FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

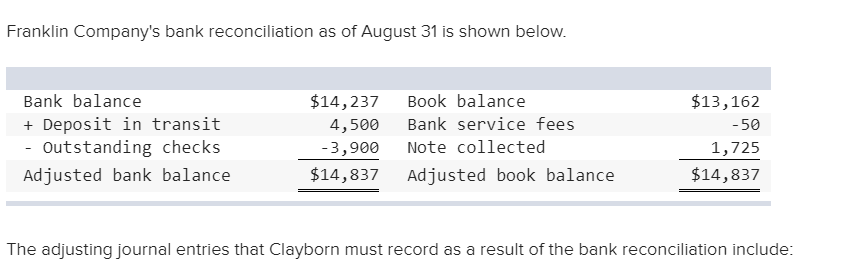

Transcribed Image Text:Franklin Company's bank reconciliation as of August 31 is shown below.

Bank balance

$14,237

Book balance

$13,162

Deposit in transit

- Outstanding checks

Bank service fees

4,500

-50

Note collected

-3,900

1,725

$14,837

$14,837

Adjusted bank balance

Adjusted book balance

The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank $18,250 Balance per company records 12,045 Bank service charges 30 Deposit in transit 3,500 Note collected by bank with $160 interest 4,160 Outstanding checks 5,575 a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Reddan Company based on the bank reconciliation. For a compound transaction, if an amount box does not require an entry, leave it blank. ? ? ? ? ? ? ? ? ? ? ? ? ? Please don't provide images in answers thank youarrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR [ Select ] ["Cash", "Bank Service Charges", "Interest Income", "Bank Errors", "Interest Expense"] [ Select ] ["$300", "$852", "$30", "$569", "$1,020"] CR [ Select ] ["Bank Errors", "Interest Income", "Bank Service Charges", "Interest Expense", "Cash"] [ Select ] ["$30", "$852", "$569", "$300", "$1,030"] and DR…arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $23,900. Cash balance according to the bank statement at July 31, $25,170. Checks outstanding, $4,850. Deposit in transit, not recorded by bank, $3,900. A check for $590 issued in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $40. Journalize the entries that should be made by the company, part (a) Error and part (b) Service Charge. If an amount box does not require an entry, leave it blank. a. July 31 - Select - - Select - - Select - - Select - b. July 31 - Select - - Select - - Select - - Select -arrow_forward

- Entries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $25,010. Cash balance according to the bank statement at July 31, $26,060. Checks outstanding, $5,080. Deposit in transit, not recorded by bank, $4,080. A check for $340 issued in payment of an account was erroneously recorded in the check register as $430. Bank debit memo for service charges, $40. Journalize the entries that should be made by the company, part (a) Error and part (b) Service Charge. If an amount box does not require an entry, leave it blank. a. July 31 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 b. July 31 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $22,240. Cash balance according to the bank statement at July 31, $23,450. Checks outstanding, $4,510. Deposit in transit, not recorded by bank, $3,630. A check for $590 in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 b. July 31arrow_forwardMazaya Company gathered the following reconciling information in preparing its November bank reconciliation: Cash balance per books (11/30) R.O.4,400; Deposits in transit R.O. 60o; Notes receivable and interest collected by bank R.O.1,400; Bank charge for check printingarrow_forward

- Jamison Company gathered the following reconciling information in preparing its June bank reconciliation. Cash balance per bank, June 30 $10,580 Note receivable collected by bank 5,781 8,771 3,495 127 1,779 Outstanding checks Deposits in transit Bank service charge NSF check Determine the cash balance per company records (before adjustment) on June 30. a. $9,179 b. $22,846 OC. $5,304 d. $1,429arrow_forwardMore info (Click the icon to view the bank statement.) a. A deposit of $2,300 is in transit. b. Rick's Deli has an ending checkbook balance of $6,010. c. Checks outstanding: no. 111, $800; no. 119, $1,600; no. 121, $360. d. Bill Johnson's check for $500 bounced due to lack of sufficient funds. e. Bank service charge $75. Print Done Old Balance 6,700 Lowell National Bank Rio Mean Branch Bugna, Texas Rick's Deli 8811 2nd St. Bugna, Texas Checks and Other Withdrawals in Order of Payment 50.00 270.00 220.00 510.00 500.00 NSF 1,350.00 520.00 75.00 SC (NSF = nonsufficient funds; SC = service charge.) Deposits 230.00 650.00 310.00 1,280.00 220.00 Date 2/2 2/3 2/10 2/15 2/20 2/24 2/28 New Balance 6,700 6,380 6,390 6,530 6,340 6,270 5,895arrow_forwardPart ii. Prepare the journal entries resulting from the bank reconciliationarrow_forward

- Mazaya Company developed the following reconciling information in preparing its April bank reconciliation: Cash balance per bank, 4/30 RO.15,400; Note receivable collected by bank 8,400; Outstanding checks 12,600; Deposits in transit 6,300; Bank service charge 150; NSF check 1,680; Using the above information, determine the cash balance per books (before adjustments) for the Mazaya Company.arrow_forwardCopeland Company's bank reconciliation as of February 28 is shown below. Bank balance $ 38,943 3,600 + Deposit in transit - Outstanding checks Adjusted bank balance. Book balance Note collection Check printing - 2,380 $ 40,163 Adjusted book balance One of the journal entries that Copeland must record as a result of the bank reconciliation includes: Multiple Choice O Debit Cash $3,600; credit Accounts Receivable $3,600. Debit Cash $875; credit Notes Receivable $875. Debit Miscellaneous Expense $50, credit Accounts Payable $50. Debit Cash $3,600; credit Sales $3,600 $ 39,338 +875 -50 $ 40,163arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $6,788 Book balance: $6,525 Deposits in transit: $1,688 Outstanding checks: $569 and $1,523 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $245 but posted in the accounting records as $254. This check was expensed to Utilities Expense. Bank Reconciliation Bank Statement Balance at (date) $fill in the blank 1 Add: Deposits in Transit Outstanding Checks Less: - Select - Adjusted Bank Balance $fill in the blank 8 Book Balance at (date) $fill in the blank 9 Add: - Select - Less: - Select - Adjusted Book Balance $fill in the blank 14arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education