Block, S., Hirt, G., & Danielsen, B. (2017). Foundations of

Chapter 7, Problem #11:

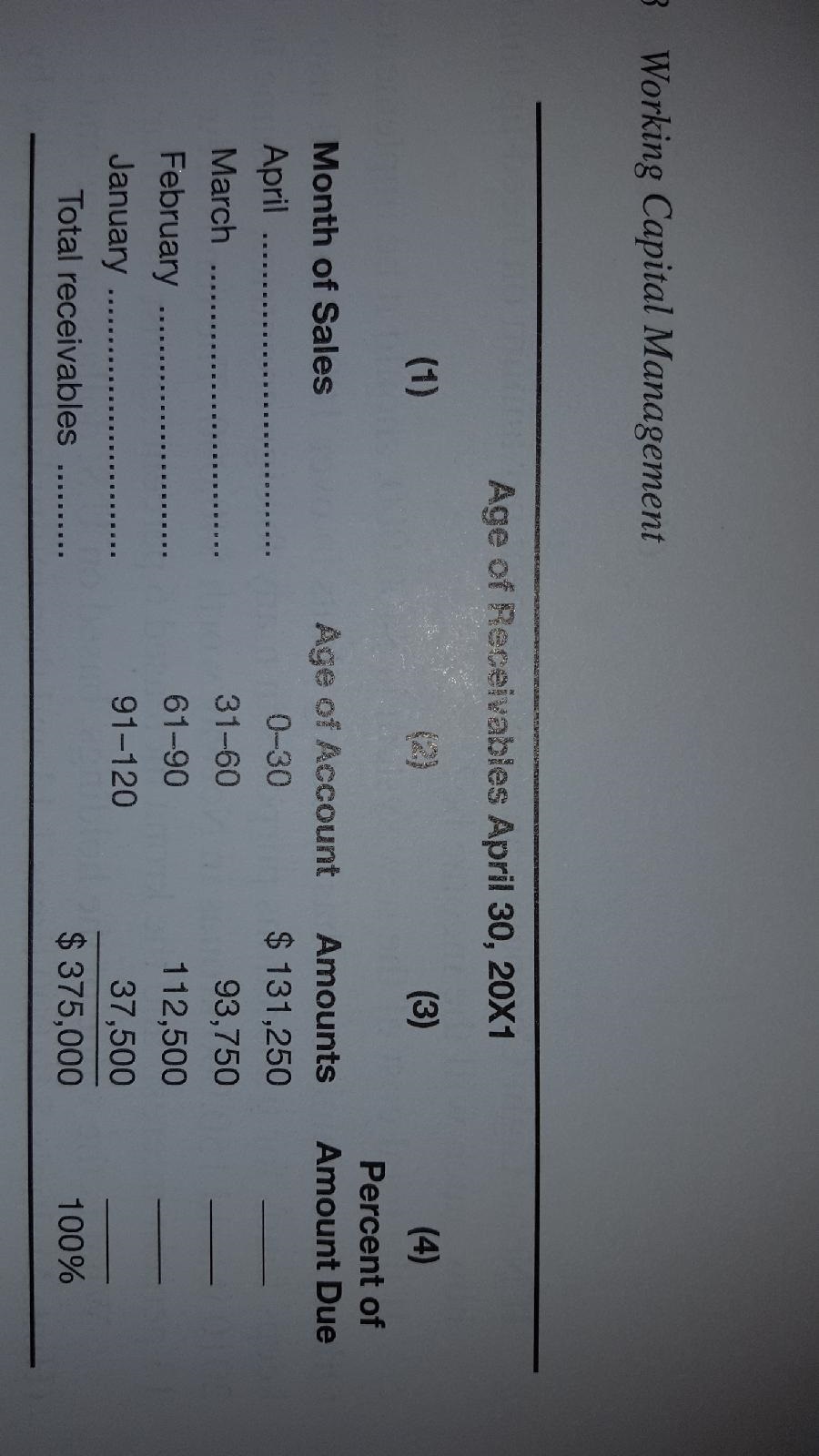

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

A. Fill in column (4) for each month. (Please see uploaded image of chart)

B. If the firm had $1,500,000 in credit sales over the four-month period, compute the average collection period. Average daily sales should be based on a 120 day-period.

