Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

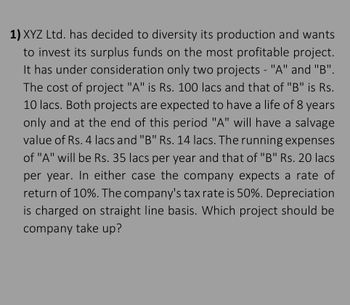

Transcribed Image Text:1) XYZ Ltd. has decided to diversity its production and wants

to invest its surplus funds on the most profitable project.

It has under consideration only two projects - "A" and "B".

The cost of project "A" is Rs. 100 lacs and that of "B" is Rs.

10 lacs. Both projects are expected to have a life of 8 years

only and at the end of this period "A" will have a salvage

value of Rs. 4 lacs and "B" Rs. 14 lacs. The running expenses

of "A" will be Rs. 35 lacs per year and that of "B" Rs. 20 lacs

per year. In either case the company expects a rate of

return of 10%. The company's tax rate is 50%. Depreciation

is charged on straight line basis. Which project should be

company take up?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Fox Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Unit sales Sales price Variable cost per unit Fixed operating costs This project will require an investment of $15,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at t = 0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Fox pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. O $20,571.03 O $27,428.04 O $26,285.20 O $22,856.70 Which of the following most closely approximates what the project's net present value (NPV) would be under the new tax law?(Hint: Round your final answer to two decimal places and choose the value that most closely matches your answer.) Year 1 Year 2 Year 3 3,000 3,250 3,300 $17.25…arrow_forwardCoronado, Inc. is considering purchasing equipment costing $39000 with a 7-year useful life. The equipment will provide cost savings of $8700 and will be depreciated straight-line over its useful life with no salvage value. Coronado Inc. requires a 9% rate of return. What is the approximate internal rate of return for this investment? Period 7 10% O 11% 000 9% 8% 7% 5.389 8% Present Value of an Annuity of 1 5.206 9% 5.033 10% 4.868 11% 4.712 14% 4.288arrow_forwardTerminal Ltd purchased a machine at R80 000 two years ago. This machine can be replaced with a new machine at a cost of R100 000. The new machine can be sold for R30 000 after completion of a 5-year project. The old machine can be sold for R15 000 today. The SARS capital allowance on both machines is calculated at 20% per year. Net working capital will decrease with R1 500 at the end of the project life. Assume a tax rate of 28%. What is the net cash flow of the project in year 5? R20 100 R21 600 R30 000 R28 500 R8 400arrow_forward

- Giant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Project 1Cost $175,000 Project 2 Cost $185,000 Future Cash Flows For Project 1 Year 1 Year 2 Year 3 Year 4 Year 5 is 76,000 83,000 67,000 65,000 55,000 respectively. For Project 2 it is 87,000 78,000 69,000 65,000 57,000 for Year 1 Year 2 Year 3 Year 4 Year 5 resp. Required: a) Identify which project should the company accept based on NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflictarrow_forwardThe Alabi corp is considering a project which requires an expenditure of $100,000 at t=0 intially, it will have additional revenue sales of $150k per year for the next to years (t=1 & t=2) with expenses of $30k per year for operating costs and general expenses attributed with the project but does not include depreciation of the intial expenditure of the $100k. The depreciation is straight line with zero salvage . Alabi weighted average cost of capital is 9.13% and taxed at 30%. What is the net present value for the project?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education