ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please explain so I can understand please engineering econ

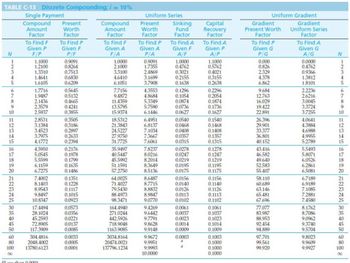

Transcribed Image Text:TABLE C-13 Discrete Compounding; i = 10%

Single Payment

N

12445

67KOO HLRAY 48

9

10

11

12

13

14

16

17

18

19

20

21

22

23

25

30

35

40

45

50

60

80

100

Compound Present

Amount

Factor

Worth

Factor

To Find F

Given P

F/P

1.1000

1.2100

1.3310

1.4641

1.6105

1.7716

1.9487

2.1436

2.3579

2.5937

2.8531

3.1384

3.4523

3.7975

4.1772

4.5950

5.0545

5.5599

6.1159

6.7275

7.4002

8.1403

8.9543

9.8497

10.8347

17.4494

28.1024

45.2593

72.8905

117.3909

304.4816

2048.4002

13780.6123

al oss than 0.0001

To Find P

Given F

P/F

0.9091

0.8264

0.7513

0.6830

0.6209

0.5645

0.5132

0.4665

0.4241

0.3855

0.3505

0.3186

0.2897

0.2633

0.2394

0.2176

0.1978

0.1799

0.1635

0.1486

0.1351

0.1228

0.1117

0.1015

0.0923

0.0573

0.0356

0.0221

0.0137

0.0085

0.0033

0.0005

0.0001

Compound

Amount

Factor

To Find F

Given A

F/A

1.0000

2.1000

3.3100

4.6410

6.1051

7.7156

9.4872

11.4359

13.5795

15.9374

18.5312

21.3843

24.5227

27.9750

31.7725

35.9497

40.5447

45.5992

51.1591

57.2750

64.0025

71.4027

79.5430

88.4973

98.3471

164.4940

271.0244

442.5926

718.9048

1163.9085

3034.8164

20474.0021

137796.1234

Uniform Series

Present

Worth

Factor

To Find P

Given A

P/A

0.9091

1.7355

2.4869

3.1699

3.7908

4.3553

4.8684

5.3349

5.7590

6.1446

6.4951

6.8137

7.1034

7.3667

7.6061

7.8237

8.0216

8.2014

8.3649

8.5136

8.6487

8.7715

8.8832

8.9847

9.0770

9.4269

9.6442

9.7791

9.8628

9.9148

9.9672

9.9951

9.9993

10.0000

Sinking

Fund

Factor

To Find A

Given F

A/F

1.0000

0.4762

0.3021

0.2155

0.1638

0.1296

0.1054

0.0874

0.0736

0.0627

0.0540

0.0468

0.0408

0.0357

0.0315

0.0278

0.0247

0.0219

0.0195

0.0175

0.0156

0.0140

0.0126

0.0113

0.0102

0.0061

0.0037

0.0023

0.0014

0.0009

0.0003

a

Capital

Recovery

Factor

To Find A

Given P

A/P

1.1000

0.5762

0.4021

0.3155

0.2638

0.2296

0.2054

0.1874

0.1736

0.1627

0.1540

0.1468

0.1408

0.1357

0.1315

0.1278

0.1247

0.1219

0.1195

0.1175

0.1156

0.1140

0.1126

0.1113

0.1102

0.1061

0.1037

0.1023

0.1014

0.1009

0.1003

0.1000

0.1000

0.1000

Uniform Gradient

Gradient

Present Worth Uniform Series

Gradient

Factor

To Find P

Given G

P/G

0.000

0.826

2.329

4.378

6.862

9.684

12.763

16.029

19.422

22.891

26.396

29.901

33.377

36.801

40.152

43.416

46.582

49.640

52.583

55.407

58.110

60.689

63.146

65.481

67.696

77.077

83.987

88.953

92.454

94.889

97.701

99.561

99.920

Factor

To Find A

Given G

A/G

0.0000

0.4762

0.9366

1.3812

1.8101

2.2236

2.6216

3.0045

3.3724

3.7255

4.0641

4.3884

4.6988

4.9955

2789

5.5493

5.8071

6.0526

6.2861

6.5081

6.7189

6.9189

7.1085

7.2881

7.4580

8.1762

8.7086

9.0962

9.3740

9.5704

9.8023

9.9609

9.9927

N

12345676 HAC 48288

8

9

10

11

12

13

14

15

16

17

18

19

20

21

30

35

40

45

50

60

80

100

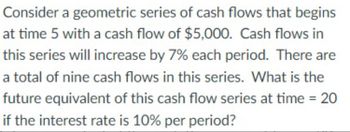

Transcribed Image Text:Consider a geometric series of cash flows that begins

at time 5 with a cash flow of $5,000. Cash flows in

this series will increase by 7% each period. There are

a total of nine cash flows in this series. What is the

future equivalent of this cash flow series at time = 20

if the interest rate is 10% per period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (a) Can we determine if point F is allocatively efficient? If so, is it allocatively efficient?arrow_forwardExplain to a new farmer why she/he should conduct an economic analysis to decide in she/he needs a tractor and a combine for her/his operation.arrow_forwardDo Homework - Basics of Econ, Opportunity Cost, Production Possibilities. - Google Chrome A mathxl.com/Student/PlayerHomework.aspx?homeworkld%3D6112948988&questionld%3D298&flushed%3Dtrue&cld%3D6721186¢erwi- ITMG 1B Econ 2100 Kanish Bhardwaj & HW Score: 0%, 0 of 81 points O Points: 0 of 1 Homework: Basics ... Question 29, 2.1 Questio... > The statement that "most economists are of the opinion that rent controls will usually leads to a housing shortage" is O A. positive, since its accuracy can be verified. O B. normative, since it references the opinions of economists. O C. both positive and normative. O D. positive, since it is true. IIarrow_forward

- Assume that someone have to pay tuition for four years. Two years at RCC school and then two years at Northeastern University. Two years at RCC cost $25000 for Two years at Northeastern University $144000 That person then get a fulltime engineering job for $90000/yr. What is that person own simple payback period and his/her ROI for paying for school in order to get that Engineering job?arrow_forward9:11 %00N a 46 l VOLTE عدنان الكثيري قبل ۱5 دقيقة Government spending Social Security contributions Corporate taxes Personal income taxes 50 Profit 28 20 Indirect business taxes 10 Imports Exports Interest 8 Rent 54 Wages Consumption expenditures Gross Private Domestic Investment 231 Depredation Government transfer payments 10 250 8 40 Using the above table, the Disposable Personal Income (DPI) for the country is Select one: O a. 147. O b. 78. O 220. Od. 293. ?? Aarrow_forwardPlease solve the problem of microeconomics with the full step. Im needed max in 30-60 minutes thank uarrow_forward

- please give me correct answer with calculationarrow_forward(a) is the profession in which a knowledge of the mathematical and natural sciences gained by study, experience, and practice is applied with judgment to develop ways to utilize, economically, the materials and forces of nature for the benefit of mankind". From that statement, outline the THREE (3) importance of the engineering economy for engineers with an example of each point. OPEN The Accreditation Board for Engineering and Technology states that "engineering ENDED C2arrow_forwardWhat are the Methods for Finding Rate of Return?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education