C. If the firm likes to see it bills collected in 35 days, should it be satisfied with the average colleciton period?

D. Disregarding your answer to part C and considering the aging schedule for accounts receivable, should the company be satisfied?

E. What additional information does the againg schedule bring to the company that the average collection period may not show?

Thank you in advance!

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

- At January 1, 2024, Tarjee Inc. reported the following information on its statement of financial position: Accounts receivable $530,000 40,000 Allowance for expected credit losses ,40,000 During 2024, the company had the following summary transactions for receivables: Sales on account, $1,930,000; cost of goods sold, $1,061,500; return rate, 5% Selling price of goods returned, $76,000; cost of goods returned to inventory, $41,800 Collections of accounts receivable, $1,700,000 Write-offs of accounts receivable deemed uncollectible, $53,000 Collection of accounts previously written off as uncollectible, $12,000 After considering all of the above transactions, total estimated uncollectible accounts, $32,000 Prepare the journal entries to record each of the above summary transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardUse the following to answer questions 28-29: Accounts receivable Allowance Cash realizable value 12/31/2016 $525,000 (45,000) $480.000 During 2017, sales on account were $145,000 and collections on account were $86,000. Also during 2017; the company wrote off $8,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $54,000. 28. The change in the cash realizable value from the balance at 12/31/2016 to 12/31/2017 was a:. A) $50,000 B) $59,000. C) $42,000 D) $51,000 29. Bad debts expense for 2017 is: A) $17,000 B) $9,000 C) $54,000 D) $1,000arrow_forwardMr. Husker's Tuxedos Corp. ended the year 2021 with an average collection period of 35 days. The firm's credit sales for 2021 were $56.4 million. What is the year-end 2021 balance in accounts receivable for Mr. Husker's Tuxedos? (Enter your answer in dollars not in millions.) Accounts receivablearrow_forward

- Memanarrow_forwardAt the end of the current year, the accounts receivable account has a debit balance of $1,117,000 and sales for the year total $12,670,000. a. The allowance account before adjustment has a credit balance of $15,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a credit balance of $15,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $48,300. c. The allowance account before adjustment has a debit balance of $6,400. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $6,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $53,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. b. $ C. $ d. $arrow_forwardMacroware Corporation reported the following information in its financial statements for three successive quarters ($ in millions): Three Months Ended 6/30/2020 () 3/31/2020 (Q3) 12/31/2019 () Balance Sheets: Accounts receivable, net Income statements : Sales revenue $15, 761 $ 19,810 $ 12,900 24, 550 $ 23,330:22,120 Required: Compute the receivables turnover ratio and the average collection period for Q4 and Q3. Assume that each quarter consists of 91 days. Note: Round "Receivables turnover ratio " answers to 3 decimal places and " Average collection period" answers to 2 decimal places. Receivables turnover ratio Q4 times Receivables turnover ratio Q3 1.427 times Average collection period Q4 Average collection period Q3 days 63.79 days Balance Sheets: Accounts receivable, net Income statements: Sales revenue Macroware Corporation reported the following information in its financial statements for three successive quarters ($ in millions): Three Months Ended 3/31/2020 (03) 12/31/2019…arrow_forward

- How do I find the turnover and number of days' sales in receivables?arrow_forwardK Accounts receivable management This table, shows that Blair Supply had an end-of-year accounts receivable balance of $300,000. The table also shows how much of the receivables balance originated in each of the previous six months. The company had annual sales of $2.40 million and it normally extends 30-day credit terms to its customers. a. Use the year-end total to evaluate the firm's collection system. b. If 70% of the firm's sales occur between July and December, would this affect the validity of your conclusion in part a? Explain. a. The average collection period is days. (Round to two decimal places.)arrow_forwardDahlia Corporation has a current accounts receivable balance of $329,800. Credit sales for the year just ended were $4,369,850. a. What is the company's receivables turnover? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the company's days' sales in receivables? (Use 365 days a year. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. How long did it take on average for credit customers to pay off their accounts during the past year? (Use 365 days a year. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Receivables turnover b. Days' sales in receivables c. Average collection period times days daysarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education