FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is Ratio Corporation's

Question 1 options:

|

|

None of these options |

|

|

$38,000 |

|

|

$80,000 |

|

|

$42,000 |

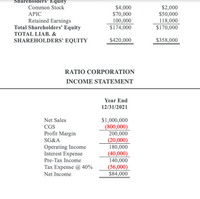

Transcribed Image Text:RATIO CORPORATION

BALANCE SHEET

December 31

ASSETS

2021

2020

Current Assets

$20,000

$18,000

8,000

30,000

4,000

$80,000

Cash

$10,000

$13,000

5,000

25,000

5,000

$58,000

Marketable Securities

Accounts Receivable

Merchandise Inventory

Other Current Assets

Total Current Assets

Noncurrent Assets

Buildings and Equipment (cost) $550,000

(210,000)

$340,000

$420,000

$500,000

(200,000)

$300,000

$358,000

Accumulated Depreciation

Buildings and Equipment (net)

TOTAL ASSETS

LIABILITIES & SHAREHOLDERS

EQUITY

Current Liabilities

Accounts Payable

Wages Payable

Other Payables

$18,000

11,000

9,000

$38,000

$15,000

1,000

12,000

$28,000

Total Current Liabilities

Noncurrent Liabilities

Bonds Payable

$208,000

$246,000

$160,000

$188,000

TOTAL LIABILITIES

Transcribed Image Text:Shareholders' Equity

Common Stock

$4,000

$70,000

100,000

$174,000

$2,000

$50,000

118,000

$170,000

APIC

Retained Earnings

Total Shareholders' Equity

TOTAL LIAB. &

SHAREHOLDERS' EQUITY

$420,000

$358,000

RATIO CORPORATION

INCOME STATEMENT

Year End

12/31/2021

$1,000,000

(800,000)

200,000

(20,000)

180,000

(40,000)

140,000

(56,000)

$84,000

Net Sales

CGS

Profit Margin

SG&A

Operating Income

Interest Expense

Pre-Tax Income

Тах Expense @ 40%

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Using the FCFE Model, Calculate the current equity value of this project. Show detailed workingsarrow_forwardFCF £800 £1,000 a. Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows. Debt Payments ABC Equity Payments Debt Payments XYZ Equity Payments b. Suppose you hold 10% of the equity of ABC. What is another portfollo you could hold that would provide the same cash flows? c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows?arrow_forward1arrow_forward

- provide the answer please choice correct optionarrow_forward32-If the value of your estate is above the nil rate band (NRB) £325,000, then the part of your estate above the threshold might be liable for tax at the rate of O a. 20% O b. None of the options O c. 40% O d. 10%arrow_forwardProblem 17-2 (Algo) PBO calculations; present value concepts [LO17-3] Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.4% × service years × final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $92,000 at the end of 2021 and the company's actuary projects her salary to be $290,000 at retirement. The actuary's discount rate is 6%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021.3. What is the company's projected benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer…arrow_forward

- EBITDA multiple Terminal value in 2027 8.0 x Present value of terminal value Present value of stage 1 cash flows Enterprise value (stage 1 + 2) 6,621,062 Using the above information, what is the enterprise value of the firm if the cost of capital is 10%?arrow_forwardPlease don't give image formatarrow_forwardQ7arrow_forward

- answer must be in proper format or i will five down votearrow_forwardNonearrow_forwardQS 11-17 (Algo) Net present value of annuity and salvage value LO P3 Pablo Company is considering buying a machine that will yield income of $3,100 and net cash flow of $14,700 per year for three years. The machine costs $45,900 and has an estimated $11,100 salvage value. Pablo requires a 10% return on its investments. Compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.) Years 1-3 Year 3 salvage Totals [Initial investment Net present value Net Cash Flows X PV Factor 14,700 x 11,100 x $ S = = Present Value of Net Cash Flows $ 0 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education