ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

am. 117.

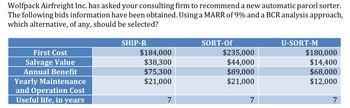

Transcribed Image Text:Wolfpack Airfreight Inc. has asked your consulting firm to recommend a new automatic parcel sorter.

The following bids information have been obtained. Using a MARR of 9% and a BCR analysis approach,

which alternative, of any, should be selected?

First Cost

Salvage Value

Annual Benefit

Yearly Maintenance

and Operation Cost

Useful life, in years

SHIP-R

SORT-Of

U-SORT-M

$184,000

$235,000

$180,000

$38,300

$44,000

$14,400

$75,300

$89,000

$68,000

$21,000

$21,000

$12,000

7

7

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BASED ON ESTIMATES THE DATA FOR TWO TYPES OF BRIDGES WITH DIFFERENT LIVES ARE AS FOLLOWS. IFTHE MINIMUM RATE OF RETURN IS 9%, DETERMINE W/C PROJECT IS MORE DESIRABLE. TIMBER BRIDGE STEEL BRIDGEFIRST COST P 50,000.00 P 140,000.00SALVAGE VALUE 2,000.00 10,000.00LIFE IN YEARS 12 36ANNUAL MAINTENANCE 6,000.00 2,500.00EVALUATE USING:A.) THE ANNUAL COST METHODB.) PRESENT WORTH COST METHODC.) RATE OF RETURN METHODarrow_forwardThe following annual costs are associated with three new extruder machines being considered for use in a Styrofoam cup plant: Data Useful Life, Years First Cost Salvage Value Annual Benefit M&O M&O Gradient X 17 $2,500,000 $105,000 $199,000 $65,000 $16,000 X-TRUD 13 $2,620,000 $109,000 $614,000 $80,000 $14,500 O Choosing SUPR-X is best because it has the highest Annual Benefit Choosing SUPR-X is best because it has the lowest M&O cost in yr1 SUPR-X 7 $2,020,000 $117,000 $671,000 $56,000 $11,000 The company's interest rate (MARR) is 4%. Which extruder should the Styrofoam company choose? Use Annual Cash Flow Analysis and provide the right reason. O Choosing SUPR-X will maximize the EUAB-EAUC; its value is $442,101 higher than X and $62,879 higher than X-TRUD. O Choosing SUPR-X will maximize the EUAB-EAUC; its value is $-38,899 higher than X and $-18,121 higher than X-TRUD.arrow_forwardThe interest is 5%arrow_forward

- The management of Brawn Engineering is considering three alternatives to satisfy an OSHA requirement for safety gates in the machine shop. Each gate will completely satisfy the requirement, so no combinations need to be considered. The first costs, operating costs, and salvage values over a 5-year planning horizon are shown below. End of Year Gate 1 Gate 2 Gate 3 0 -$15,000 -$19,000 -$24,000 1 -$6,500 -$5,600 -$4,000 2 -$6,500 -$5,600 -$4,000 3 -$6,500 -$5,600 -$4,000 4 -$6,500 -$5,600 -$4,000 5 -$6,500 + $0 -$5,600 + $2,000 -$4,000 + $5,000 Show the comparisons and internal rates of return used to make your decision:Comparison 1: (Gate 1 versus Gate 3 or Gate 2 versus Gate 3 or Gate 2 versus Gate 1?) IRR 1: %Comparison 2: (Gate 1 versus Gate 2 or Gate 2 versus Gate 3 or Gate 3 versus Gate 1?) IRR 2: Using an internal rate of return…arrow_forwardThe management of Brawn Engineering is considering three alternatives to satisfy an OSHA requirement for safety gates in the machine shop. Each gate will completely satisfy the requirement, so no combinations need to be considered. The first costs, operating costs, and salvage values over a 5-year planning horizon are shown below. End of Year Gate 1 Gate 2 Gate 3 0 -$15,000 -$19,000 -$24,000 1 -$6,500 -$5,600 -$4,000 2 -$6,500 -$5,600 -$4,000 3 -$6,500 -$5,600 -$4,000 4 -$6,500 -$5,600 -$4,000 5 -$6,500 + $0 -$5,600 + $2,000 -$4,000 + $5,000 What is the future worth of each alternative?arrow_forwardYou are charged with choosing a vendor to produce a new software that is going to benefit your company. The project has a life cycle of 8 years and MARR of 8% annual interest. Part a.) Draw the cash flow diagram for each vendor. Part b.) Calculate a PW cost for each vendor. Part c.) Indicate which vendor you would choose. Task Development Programming Operation Support Vendor M Cost, $ 200,000 150,000 42,000 20,000 40,000 30,000 Time Frame Now Years 1-4 Now Years 1-3 Years 1-8 Years 1-8 Vendor N Cost, $ Time Frame 70,000 60,000 45,000 50,000 35,000 Now Now Years 1-5 Years 1-8 Years 1-8 Vendor O Cost, $ 150,000 Time Frame Years 1-8arrow_forward

- Margaret has a project with a £ 28,000 first cost that returns £ 5,000 per year over its 10-year life. It has salvage value of £ 2,900 at the end of 10 years. If the MARR is 11 %, (Use 5 significant figures for your calculations, and round your answers to the nearest dollar. Indicate losses as a negative value.) (a) What is the present worth of this project? (b) What is the annual worth of this project? (c) What is the future worth of this project after 10 years?arrow_forwardEngineering Ecoarrow_forward. A manager has been presented with two proposals for automating a production process. Proposal A involves an initial cost of $15,000 and an annual operating costof $2,000 per year for the next 4 years. Thereafter, the operating cost is expected to increase by $100 per year. This equipment is expected to have a 10-year life with no salvage value.Proposal B requires an initial investment of $28,000 and an annual operating cost of $1,200 per year for the first 3 years. Thereafter, theoperating cost is expected to increase by $120 per year. This equipment is expected to last for 20 years and will have a $2,000 salvage value. If the company's minimum attractive rate of return is 10%, which proposal should be accepted on the basis of present worth analysis?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education