FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

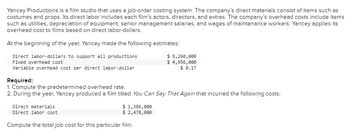

Transcribed Image Text:Yancey Productions is a film studio that uses a job-order costing system. The company's direct materials consist of items such as

costumes and props. Its direct labor includes each film's actors, directors, and extras. The company's overhead costs include items

such as utilities, depreciation of equipment, senior management salaries, and wages of maintenance workers. Yancey applies its

overhead cost to films based on direct labor-dollars.

At the beginning of the year, Yancey made the following estimates:

Direct labor-dollars to support all productions

Fixed overhead cost

$ 8,260,000

$ 4,956,000

Variable overhead cost per direct labor-dollar

$ 0.17

Required:

1. Compute the predetermined overhead rate.

2. During the year, Yancey produced a film titled You Can Say That Again that incurred the following costs:

Direct materials

Direct labor cost

Compute the total job cost for this particular film.

$ 1,386,000

$ 2,478,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $21.50 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 64,900 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost $ 2,806,000 $ 443,900 571,900 385,700 $ 1,401,500 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha. Required 1 Required 2 Complete this question by entering your answers in the tabs below. Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Plantwide predetermined overhead rate Eper DLHarrow_forwardYancey Productions is a film studio that uses a job-order costing system. The company's direct materials consist of items such as costumes and props. Its direct labor includes each film's actors, directors, and extras. The company's overhead costs include items such as utilities, depreciation of equipment, senior management salaries, and wages of maintenance workers. Yancey applies its overhead cost to films based on direct labor-dollars. At the beginning of the year, Yancey made the following estimates: Direct labor-dollars to support all productions Fixed overhead cost Variable overhead cost per direct labor-dollar Required: 1. Compute the predetermined overhead rate. $ 8,710,000 $ 5,226,000 $ 0.08 2. During the year, Yancey produced a film titled You Can Say That Again that incurred the following costs: Direct materials Direct labor cost $ 1,426,000 $ 2,613,000 Compute the total job cost for this particular film. Complete the question by entering your answers in the tabs given…arrow_forwardTillman Corporation uses a Job Order Costing system and has two production departments--Molding and Assembly. The company applies manufacturing overhead to production orders on the basis of direct labor costs. Separate departmental predetermined overhead rates are used. Budgeted manufacturing costs for the year are as follows: Molding Assembling Direct Materials P700,000 P100,000 Direct Labor 200,000 800,000 Manufacturing Overhead 600,000 400,000 The actual material and labor costs charged to Job 432 were as follows: Direct Materials 25,000 Direct Labor Molding 8,000 Assembling 12,000 20,000 Tillman applies manufacturing overhead to production orders on the basis of direct labor cost using a departmental rate predetermined at the beginning of the year based on the annual budget. The total manufacturing cost associated with Job 432 should be?arrow_forward

- Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.)arrow_forwardSpeedy Auto Repairs uses a job-order costing system. The company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. Speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output Fixed overhead cost Variable overhead cost per direct labor-hour 24,000 $ 288,000 $ 1.00 Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: $ 615 $208 9 Direct materials Direct labor cost Direct labor-hours used Compute Mr.…arrow_forwardXYZ Company has two production departments, Machining and Customizing. The company uses a job- order costing system and computes a predetermined overhead rate (POHR) in each department. The Machining Department's POHR is based on machine- hours (Mhrs) and the Customizing Department's POHR is based on direct labor-hours (DLH). At the beginning of the current year, the company estimated the following yearly Mhrs and DLH to be used in each department: 20,000 Mhrs and 15,000 DLH in the Marching Department; 10,000 Mhrs and 25,000 DLH in the Customizing Department. The company also estimated the yearly total manufacturing overhead cost in each department: OMR150,000 in the Machining Department and OMR100,000 in the Customizing Department. During the year, Job XY incurred the following numbber of hours in each department: 58 Mhrs and 30 DLH in the Machining Department; and 80 Mhrs and 50 DLH in the- Customizing Department. What is the total amount of manufacturing overhead that should be…arrow_forward

- Speedy Auto Repairs uses a job-order costing system. The company’s direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics’ hourly wages. Speedy’s overhead costs include various items, such as the shop manager’s salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. The company applies all of its overhead costs to jobs based on direct labor-hours. At the beginning of the year, it made the following estimates: Direct labor-hours required to support estimated output 40,000 Fixed overhead cost $ 640,000 Variable overhead cost per direct labor-hour $ 1.00 Required: 1. Compute the predetermined overhead rate. 2. During the year, Mr. Wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. The following information was available with respect to his job: Direct materials $ 707 Direct labor cost $ 230 Direct…arrow_forwardSpecter Company uses a job order cost system and applies manufacturing overhead to jobs usinga predetermined overhead rate based on direct labour-hours. Last year manufacturing overheadand direct labour-hours were estimated at $50,000 and 20,000 hours, respectively, for the year.In June, Job #461 was completed. Materials costs on the job totaled $4,000 and direct labourcosts totaled $1,500 at $5 per hour. At the end of the year, it was determined that the companyworked 24,000 direct labour hours for the year and incurred $54,000 in actual manufacturingoverhead costs.Required: (You must show all calculations for each part.)a) Calculate the total cost of Job #461. (b) If Job #461 consisted of 100 units what is the cost per unit? (c) What is the underapplied or overapplied overhead for the year? (arrow_forwardWheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: Bike parts Factory machinery depreciation Factory supervisor salaries Factory direct labor Factory supplies Factory property tax Advertising cost Administrative salaries Administrative-related depreciation Total expected costs $ 338,800 58,500 142,500 235,790 Required: 1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $12.41 per hour. 2. Determine the amount of applied overhead if 17,900 actual hours are worked in the upcoming year. Required 1 40,400 33,750 22,500 54,500 25,700 $ 952,440 Complete this question by entering your answers in the tabs below.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education