Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

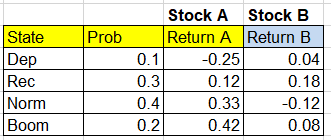

how much of your capital (what weight) would you invest in stock A to maximize your portfolio's expected return per unit risk (maximize the Sharpe Ratio)?

Transcribed Image Text:State

Dep

Rec

Norm

Boom

Prob

0.1

0.3

0.4

0.2

Stock A

Return A

-0.25

0.12

0.33

0.42

Stock B

Return B

0.04

0.18

-0.12

0.08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Selling shares of stock for more than you originally paid is called modern portfolio theory. leverage. current income. capital gain.arrow_forwardThe beta risk of a share reflects the sensitivity of cash flow, earnings, and the share price to what sort of movements? Select one: a. Industry-wide market movements. b. Capital market movements. c. Economy-wide market movements. d. All of these.arrow_forwardApart from using PE ratio, what is another way of valuing the stock price? if we have the EPS, Share Price, Dividend Per Share, ROE and the discount rate (R). And what are the assumptions and the limitations of this model? What can be said about the dividend growth model? Similarly what can be said about the capital asset pricing model?arrow_forward

- Based on the results from Fama and French, does it matter for the Efficient Markets Hypothesis if value stocks are riskier than growth stocks, or if growth stocks are riskier than value stocks? Why or why not?arrow_forward. The cash flow of a long stock and long put strategy is equal to the cash flow from a long call strategy. True or False can i also get some explantation please?arrow_forwardHow will the change in required return influence the price of a stock? How will the dividend growth rate influence the price of a stock?arrow_forward

- Apart from using PE ratio, what is another way of valuing the stock price? if we have the EPS, Share Price, Dividend Per Share, ROE and the discount rate (R). And what are the assumptions and the limitations of this model? Is it the PEG ratio or not??arrow_forwardDiscuss the impact of investor sentiment on stock returns conditional on economic conditions?arrow_forwardWhy do we call alpha a “nonmarket” return premium? Why are high-alpha stocks desirable investments for active portfolio managers? With all other parameters held fixed, what would hap-pen to a portfolio’s Sharpe ratio as the alpha of its component securities increased?arrow_forward

- 1. Are the firm’s expected future earnings important in determining a stock’s investment merits? Discuss how stock valuation relies on these and other future estimatesarrow_forwardBeta is a measure of? Risk in a well diversified portfolio Systematic risk The extent to which the stocks return moves up and down with the market All of the avovearrow_forwardThe “market RISK premium”arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education