FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

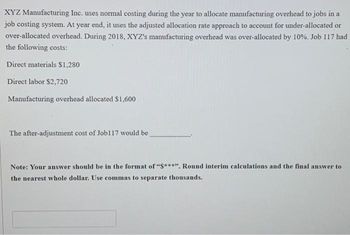

Transcribed Image Text:XYZ Manufacturing Inc. uses normal costing during the year to allocate manufacturing overhead to jobs in a

job costing system. At year end, it uses the adjusted allocation rate approach to account for under-allocated or

over-allocated overhead. During 2018, XYZ's manufacturing overhead was over-allocated by 10%. Job 117 had

the following costs:

Direct materials $1,280

Direct labor $2,720

Manufacturing overhead allocated $1,600

The after-adjustment cost of Job117 would be

Note: Your answer should be in the format of "S***". Round interim calculations and the final answer to

the nearest whole dollar. Use commas to separate thousands.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wildhorse Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2022, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $24,400, direct labor $14,640, and manufacturing overhead $19,520. As of January 1, Job 49 had been completed at a cost of $109,800 and was part of finished goods inventory. There was a $18,300 balance in the Raw Materials Inventory account on January 1. During the month of January, Wildhorse Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $148,840 and $192,760, respectively. The following additional events occurred during the month. 1. 2. 3. 4. 5. (a) Purchased additional raw materials of $109,800 on account. Incurred factory labor costs of $85,400. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $14,640; and…arrow_forwardMolin Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year: Estimated total manufacturing overhead at the beginning of the year Estimated direct labor-hours at the beginning of the year Results of operations: Actual direct labor-hours Manufacturing overhead: Indirect labor cost Other manufacturing overhead costs incurred Cost of goods sold (unadjusted) Required: a. What is the total amount of manufacturing overhead applied to production during the year? b. Is manufacturing overhead overapplied or underapplied for the year? By how much? c. What is the adjusted cost of goods sold for the year? Complete this question by entering your answers in the table below. Required A Required B Required C What is the total amount of manufacturing overhead applied to production during the yeararrow_forwardLittle Lizards Everywhere Co. ("LLE") uses job-order costing and allocates MOH using normal costing. LLE uses two MOH (Manufacturing Overhead) accounts: MOH Control for accumulating MOH costs and MOH Allocated for recording MOH allocated to Jobs. For 2019, LLE decided to use machine hours as its base for allocating MOH and estimated that it would use 50,000 machine hours that year. Before the year began, LLE set a MOH rate of $24 per machine hour. During 2019 LLE actually used 51,000 machine hours and actually spent $1,100,000 on MOH costs. What total amount of MOH did LLE allocate to its products during 2019?arrow_forward

- Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forwardThe LLO-24784 company uses a job-order costing system with direct labor hours as its allocation base. The company estimates its manufacturing overhead cost for the year to be $974,700. During the year, actual direct labor-hours were 36,360 hours, the actual manufacturing overhead cost was $930,000, and manufacturing overhead was overapplied by $51,720. How much was the LLO-24784 company's estimated direct labor-hours used in the calculation of its predetermined overhead rate? (Round your intermediate calculations to 2 decimal places.) Multiple Choice 32,529 direct labor-hours 36,360 direct labor-hours 36,100 direct labor-hours 34,444 direct labor-hoursarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $25.000. direct labor $15,000, and manufacturing overhead $20,000. As of January 1, Job 49 had been completed at a cost of $112.500 and was part of finished goods inventory. There was a $18.750 balance in the Raw Materials Inventory account. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $152,500 and $197.500, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $112.500 on account. incurred factory labor costs of $87.500. Of this amount $20,000 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect materials…arrow_forward

- Ali Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department X and machine hours in Department Z. In establishing the predetermined overhead rates for 2020, the following estimates were made for the year. Department X Z Manufacturing overhead $78000 $75000 Direct labor costs $60000 $60000 Direct labor hours 5000 4000 Machine hours 10000 15000 During March, the job cost sheets showed the following costs and production data. Department X Z Direct materials used $9200 $6400 Direct labor costs $4800 $5000 Manufacturing overhead incurred $6600 $6210 Direct labor hours 400 420 Machine hours 800 1260 Required: Compute the predetermined overhead rate for…arrow_forwardThe JOC-10847 company uses a job-order costing system with a predetermined overhead rate using direct labor hours as the allocation base. The company made the following estimates at the beginning of last year: Direct labor-hours required for the estimated production Fixed manufacturing overhead cost Variable manufácturing overhead cost per direct labor-hour 153,000 $ 654,000 $ 4.60 The JOC-10847 company started and completed Product A989 last year. It recorded the following information for Product A989: Direct materials Direct labor cost Direct labor hours used Number of units produced $ 330 $ 220 34 hours 50 units The JOC-10847 company uses a markup percentage of 110% of its total manufacturing cost in determining selling price. The selling price per unit the company would charge for Product A989 is closest to: (Carry out your calculations up to 2 decimal places) O$ 33.17 O$ 14.19 O$ 31.44 O$ 29.81arrow_forwardLott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $23,200, direct labor $13,920, and manufacturing overhead $18,560. As of January 1, Job 49 had been completed at a cost of $104,400 and was part of finished goods inventory. There was a $17,400 balance in the Raw Materials Inventory account. During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $141,520 and $183,280, respectively. The following additional events occurred during the month. 1. 2. 3. 4. Job No. 50 Purchased additional raw materials of $104,400 on account. Incurred factory labor costs of $81,200. Of this amount $18,560 related to employer payroll taxes. Incurred manufacturing overhead costs as follows: indirect…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education