FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

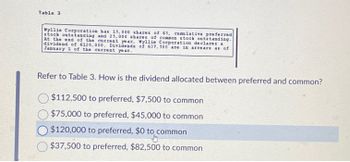

Transcribed Image Text:Table 3

Wyllie Corporation has 15, 000 shares of 63, cumulative preferred

stock outstanding and 25,000 shares of common stock outstanding.

At the end of the current year, Wyllie Corporation declares a

dividend of $120,000. Dividends of 637, 500 are in arrears as of

January 1 of the current year.

Refer to Table 3. How is the dividend allocated between preferred and common?

$112,500 to preferred, $7,500 to common

$75,000 to preferred, $45,000 to common

$120,000 to preferred, $0 to common

$37,500 to preferred, $82,500 to common

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Markus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 6. What is the book value per share at the end of this year?arrow_forwardAt the end of the accounting period, Houston Company had $8,000 of par value common stock issued, additional paid-in capital in excess of par value – common of $10,300, retained earnings of $8,500, and $6,000 of treasury stock. What is the total amount of stockholders' equity?arrow_forwardBelow is the financial data for Arla Inc. for the year ended December 31, 2020: Market price per share... Net Income...... $150.00 $1,750,000 Preferred Dividends declared... $75,000 Average # of common shares....... Dividends per share...... Average common shareholders' equity..... Total assets..... Total Liabilities... Accumulated Other Comprehensive Income..... 100,000 $2.50 10,000,000 $22,500,000 $11,675,000 $185,000 Instructions Calculate the Return on shareholders' equity (use up to 2 decimal places and do not include a % sign)arrow_forward

- Calgate Company had the following shares outstanding and retained earnings at the end of the current year: Preferred shares, 4% (par value $15; outstanding, 10,300 shares) Common shares (outstanding, 33,000 shares) Retained earnings The board of directors is considering the distribution of a cash dividend to both groups of shareholders. No dividends were declared during the previous two years. Three independent cases are assumed: Case A: The preferred shares are non-cumulative; the total amount of dividends is $51,600. Case B: The preferred shares are cumulative; the total amount of dividends is $63,000. Case C: Same as case B, except the amount is $97,500. Required: 1. Compute the amount of dividends, in total and per share, that would be payable to each class of shareholders for each case. (Round "Per share" to 2 decimal places.) Case A: Total Per share Case B: Total Per share $ 154,500 615,000 296,000 Case C: Total Per share Preferred Shares Common Sharesarrow_forwardRichards Corporation had net income of $231,470 and paid dividends to common stockholders of $45,400. It had 58,600 shares of common stock outstanding during the entire year. Richards Corporation's common stock is selling for $52 per share. The price-earnings ratio is a.16.00 times b.3.95 times c.1.00 times d.13.16 timesarrow_forwardMarkus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 3. What are the dividend payout ratio and the dividend yield ratio?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education