Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

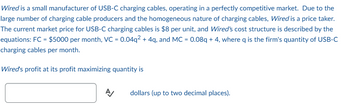

Transcribed Image Text:Wired is a small manufacturer of USB-C charging cables, operating in a perfectly competitive market. Due to the

large number of charging cable producers and the homogeneous nature of charging cables, Wired is a price taker.

The current market price for USB-C charging cables is $8 per unit, and Wired's cost structure is described by the

equations: FC = $5000 per month, VC = 0.04q² + 4q, and MC = 0.08q + 4, where q is the firm's quantity of USB-C

charging cables per month.

Wired's profit at its profit maximizing quantity is

A

dollars (up to two decimal places).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A local shoe has total costs of production given by the equation TC-125+10q+5q². The market demand for shoes is given by the equation QD-50- (1/5) *P. a) Write the equations showing the average total cost and average variable cost and average fixed cost, each as a function of q. b) What is the breakeven price and breakeven quantity for this firm in the short run? c) What is the shutdown price and shutdown quantity for this firm in the short run? d) If the market price of the output is $50, how many units will this firm produce? e) Given a market price of $50. how many firms are in this market?arrow_forwardA local newspaper currently has 84,000 subscribers at a quarterly charge of $30.Market research has suggested that if the owners raise the price to $32, they wouldlose 5,000 subscribers. Assuming that subscriptions are linearly related to theprice, what price should the newspaper charge for a quarterly subscription tomaximize their revenue?a) Find the cost function (Hint: find slope and use point-slope form to find thecost function) b) Find the revenue function c) Find the maximum revenue d) Find the profit functionarrow_forwardIn the market for foam fire retardant there is only one firm. The demand func-tion for the product is Q = 15,000 – 10P where Q is the annual sales quantity in tons and P is the price per ton. The firm’s total cost function (in dollars) is C = 1,400,000 + 300Q + 0.05Q2.a) How much foam fire retardant should this firm produce and sell in order to maximize its profit? What price should it charge?b) Compute the firm’s total profit.c) Suppose now that the firm faces a 20% increase in variable costs. Determine what impact this will have on the firm’s optimal choice.arrow_forward

- The weekly demand for the LectroCopy photocopying machine is given by the equation p=2000-.04x where P debates the wholesale unit pricearrow_forwardA company manufactures and sells x cellphones per week. The weekly price-demand and cost equations are given below. p=600-0.1x and C(x)= 15,000+ 130x (A) What price should the company charge for the phones, and how many phones should be produced to maximize the weekly revenue? What is the maximum weekly revenus? The company should produce phones each week at a price of $ (Round to the nearest cent as needed.) The maximum weekly revenue is S. (Round to the nearest cent as needed.) (B) What price should the company charge for the phones, and how many phones should be produced to maximize the weekly profit? What is the maximum weekly profit? The company should produce phones each week at a price of $ (Round to the nearest cent as needed.) The maximum weekly profit is $ (Round to the nearest cent as needed.)arrow_forwardshow work pleasearrow_forward

- The Lead Zeppelin Company produces powered and steerable lighter-than-air craft. The company’s airships are specially lined and are therefore safer than normal dirigibles. The table below shows the weekly production of dirigibles, along with the associated Average Cost and Total Revenue figures (the Average Cost and Total Revenue figures are actually in thousands of dollars, so the $15 represents $15,000, but we have left off the zeros to save space). Quantity Average Cost Total Cost Total Revenue 0 -- 0 $0 1 $15 15 $10 2 $9 18 $20 3 $8 24 $30 4 $8.50 34 $40 5 $9 45 $50 6 $10 60 $60 7 $12 84 $70 The Lead Zeppelin Company has decided that it will produce at least 1 dirigible. Now the question becomes, how many more dirigibles should it produce to make as much profit as possible? Use the profit-maximizing rule to explain how many dirigibles the Lead Zeppelin Company should produce to…arrow_forwardThe El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and The New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the demand and cost schedules shown in the spreadsheet that follows: a- Create a spreadsheet using Microsoft Excel (or any other spreadsheet software) that matches the one above by entering the output, price, and cost data given. b- Use the appropriate formulas to create three new columns (4, 5, and 6) in your spreadsheet for total revenue, marginal revenue (MR), and marginal cost (MC), respectively. [Computation check: At Q = 3,000, MR = $0.50 and MC = $0.16]. What price should the manager of the El Dorado Star charge? How many papers should be sold daily to maximize profit? c- At the price and output level you answered in part b, is the El Dorado Star…arrow_forwardMaximizing Profits The weekly demand for the Pulsar 40-in. high-definition television is given by the following demand equation where p denotes the wholesale unit price in dollars and X denotes the quantity demanded. p=-0.05x+622 (0 ≤ x ≤ 12000) The weekly total cost function associated with manufacturing these sets is given by the following function where C(x) denotes the total cost incurred in producing x sets. C(x)=0.000002x³-0.01x² +400x + 80000 Find the level of production that will yield a maximum profit for the manufacturer. Hint: Use the quadratic formula. (Round your answer to the nearest whole number.) unitsarrow_forward

- Presently, APlus Transport and Big Movers are the only suppliers of services that haul heavy construction equipment between jobs within the Midwest. No other suppliers have the equipment necessary to perform the service. The market inverse demand for these hauling services is given below. P-4,030-40 where P is price per trip and Q is total number of trips per year. For simplicity, also assume that neither firm has fixed costs. From company records, you are given the following variable cost function for each firm: TVC,=300, TVC, - 800 a. Assume these two competitors operate as a two-firm Cournot duopoly. Find the reaction functions for each firm. b. Calculate the Cournot market equilibrium price-output solutions for each firm including their respective profits. c. Suppose Big Movers shuts down operations so that APlus now has a monopoly in this market. What is the price, quantity, and profits for APlus after this change? d. Summarize the results of your findings over the two possible…arrow_forwardPakPerfect Inc. estimates equation of its total costs of production as TC = 500 + 10Q + 5Q2 and market demand for its product as Qd = 105 – (1/2) P, where Q is quantity in units and P is price in Pak$. (i) Write the equations of the firm’s costs, as a function of Q (ii) Average Total Cost ATC (iii) Average Variable Cost AVC (iv) Average Fixed Cost AFC a. Given above costs can you determine what will be the firm’s production in Stage 1? What is the breakeven price and breakeven quantity for this firm? b. What is the shutdown price and quantity for this firm? c. Draw the firm’s costs in a graph as per your determination in (a). Label the breakeven and shutdown price and quantity using information in (b) and (c) above. d. Given the market price of Pak$ 50 (i) how many units should the firm produce? (ii) how many firms are competing in this market in short-run? (iii) How many firms will be in the industry in the long-run? e. How do you interpret the profit or loss condition of PakPerfect?…arrow_forwardRoad Runner Co is a Pakistani manufacturer making Bicycles. It exports to two markets,Bangladesh and Sri Lanka. Demand for Bicycles in thesetwo markets is given by the following Functions: Bangladesh Q1 = 12 – P1 Sri Lanka Q2 = 8 – P2 Where Q1 and Q2 are respective quantities sold (in thousands) andP1 and P2 are the respective prices (in Pak. Rupees per unit) in the two markets. Total cost function is C = 5 + 2 (Q1+ Q2) (i) Company is effectively able to price discriminate in the two markets. What will be the total profits? (ii) Suppose the company does not engage in price discrimination. By charging the same price in the two markets what are the profit maximizing levels of price, output, and the total profits? (iii) Analyze, with graphs, the two alternative pricing strategies available to the company.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning