FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

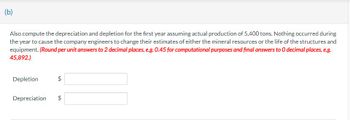

Transcribed Image Text:(b)

Also compute the depreciation and depletion for the first year assuming actual production of 5,400 tons. Nothing occurred during

the year to cause the company engineers to change their estimates of either the mineral resources or the life of the structures and

equipment. (Round per unit answers to 2 decimal places, e.g. 0.45 for computational purposes and final answers to O decimal places, e.g.

45,892.)

Depletion

$

Depreciation $

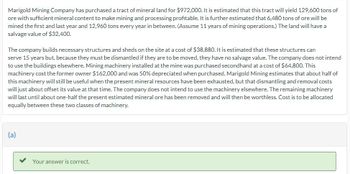

Transcribed Image Text:Marigold Mining Company has purchased a tract of mineral land for $972,000. It is estimated that this tract will yield 129,600 tons of

ore with sufficient mineral content to make mining and processing profitable. It is further estimated that 6,480 tons of ore will be

mined the first and last year and 12,960 tons every year in between. (Assume 11 years of mining operations.) The land will have a

salvage value of $32,400.

The company builds necessary structures and sheds on the site at a cost of $38,880. It is estimated that these structures can

serve 15 years but, because they must be dismantled if they are to be moved, they have no salvage value. The company does not intend

to use the buildings elsewhere. Mining machinery installed at the mine was purchased secondhand at a cost of $64,800. This

machinery cost the former owner $162,000 and was 50% depreciated when purchased. Marigold Mining estimates that about half of

this machinery will still be useful when the present mineral resources have been exhausted, but that dismantling and removal costs

will just about offset its value at that time. The company does not intend to use the machinery elsewhere. The remaining machinery

will last until about one-half the present estimated mineral ore has been removed and will then be worthless. Cost is to be allocated

equally between these two classes of machinery.

(a)

Your answer is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- am. 134.arrow_forwardA machine with a cost of $68,856 has an estimated residual value of $5,301 and an estimated life of 3 years or 15,143 hours. It is to be depreciated by the units-of-activity method. What is the amount of depreciation for the second full year, during which the machine was used 4,595 hours? Do not round your intermediate calculations. a. $21,185.00 b. $42,370.00 c. $19,285.16 d. $20,893.70arrow_forwardThe Weber Company purchased a mining site for $573,259 on July 1. The company expects to mine ore for the next 10 years and anticipates that a total of 94,508 tons will be recovered. During the first year the company extracted 4,359 tons of ore. The depletion expense is a.$51,961.60 b.$23,966.29 c.$26,459.13 d.$53,643.00arrow_forward

- Pharoah Company purchased for $4,543,000 a mine that is estimated to have 45,430,000 tons of ore and no salvage value. In the first year, 14,040,000 tons of ore are extracted. (a1) Calculate depletion cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depletion cost per unit $ per ton Save for Later (a2) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardHidden Hollow Mining Co. acquired mineral rights for $69,000,000. The mineral deposit is estimated at 60,000,000 tons. During the current year, 13,200,000 tons were mined and sold. a. Determine the depletion rate. If required, round your answer to two decimal places. Sfill in the blank d39a0a00ffc1f93_1 per tonarrow_forwardAn asset for drilling was purchased and placed in service by a petroleum production company. Its cost basis is $60,000 and it has an estimated MV of $12,000 at the end of an estimated useful life of 14 years. Compute the accumulated depreciation in the third year and the BV at the end of 5th year of life by each of these methods at the rate of 9%: b. The DB Method (Declining Balance Method)- Provide the complete manual solution (not excel or tables) and cash flow diagramarrow_forward

- Dow Deep Mining Co acquired mineral rights for $56,000,000. The mineral deposit is estimated at 70,000,000 tons. During the current year, 18,200,000 tons were mined an a. Determine the depletion rate. It required, round your answer to two decina aces A) Depletion rate per ton.arrow_forwardDepletion: Calculating and Journalizing Mineral Works Co. acquired a salt mine at a cost of $1,700,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,400,000 tons. a. During the first year, 200,000 tons are mined and sold. b. During the second year, 600,000 tons are mined and sold. Required: 1. Calculate the amount of depletion expense for both years. Year 1 Year 2 2. Prepare general journal entries for depletion expense. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 1 Year 1 2 3 3 4 Year 2 4 5 6 6arrow_forwardMonty Corp. purchased for $5,977,200 a mine that is estimated to have 49,810,000 tons of ore and no salvage value. In the first year, 12,090,000 tons of ore are extracted. (a1) × Your answer is incorrect. Calculate depletion cost per unit. (Round answer to 2 decimal places, e.g. 0.50.) Depletion cost per unit $ eTextbook and Media 0.22 per tonarrow_forward

- The Weber Company purchased a mining site for $674,927 on July 1. The company expects to mine ore for the next 10 years and anticipates that a total of 87,066 tons will be recovered. During the first year the company extracted 4,680 tons of ore. The depletion expense is a.$36,270.00 b.$62,964.00 c.$33,844.61 d.$45,287.00arrow_forwardQuavo Mining Co. acquired mineral rights for $16,500,000. The mineral deposit is estimated at 36,500,000 tons. During the current year, 10,037,500 tons were mined and sold. a. Determine the amount of depletion expense for the current year. Do not round intermediate calculation and round your answer to nearest whole value.$fill in the blank 1 b. Illustrate the effects on the accounts and financial statements of the depletion expense. For decreases in accounts or outflows of cash, enter your answers as negative numbers. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Balance Sheet Assets = Liabilities + Stockholders' Equity - Accumulated depletion + No effect = No effect + Retained earnings fill in the blank 6 fill in the blank 7 fill in the blank 8 fill in the blank 9 Statement of Cash Flows Income Statement No effect fill in the blank 11 Depletion expense…arrow_forwardDepletion: Calculating and Journalizing Mineral Works Co. acquired a salt mine at a cost of $1,925,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,500,000 tons. a. During the first year, 220,000 tons are mined and sold. b. During the second year, 290,000 tons are mined and sold. Required: 1. Calculate the amount of depletion expense for both years. Year 1 Year 2 2. Prepare general journal entries for depletion expense. Page: 1 DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 1 Year 1 1 2 3 3 4 Year 2 4 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education