FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

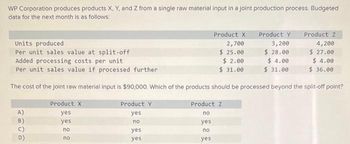

Transcribed Image Text:WP Corporation produces products X, Y, and Z from a single raw material input in a joint production process. Budgeted

data for the next month is as follows:

A)

B)

Product X

yes

yes

no

no

Units produced

Per unit sales value at split-off

Added processing costs per unit

Per unit sales value if processed further

The cost of the joint raw material input is $90,000. Which of the products should be processed beyond the split-off point?

Product Y

yes

no

yes

yes

Product X

2,700

$ 25.00

$ 2.00

$31.00

Product Z

no

yes

no

yes

Product Y

3,200

$ 28.00

$ 4.00

$31.00

Product Z

4,200

$ 27.00

$4.00

$36.00

Transcribed Image Text:O

O

O

Choice A

Choice B

Choice C

Choice D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Acton Acton makes and sells three products and has budgeted production overheads as follows for next year: £ Set ups 784,000 Materials handling 338,800 Inspection 540,400 Total 1,663,200 Details of the three products are as follows: Fe Fi Fo Budget (units) 10,000 16,000 18,000 Production run size 100 200 300 Set-ups per batch 4 6 12 Material requisitions 16,530 20,938 17,632 Inspections 1,188 1,782 2,430 Required: Calculate the production overhead per unit for each product using activity based costing.arrow_forwardThe following data is give for the Walker Company: Budgeted production 1,000 units Actual production 980 units Materials: Standard price per lb $2.00 Standard pounds per completed unit 12 Actual pounds purchased and used in production 11,800 Actual price paid for materials $23,000 Labor: Standard hourly labor rate $14 per pound Standard hours allowed per completed unit 4.5 Actual labor hours worked 4,560 Actual total labor costs $62,928 Overhead: Actual and budgeted fixed overhead…arrow_forwardUse this information for Harry Company to answer the question that follow.The following data are given for Harry Company: Budgeted production 26,000 units Actual production 27,500 units Materials: Standard price per ounce $6.50 Standard ounces per completed unit 8 Actual ounces purchased and used in production 228,000 Actual price paid for materials $1,504,800 Labor: Standard hourly labor rate $22.00 per hour Standard hours allowed per completed unit 6.6 Actual labor hours worked 183,000 Actual total labor costs $4,020,000 Overhead: Actual and budgeted fixed overhead $1,029,600 Standard variable overhead rate $24.50 per standard labor hour Actual variable overhead costs $4,520,000 Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)The direct labor rate variance is a.$5,490 favorable b.$5,490 unfavorable c.$33,000 unfavorable d.$33,000 favorablearrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.40q Indirect labor $4,000 + $1.40q Utilities $5,300 + $0.30q Supplies $1,600 + $0.10q Equipment depreciation $18,500 + $3.00q Factory rent $8,200 Property taxes $2,500 Factory administration $13,600 + $0.60q The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March Direct labor $ 70,480 Indirect labor $ 9,340 Utilities $ 7,010 Supplies $ 2,250 Equipment depreciation $ 31,100 Factory rent $ 8,600 Property taxes $ 2,500 Factory…arrow_forwardBelinda Company has the following budgeted variable costs per unit produced: Direct materials $ 7.50 Direct labour 2.24 Variable overhead: Supplies 0.33 Maintenance 0.17 Power 0.18 Budgeted fixed overhead costs per month include supervision of $68,000, depreciation of $71,000, and other overhead of $205,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 120,000 units, 130,000 units, and 145,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.)arrow_forwardWP Corporation produces products X, Y, and Z from a single raw material input in a joint production process. Budgeted data for the next month is as follows: Product X Product Y Product Z 1,800 2,300 3,300 $16.00 $19.00 $18.00 Added processing costs per unit $ 3.00 $5.00 $5.00 Per unit sales value if processed further $ 20.00 $ 20.00 $25.00 The cost of the joint raw material input is $71,000. Which of the products should be processed beyond the split-off point? Product XProduct Y Product Z A) yes yes Units produced Per unit sales value at split-off B) yes C) no D) no no yes yes no yes no yesarrow_forward

- The following data have been provided by Mathews Corporation: Budgeted production 6,900 units Standard machine-hours per unit 9.4 machine-hours Standard lubricants rate $1.20 per machine-hour Standard supplies rate $1.00 per machine-hour Actual production 7,000 units Actual machine-hours (total) 66,230 machine-hours Actual lubricants cost (total) $78,100 Actual supplies cost (total) $66,536 Lubricants and supplies are both elements of variable manufacturing overhead. The variable overhead rate variance for supplies is closest to:arrow_forwardStupji Ltd uses activity based costing. The budgeted distribution costs for the next year are: Transport costs $2,631 Order processing $1,573 -------- Total distribution costs $4,204 It is estimated that in the next year, 325,000 orders will be processed, and that the delivery vehicles will travel 1,495,000 km. A customer has indicated that 138 orders, each of which will require a journey of 122 km for each order will be placed next year. To the nearest $, what is the distribution cost for this customer? a. $47,342 b. $38,891 c. $30,299 d. $1,785arrow_forwardThe Document Creation Center (DCC) for Arlington Corp. provides photocopying and document services for three departments in the Minneapolis office. The following budget has been prepared for the year. Available capacity 8,100,000 pages Budgeted usage: Software Development 1,700,000 pages Training 3,100,000 pages Management 2,500,000 pages Cost equation $285,000 + $0.02 per page If DCC uses a dual-rate for allocating its costs based on usage, how much cost will be allocated to the Software Development Department? Multiple Choice $116,740. $100,370. $45,630. $162,000.arrow_forward

- The Document Creation Center (DCC) for Arlington Corp. provides photocopying and document services for three departments in the Minneapolis office. The following budget has been prepared for the year. Available capacity 8,000,000 pages Budgeted usage: Software Development 1,600,000 pages Training 3,000,000 pages Management 2,400,000 pages Cost equation $280,000 + $0.03 per page If DCC uses a dual-rate for allocating its costs, how much cost will be allocated to the Training Department, assuming the Training Department actually made 2,770,000 copies during the year? Multiple Choice $193,900. $203,100. $180,050. $190,079.arrow_forwardElevator Co. makes two product models, A and B, and provides both installation and inspection services for its customers. Budgeted information is as follows: Installation Inspection Total Budgeted overhead 300,000 210,000 510,000 Budgeted labor hours 2,000 3,000 5,000 Product A Product B Total Direct labor hours per unit: 2.0 1.5 5,000 Installation 1.0 0.5 2,000 Inspection 1.0 1.0 3,000 Units 1,000 2,000 3,000 The company uses a departmental method to allocate overhead in each of the two cost pools - installation and inspection. How much overhead per unit is allocated to product B if the company uses direct labor hours as the allocation base? Choose any of the answer below. A. 145 B. 105 C. 110 D. 225arrow_forwardT-Shirt Co. makes two products: A and B. In the cutting department, budgeted information is as follows: Budgeted manufacturing overhead: $400,000 Budgeted machine hours: 80,000 Budgeted units produced: 50,000 The company allocates overhead based on units produced. The actual number of machine hours spent on product B is 30,000 and 10,000 units of product B are produced. How much is the manufacturing overhead of product B in the cutting department? 80,000 230,000 320,000 150,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education