FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

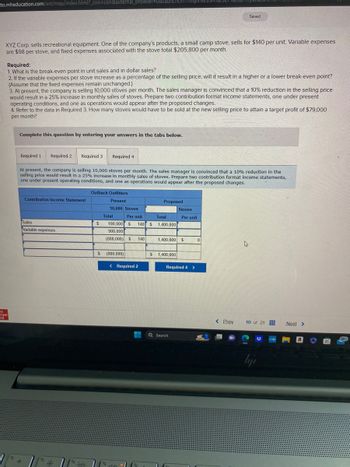

Transcribed Image Text:**Educational Content: Break-Even Analysis and Contribution Margin**

**Scenario Overview:**

XYZ Corp. sells recreational equipment, including a small camp stove priced at $140 per unit. The variable expense per stove is $98, and the company faces fixed expenses totaling $205,800 monthly.

**Key Questions:**

1. **Determine the Break-Even Point:**

- Calculate both in units and dollar sales.

2. **Impact of Variable Expense Changes:**

- Analyze how increasing variable expenses as a percentage of the selling price affects the break-even point.

3. **Effect of Pricing Strategy:**

- Explore the potential effect of a 10% price reduction on sales and profits.

- Prepare contribution format income statements for current and proposed conditions.

4. **Target Profit Analysis:**

- Calculate the number of stoves needed to reach a $79,000 monthly profit under new pricing.

**Contribution Income Statement Analysis:**

- **Present Conditions:**

- **Sales**: 10,000 stoves at $140 each, totaling $1,400,000.

- **Variable Expenses**: Total $980,000.

- **Contribution Margin**: $420,000.

- **Proposed Conditions:**

- After a 10% price reduction, recalculate the income statement.

- Present the changes in contribution margin and overall sales.

**Understanding Break-Even Analysis:**

- **Break-Even Point**: Where total sales equal total expenses, resulting in zero profit.

- **Contribution Margin**: Sales price minus variable costs; it helps cover fixed costs.

**Graph/Diagram Explanation:**

The table displays financial data categorized into "Present" and "Proposed" conditions, showcasing sales, expenses, and contribution margins. It illustrates the impact of pricing and cost changes on profitability, aiding in strategic decision-making.

This analysis equips students with foundational knowledge in financial assessment, demonstrating the importance of pricing strategies and cost management in business profitability.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Mauro Products distributes a single product, a woven basket whose selling price is $21 per unit and whose variable expense is $18 per unit. The company's monthly fixed expense is $4,500. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales 2. Break-even point in dollar sales 3. Break-even point in unit sales 3. Break-even point in dollar sales 1,500 baskets basketsarrow_forwardRaveen Products sells camping equipment. One of the company’s products, a camp lantern, sells for $90 per unit. Variable expenses are $63 per lantern, and fixed expenses associated with the lantern total $135,000 per month. Required: 1. Compute the company’s break-even point in number of lanterns and in total sales dollars. 2. Compute the company’s Margin of Safety in sales dollar and in percentage. 3. At present, the company is selling 8,000 lanterns per month. The sales manager is convinced that a 10% reduction in the selling price will result in a 25% increase in the number of lanterns sold each month. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. Show both total and per unit data on your statements. 4. Refer to the data in (3) above. How many lanterns would have to be sold at the new selling price to yield a minimum net operating income of $72,000 per month?arrow_forwardKitts Company buys and sells a product that has a variable cost per unit of $22. Kitts' fixed costs amount to $56,000. The product sells for $26 each. The Company is currently making and selling 20,000 units of product. If Kitts is able to increase sales by 4,000 units, the break-even point will Multiple Choice increase by $16,000. decrease by $16,000. not change. The answer cannot be determined with the information provided.arrow_forward

- Mauro Products distributes a single product, a woven basket whose selling price is $16 per unit and whose variable expense is $14 per unit. The company's monthly fixed expense is $4,600. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales 2. Break-even point in dollar sales 3. Break-even point in unit sales 3. Break-even point in dollar sales 124 JUN 30 baskets baskets Aarrow_forwardOutback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $130 per unit. Variable expenses are $91 per stove, and fixed expenses associated with the stove total $191,100 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 15,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $71,000 per month?…arrow_forwardUrmila benarrow_forward

- Mauro Products sells a woven basket for $14 per unit. Its variable expense is $11 per unit and the company's monthly fixed expense is $9,000. Required: 1 Calculate the company's break-even point in unit sales 2 Calculate the company's break-even point in dollar sales Note: Do not round intermediate calculations. 3. If the company's fixed expenses increase by $600, what would become the new break even point in unit sales? In dollar sales? Note: Do not round intermediate calculations. 1. Break-even point in unit sales 2 Break-even point in dollar sales 3. Break-even point in unit sales 3. Break-even point in dollar sales baskets basketsarrow_forwardHi, I need help with the following problem. Thanks!arrow_forwardNeed step by step explanation.Mauro Products distributes a single product, a woven basket whose selling price is $14 per unit and whose variable expense is $12 per unit. The company’s monthly fixed expense is $4,600. Required: Calculate the company’s break-even point in unit sales. Calculate the company’s break-even point in dollar sales. (Do not round intermediate calculations.) If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education