 percent interest, what lump-sum payment must Jeremiah place in the fund today to meet his college funding goals? Round the answer to the nearest cent. Round PV-factor to three decimal places.arrow_forwardA professor has two daughters that he hopes will one day go to college. Currently, in-state students at the local University pay about $20,295.00 per year (all expenses included). Tuition will increase by 4.00% per year going forward. The professor's oldest daughter, Sam, will start college in 16 years, while his youngest daughter, Ellie, will begin in 18 years. The professor is saving for their college by putting money in a mutual fund that pays about 9.00% per year. Tuition payments are at the beginning of the year and college will take 4 years for each girl. (Sam's first tuition payment will be in exactly 16 years) The professor has no illusion that the state lottery funded scholarship will still be around for his girls, so how much does he need to deposit each year in this mutual fund to successfully put each daughter through college. (ASSUME that the money stays invested during college and the professor will make his last deposit in the account when Sam, the OLDEST daughter,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education