Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

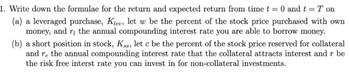

Transcribed Image Text:1. Write down the formulae for the return and expected return from time t = 0 and t = T on

(a) a leveraged purchase, Klev, let w be the percent of the stock price purchased with own

money, and r, the annual compounding interest rate you are able to borrow money.

(b) a short position in stock, K.s, let c be the percent of the stock price reserved for collateral

and re the annual compounding interest rate that the collateral attracts interest and r be

the risk free interst rate you can invest in for non-collateral investments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- This is part a) question and it's answer in order to answer part b) question Question: You hold a consol that pays a coupon C in perpetuity. The current interest rate is i, and the average expectation in the market is that this will remain unchanged. What will be the price of the consol today? answer : According to the question we need to calculate the current price of the perpetual consol. Perpetual consoles are priced differently because their expected income is spread through an indefinite period. So, perpetual consoles are priced using the current yield. The current yield is calculated as:- coupon amountMarket price×100coupon amountMarket price×100 After calculating the current yield price is calculated by the above formula where, i = Current interest rate y = yield so, the price of this consol will be Price = i/y I please need the solutions for part b) question b) In the next period however, the interest rate changes unexpectedly to i . What is the new price of the bond? If…arrow_forwardConsider the discrete-time binomial tree model with three periods of length 1, i.e. T = 3 and t = 0, 1, 2, 3. In each period the price can move up or down, St+1 is either uSt or dSt. Assume that the factor for moving up is u = 4/3, the factor for moving down is d = 3/4, and that the interest rate is r = 0.0. The initial stock price is So = 1. (a) Compute the price process (i.e. prices at all times and states) for a European Put option on the stock with strike price K = 1 and maturity T = 3. (x - ž) (b) Compute the price at time t = 0 of the Australian option K with ST K = 1. Note: As this option is path dependent, you will not be able to use the recursive method, nor will you be able to use the CRR formula.arrow_forwardGiven a real rate of interest of 3.4%, an expected inflation premium of 3.6%, and risk premiums for investments A and B of 4.7% and 6.8% respectively, find the following: a. The risk-free rate of return, rf b. The required returns for investments A and B a. The risk-free rate of return is %. (Round to one decimal place.)arrow_forward

- In the Gordon Growth (dividend discount) Model, the growth rate is assumed to be the required return on equity. a. proportional to O b. Blank O c. equal to O d. greater than O e. less thanarrow_forwardStock A has an expected return of 13.52 percent. Stock B has an expected return of 9.24 percent. Assuming the Capital Asset Pricing Model holds, and Stock A's beta is greater than Stock B's beta by 0.32, what is the expected market risk premium (in percent)? Answer to two decimalsarrow_forwardWhich of the following investments will experience the largest change in its market value as a result of changes in the level of interest rates (we are talking about the absolute value of the change, up or down)? Suppose interest rates go up or down by 50 basis points (0.5%). Rank the investments from 1 to 4 where a 1 is the most affected (largest absolute change in value) while a 4 is the least affected (smallest absolute change in value). A: $1 million invested in 3-month Treasury bills. 请选择~ B: $1 million invested in STRIPS (zero coupons) maturing in three years. |请选择 C: $1 million invested in a Treasury note maturing in three years. The note pays a 5% annual coupon. |请选择︾ D: $1 million invested in a Treasury note maturing in three years. The note pays a 10.0% annual coupon. |请选择arrow_forward

- of stion According to MM Case II, if the expected return on assets decreases, what happens to the expected return on equity? Select one: Oa increases O b. remains constant Oc decreases O d. depends on the firm's capital structure Time learrow_forwardA stock's internal rate of return (IRR) is the discount rate that cause the present value of future dividends and the price at which a stock is expected to be sold to equal the current price of the stock. O True O False Carrow_forwardaccording to capm the expected return on equity includes a reward for: a. market risk and specific risk b. Specific risk only c. Time value of money and market risk d. Diversification and portfolio risk e. Time value of money and specific riskarrow_forward

- how much of your capital (what weight) would you invest in stock A to maximize your portfolio's expected return per unit risk (maximize the Sharpe Ratio)?arrow_forwardGiven a real rate of interest of 2%, an expected inflation premium of 3%, and risk premiums for investments A and B of 4% and 6%, respectively, find the following. The risk-free rate of return, rfarrow_forwardAssume for parts (a) to (h) that the Capital Asset Pricing Model holds. The marketportfolio has an expected return of 5%. Stock A’s return has a market beta of 1.5, anexpected value of 7% and a standard deviation of 10%. Stock B’s return has amarket beta of 0.5 and a standard deviation of 20%. The correlation between stockA’s and stock B’s return is 0.5.Required:a) Explain the term ‘capital asset pricing model.’b) What is the risk-free rate?c) What is the expected return on stock B?d) Draw a graph with expected return on the y-axis and beta on the x-axis. Indicate the approximate position of the risk-free asset, the market portfolio and stocks A and B on this graph. Draw the line, which connects these four points.e) Explain the term ‘Securities Market Line’, and what is the slope of the SML for this economy?f) Consider a portfolio with a weight of 50% in stock A and 50% in stock B. What are its variance and expected return?g) Where would under-priced and over-priced securities plot on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education