Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting question

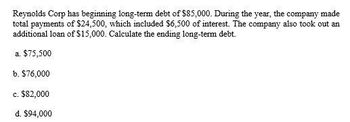

Transcribed Image Text:Reynolds Corp has beginning long-term debt of $85,000. During the year, the company made

total payments of $24,500, which included $6,500 of interest. The company also took out an

additional loan of $15,000. Calculate the ending long-term debt.

a. $75,500

b. $76,000

c. $82,000

d. $94,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 14. Gingerbread Corp was issued a $220,000 loan at 6%. The amortization schedule created by the company accountant is presented below. How much interest will Gingerbread Corp record in interest expense over a period of 6 years?arrow_forwardGingerbread Corp was issued a $250,000 loan at 8% with a five year maturity date. The partial amortization schedule prepared by the company accountant is presented below. What will the company record for interest expense in period 4? (round decimal up to the nearest whole $) Interest expense in period four ?arrow_forwardSubject : Accounting On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Borrowed $117,200 for nine years. Will pay $7,100 interest at the end of each year and repay the $117,200 at the end of the 9th year. Established a plant remodeling fund of $491,650 to be available at the end of Year 10. A single sum that will grow to $491,650 will be deposited on January 1 of this year. Agreed to pay a severance package to a discharged employee. The company will pay $76,100 at the end of the first year, $113,600 at the end of the second year, and $151,100 at the end of the third year. Purchased a $175,500 machine on January 1 of this year for $35,100 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year. Required: 1. In transaction (a),…arrow_forward

- On January 1, Year 1, Mahoney Company borrowed $168,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $42.077, What is the amount of principal repayment included in the payment made on December 31, Year 1? Multiple Choice Ο Ο Ο Ο $13,440 $37.467 $40,725 $28,637arrow_forwardA debt of $13,000 with interest at 5% compounded semi-annually is repaid by payments of $1,850 made at the end of every 3 months. Construct an amortization schedule showing the total paid and the total cost of the debt. Complete the amorization schedule. (Round to the nearest cent as needed.) Outstanding Principal Balance $13,000 Payment Number Amount Paid Interest Paid Principal Repaid 1 $1,850 2 $1,850 3 $1,850 $ $ 4 $1,850 $ 5 $1,850 $4 6 $1.850 $ 7 $1,850 $ $ 8 $0 The total paid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The total interest is Sarrow_forwardCrafty Inc. borrowed $10,000 with a five-year 11.26% annual interest rate on 10/1/20X1. On their year-end financial statements dated 12/31/20X1, what amount should be reflected for interest expense? Input your response rounded to a whole number, without commas and without dollar signs. Your Answer: Answerarrow_forward

- A company issues $12 million in term bonds on March 1, Year One, for face value. The bonds pay a stated cash interest rate of 10 percent per year. Interest payments are made every February 28 and August 31. On financial statements for Year One, what is recognized as interest expense on the income statements? Responses $12,000,000 $300,000 $1,200,000 $1,000,000arrow_forward104.arrow_forwardHermosa Vista Company issued $180,000 5-year, 6.00% bonds and received $183,843 in cash. The market rate of interest when the bonds were issued was 5.50%. What is the amount of interest expense to be recorded for the first annual interest period if the company uses simplified effective-interest amortization? Multiple Choice $9,900.00 $10,111.37 $10,800.00 $11,030.58arrow_forward

- Oak Branch Inc. issued $100,000 of 5%, 10-year bonds when the market rate was 4%. They received $106,983. Interest was paid semi-annually. Prepare an amortization table for the first three payments. PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Semiannual Interest Period Semiannual Interest Expense Semiannual Interest Payment Amortization of Discount Ending Carrying Value 1 2 3arrow_forwardOn January 1, New York Company borrowed $180,000 to purchase machinery and agreed to pay 5% interest for 6 years on an installment note. Each note payment is due on the last day of the year. What is the total interest expense over the life of the loan? A. $32,779 B. $54,000 C. $33,657 D. $35,463arrow_forwardA company borrows $100,000 with interest at j₁2 = 9%. The loan is to be amortized by monthly payments of $1550 for as long as necessary. A final smaller payment will be calculated so the loan will be exactly repaid. The outstanding balance immediately after the th th 88 payment is $796.44. What is the value of the 89" and final payment? O A. $790.51 B. $796.44 C. $802.41 D. $808.43arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning