FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

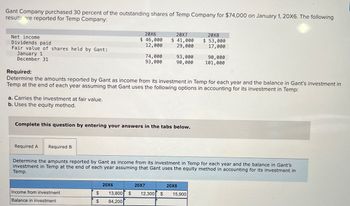

Transcribed Image Text:Gant Company purchased 30 percent of the outstanding shares of Temp Company for $74,000 on January 1, 20X6. The following

results are reported for Temp Company:

20X6

Net income

$ 46,000

20X7

$ 41,000

Dividends paid

20X8

$ 53,000

12,000

29,000

17,000

Fair value of shares held by Gant:

January 1

74,000

93,000

90,000

December 31

93,000

90,000

101,000

Required:

Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in

Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp:

a. Carries the investment at fair value.

b. Uses the equity method.

Complete this question by entering your answers in the tabs below.

Required A Required B

Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's

investment in Temp at the end of each year assuming that Gant uses the equity method in accounting for its investment in

Temp.

20X6

20X7

20X8

Income from investment

$

13,800 $ 12,300 $

15,900

Balance in investment

$

84,200

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Dd.91.arrow_forwardWinston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston's investment in Fullbright's stock increased by $20,000 each year. The companies reported the following operating results and dividend payments during the first three years of intercorporate ownership: Year 20X2 20X3 20X4 Winston Corporation Operating Income $100,000 Year 20X2 20X3 20X4 60,000 250,000 Dividends $ 40,000 80,000 120,000 Fullbright Company Dividends Net Income Fair Value Equity Method Net Income $70,000 40,000 25,000 Required: Compute the net income reported by Winston for each of the three years, assuming it accounts for its investment in Fullbright by carrying the investment at fair value, or using the equity method. $30,000 60,000 50,000arrow_forwardSunshine Inc. has the following transactions pertaining to the common stock. Jan. 1 Bought 40% of Sealand’ 60,000 outstanding shares of common stock at a cost of $12 per share, obtaining significant influence over Sealand Corp April 15 Sealand declared and paid a cash dividend of $45,000. May18 Acquired 5% of the 400,000 shares of common stock of Bluewater Corp. at a total cost of $6 per share June 1 Purchased 500 shares (2% ownership) of Young Company common stock for $30 per share plus brokerage fees of $400. July 1 Sold 100 shares of Young stock for $3,300, less a $50 brokerage fee. Aug.30 Bluewater declared and paid a $75,000 dividend. Oct.1 Received a dividend of $1.25 per share of Young Company. Dec.31 Bluewater Corp. reported net income of $244,000 for the year Dec.31 Sealand reported net income of $120,000 for the year At December 31, the market price of Bluewater Corp was $13 per share and the Young Company was $…arrow_forward

- Pagle Corporation holds 80 percent of Standard Company's common shares. The companies report the following balance sheet data for December 31, 20X1: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Standard Company Stock Total Assets Liabilities and Owners' Equity Accounts Payable Taxes Payable Preferred Stock ($10 par value) Common Stock: $10 par value $5 par value Retained Earnings Total Liabilities and Owners' Equity Pagle Corporation $ 53,000 85,000 126,000 700,000 (295,000) 160,000 $ 829,000 Basic earnings per share Diluted earnings per share $ 120,000 79,000 200,000 100,000 330,000 $ 829,000 Required: Compute basic and diluted EPS for the consolidated entity for 20X1. Note: Round your answers to 2 decimal places. Standard Company $ 43,000 65,000 76,000 330,000 (130,000) $ 384,000 $ 84,000 100,000 An 8 percent annual dividend is paid on the Pagle preferred stock and a 12 percent dividend is paid on the Standard…arrow_forwardEquity investments: 20%–50% ownership On January 2, 20Y4, Whitworth Company acquired 35% of the outstanding stock of Aloof Company for $290,000. For the year ended December 31, 20Y4, Aloof Company earned income of $75,000 and paid dividends of $23,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $306,200. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Investment in Aloof Company Stock Investment in Aloof Company Stock Cash Cash Dec. 31, 20Y4 - Income Investment in Aloof Company Stock Investment in Aloof Company Stock Income of Aloof Company Income of Aloof Company Dec. 31, 20Y4 - Dividends Cash Cash Investment in Aloof Company Stock Investment in Aloof Company Stock…arrow_forwardOdom Ltd purchased a 30% shareholding in Bryant Ltd on 1 Jan 20X7 for $60 000. This purchase resulted in Odom Ltd having significant influence over Bryant Ltd. Bryant's assets were recorded at fair values and its owners' equity, totalling $180 000, was: Share capital $80 000 Reserves $60 000 Retained profits $40 000 During 20X7 Bryant Ltd reported profit of $100 000, from which a dividend of $60 000 was paid. Also, during the year, Bryant revalued its assets upwards by $50 000, and sold inventories to Willams Ltd which is the subsidiary of Odom. Bryant made a profit of $4,000. Half of the inventories were still held by Willams by the year-end. Odom Ltd has an 80% equity interest in Willams Ltd. Required: Prepare journal entries for Odom Ltd to account for its investment in Bryant Ltd using the Equity Method. Use the Reclassification Method to account for the profit and dividends that Odom shares from Bryant. (Using the provided journal entry template to enter your answer;…arrow_forward

- garrow_forwardReden Corporation purchased 40 percent of Montgomery Company’s common stock on January 1, 20X9, at underlying book value of $262,400. Montgomery’s balance sheet contained the following stockholders’ equity balances: Preferred Stock ($4 par value, 42,000 shares issued and outstanding) $ 168,000 Common Stock ($1 par value, 145,000 shares issued and outstanding) 145,000 Additional Paid-In Capital 189,000 Retained Earnings 322,000 Total Stockholders’ Equity $ 824,000 Montgomery’s preferred stock is cumulative and pays a 5 percent annual dividend. Montgomery reported net income of $95,000 for 20X9 and paid total dividends of $46,000. Required: Give the journal entries recorded by Reden Corporation for 20X9 related to its investment in Montgomery Company common stock. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardDengararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education