ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

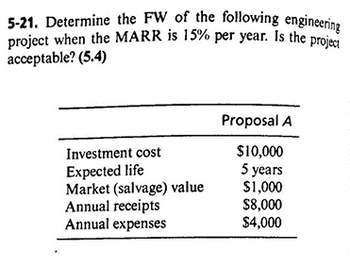

Transcribed Image Text:5-21. Determine the FW of the following engineering

project when the MARR is 15% per year. Is the project

acceptable? (5.4)

Investment cost

Expected life

Market (salvage) value

Annual receipts

Annual expenses

Proposal A

$10,000

5 years

$1,000

$8,000

$4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Project A costs $35,000 initially, has a 4-year life and incurs $4,000 in annual year-end costs. Project B costs $39,000 initially, has a 5-year life and incurs $4,500 in annual year-end costs. If the company's required return is 10%, calculate the equivalent annual cost of each project. Options Project A $16,788; Project B $15,211 Project A $13,452; Project B $12,924 Project A $15,041; Project B $14,788 Project A $12,623; Project B $11,679 Project A $14,190; Project B $13,250arrow_forwardNot using exelarrow_forwardWhich equation below gives at10% interest the total EUAC of an asset with an initial cost of $30,000, an estimated salvage value of $12,000 after its 7 -year service lile a, O&M costs of $25,000 per year? EUAC=($30,000−12,000)(A/P,10%,7)+($12,000)(A/F,1006,7)+$25,000 EUAC=($30,000−12,000)(A/P,10%,7)+($12,000)(0.10)+$25,000(A/F,10%,7) EUAC=($30,000−12,000)(A/R,10%,7)+($12,000)(0.10)+$25,000 EUAC=($30,000−12,000)(A/P,10%,7)+$25,000arrow_forward

- 6-30 The Johnson Company pays $1700 a month to a trucker to haul wastepaper and cardboard to the city dump. The material could be recycled if the company were to buy a $48,000 hydraulic press baler and spend $21,000 per year for labor to operate the baler. The baler has an estimated useful life of 15 years and no salvage value. Strapping the material would cost $1500 per year for the estimated 600 bales a year that would be produced. A wastepaper company will pick up the bales at the plant and pay Johnson $27 per bale for them. Use an annual cash flow analysis and an interest rate of 8 % to recommend whether it is economical to install and operate the baler.arrow_forwardPlease no written by hand and no emagearrow_forwardRequired information Akash Uni-Safe in Chennai, India, makes Terminator fire extinguishers. The company needs replacement equipment to form the neck at the top of each extinguisher during production. Machine First cost, $ AOC, $ per year Salvage value, $ Life, years NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. D -68,000 -14,000 8,000 E -78,000 -17,000 10,000 6 Select between two metal-constricting machines. Use the corporate MARR of 15% per year with future worth analysis using tabulated factors. The future worth of machine D is $- [138012.93 The machine selected based on the future worth analysis is and the future worth of machine E is $- 138012.93arrow_forward

- With the given information please calculate NPV, NPW, EUAW, and IRR for each alternative. The interest rate is 15%arrow_forwardM2.arrow_forwardMARR 20% EOY Cash Flow 0 $(70,000.00) 1 $ 20,000.00 2 $ 19,000.00 3 $ 18,000.00 4 $ 17,000.00 5 $ 16,000.00 6 $ 15,000.00 7 $ 14,000.00 8 $ 13,000.00 9 $ 12,000.00 10 $ 11,000.00 11 $ 10,000.00 12 $ 9,000.00 13 $ 8,000.00 14 $ 7,000.00 15 $ 6,000.00 16 $ 5,000.00 17 $ 4,000.00 18 $ 3,000.00 19 $ 2,000.00 20 $ 1,000.00 Plot a graph of FW versus MARR, where MARR varies from 0 percent to 50 percent by 1 percent increments.FW should be on the y-axis and MARR on the x-axis. How do you find FW? Please show all steps and formulas used in excel format. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education