Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

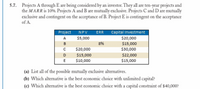

Transcribed Image Text:5.7. Projects A through E are being considered by an investor. They all are ten-year projects and

the MARR is 10%. Projects A and B are mutually exclusive. Projects C and D are mutually

exclusive and contingent on the acceptance of B. Project E is contingent on the acceptance

of A.

Project NPV ERR

Capital investment

$5,000

$20,000

$15,000

$30,000

B

8%

$20,000

$15,000

$10,000

$22,000

$15,000

D

E

(a) List all of the possible mutually exclusive alternatives.

(b) Which alternative is the best economic choice with unlimited capital?

(c) Which alternative is the best economic choice with a capital constraint of $40,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- pts) Lloyd Enterprises Year 0 1 2 WN 3 45 5 has a project which has the following cash flows: Cash Flows ($) -158,000 27,000 66,000 103,000 130,000 29,000 The cost of capital is 10 percent. The project's discounted payback period is ..years.arrow_forwardConsider the following fourmutually exclusive projects: Project J, K, L, and M. Assume that the investment in each project gets perpetually renewed (all the projects are perpetual). The cost of capital is 16%. Rank the projects according to profitability J K L M Initial investment 49,000 75,000 65,000 35,000 Annual cash flow 21,000 8,000 16,000 13,000 Lifecycle (years) 6 26 14 5s You are going to want to find the NPV and EAC of the cash flows. Since all of the cash flows are the same, you can use the PV function. Pay attention to the sign of the cash flows! You can also use the RANK function to rank the EACs for the four projects.arrow_forwardment #5 Question 8, P7-23 (similar to) Part 1 of 7 HW Score: 40%, 4 of 10 points O Points: 0 of 1 Save K You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10.4 million. Investment A will generate $2.16 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.44 million at the end of the first year, and its revenues will grow at 2.9% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 5.4%? c. In this case, for what values of the cost of capital does picking the higher IRR give the correct answer as to which investment is the best opportunity? a. Which investment has the higher IRR? The IRR of investment A is ☐ %. (Round to the nearest integer.)arrow_forward

- 7arrow_forwardExercise 12-14 (Algo) Comparison of Projects Using Net Present Value [LO12-2] Labeau Products, Limited, of Perth, Australia, has $15,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: Invest in Project X Invest in Project Y Investment required $ 15,000 $ 15,000 Annual cash inflows $ 5,000 Single cash inflow at the end of 6 years $ 36,000 Life of the project 6 years 6 years The company’s discount rate is 16%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X. 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept?arrow_forwardAnswer all the questions QUESTION 1 Questions a. After-tax cash flows for two mutually exclusive projects (with economic lives of four years each) are: Y Year Project X Project K(12,000) 5,000 01234 5,000 5,000 5,000 i. ii. iii. K(12,000) 0 0 0 25,000 The company's cost of capital is 10 percent. Compute the following: The internal rate of return for each project. The net present value for each project. Which project should be selected? Why? b. A firm is considering the purchase of an automatic machine for K6,200. The machine has an installation cost of K800 and zero salvage value at the end of its expected life of five years. Depreciation is by the straight-line method with the half-year convention. The machine is considered a five-year property. Expected cash savings before tax is K1,800 per year over the five years. The firm is in the 40 percent tax bracket. The firm has determined the cost of capital (or minimum required rate of return) as 10 percent after taxes. Should the firm…arrow_forward

- Aa 27.arrow_forward11arrow_forwardQuestion 4 BAG Corporation is considering the following two projects; namely Project X and Project Y: Project X Cash Flow ($) Cash Flow ($) -80,000 Project Y Year 0 -100,000 10,000 20,000 60,000 40,000 30,000 60,000 Year 1 Year 2 Year 3 5,000 Year 4 60,000 The discount rate for Project X is 9%, and the discount rate for Project Y is 10%. a) i. Calculate the payback period for each project. ii. Suppose Project X and Project Y are mutually exclusive (you can choose either one of Project X and Project Y, but cannot choose both), which project(s) should be accepted if BAG Corporation requires a payback period of 3 years? i. Calculate the profitability index for each project. b) ii. Suppose Project X and Project Y are mutually exclusive, which project(s) should be accepted when the profitability index rule is considered? c) i. Calculate the net present value (NPV) for each project. ii. Suppose Project X and Project Y are mutually exclusive, which project(s) should be accepted when the NPV…arrow_forward

- Problem 5.a: Consider the following set of projects at MARR = 30%. n 0 1 2 3 4 5 6 7 8 9 10 O A, B and E B and C A,B and D A, D and E A -$250 $60 $970 Determine what projects are simple investments? B,C and E B -$200 $90 $90 $60 $60 Net Cashflow C -$70 $20 $10 $5 -$50 $60 $50 $40 $30 $20 $10 D -$300 $270 $250 -$129 -$20 $120 $40 E -$90 -$100 -$50 $0 $150 $150 $100 $100arrow_forwardHw.61arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education