EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Xyz retail has annual cost of goods sold solution general accounting question

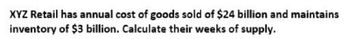

Transcribed Image Text:XYZ Retail has annual cost of goods sold of $24 billion and maintains

inventory of $3 billion. Calculate their weeks of supply.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Libscomb Technologies' annual sales are $6,974,991 and all sales are made on credit, it purchases $3,511,535 of materials each year (and this is its cost of goods sold). Libscomb also has $550,869 of inventory, $522,928 of accounts receivable, and $477,584 of accounts payable. Assume a 365 day year. What is Libscomb’s Inventory Turnover?arrow_forwardLibscomb Technologies' annual sales are $5,790,872 and all sales are made on credit, it purchases $3,221,342 of materials each year (and this is its cost of goods sold). Libscomb also has $539,653 of inventory, $498,477 of accounts receivable, and $416,602 of accounts payable. Assume a 365 day year. What is Libscomb’s Inventory Period (in days)?arrow_forwardYour company has sales of $97,200 this year and cost of goods sold of $71,200. You forecast sales to increase to $113,100 next year. Using the percent of sales method, forecast next year's cost of goods sold.arrow_forward

- Libscomb Technologies' annual sales are $6,997,444 and all sales are made on credit, it purchases $3,879,449 of materials each year (and this is its cost of goods sold). Libscomb also has $530,851 of inventory, $490,754 of accounts receivable, and $417,441 of accounts payable. Assume a 365 day year. What is Libscomb’s Receivables Turnover?arrow_forwardLibscomb Technologies' annual sales are $6,615,140 and all sales are made on credit, it purchases $4,071,988 of materials each year (and this is its cost of goods sold). Libscomb also has $553,442 of inventory, $521,646 of accounts receivable, and beginning and ending of year $448,048 and $420,069 accounts payables (respectively). Assume a 365 day year. What is Libscomb’s Cash Cycle (in days)?arrow_forwardDEF Company distributes two products, X and Y. Monthly sales for X are $150,000. Monthly sales for Y are $250,000. CM ratio for X is 70%. CM ratio for Y is 40%. Fixed expenses are $153,750 per month. Required: A) Prepare a contribution format income statement for the company as a whole. Calculate percentages to two decimal places. B) What is the company's breakeven point in dollar sales based on the current sales mix? C) What are the dollar sales of X and Y at the breakeven point you calculated in (B)?arrow_forward

- Calculate Average Payables Periods For the first year, Hawkeye, Inc., has a cost goods sold of $95,318. At the end of the year, the accounts payable balance was $22,816. How long, on average, did it take the company to pay off its suppliers during the year? What might a large value for this ratio imply?arrow_forwardSuppose a company finds that shipping cost is 3,560 each month plus 6.70 per package shipped. What is the cost formula for monthly shipping cost? Identify the independent variable, the dependent variable, the fixed cost per month, and the variable rate.arrow_forwardCalculate gross profit, cost of goods sold, and selling price MBI Inc, had sales of $900 million for fiscal 2022. The company’s gross profit ratio for that year was 37.5%.Required:Calculate the gross profit and cost of goods sold for MBI for fiscal 2022.Assume that a new product is developed and that it will cost $1,625 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022.From a management viewpoint, what would you do with this information?arrow_forward

- A retail store's cost of goods sold is $240,000, and its desired gross profit rate is 40% on sales. What should be the total sales amount amount to achieve this target?arrow_forwardPayton Inc. reports in its Year 7 annual report, sales of $7,362 million and cost of goods sold of $2,945 million. For next year, you project that sales will grow by 3% and that cost of goods sold percentage will be 1 percentage point higher. Projected cost of goods sold for Year 8 will be: Select one: a. $3,033 million b. $3,019 million c. There is not enough information to determine the amount. d. $3,109 million e. $2,945 millionarrow_forwardsaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning