FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

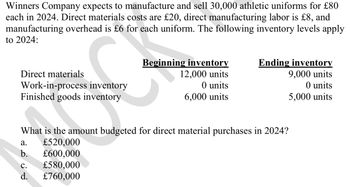

Transcribed Image Text:Winners Company expects to manufacture and sell 30,000 athletic uniforms for £80

each in 2024. Direct materials costs are £20, direct manufacturing labor is £8, and

manufacturing overhead is £6 for each uniform. The following inventory levels apply

to 2024:

Direct materials

Beginning inventory

12,000 units

Ending inventory

9,000 units

Work-in-process inventory

O units

O units

Finished goods inventory

6,000 units

5,000 units

What is the amount budgeted for direct material purchases in 2024?

a.

£520,000

b. £600,000

C.

£580,000

d. £760,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Ivanhoe, Inc. produces men's shirts. The following budgeted and actual amounts are for 2022: Cost Direct materials Direct labor Fixed overhead Budget at 2,650 units $66,250 71.550 39.050 Actual Amounts at 2,950 units $76,500 78,750 38,200arrow_forwardA9arrow_forwardUse the information provided below to prepare the Materials Purchases Budget of Lunar Limited for 2025. INFORMATION The required production of Lunar Limited for 2025 for the only product that it manufactures is 5 000 units. Four kilograms of direct materials are required for each unit produced. The direct materials inventories on 01 January 2025 and 31 December 2025 are expected to be 3 000 kilograms and 5 000 kilograms respectively. The expected purchase price is R6 per kilogram.arrow_forward

- Coronado Industries determines that 63000 pounds of direct materials are needed for production in July. There are 4200 pounds of direct materials on hand at July 1 and the desired ending inventory is 3600 pounds. If the cost per unit of direct materials is $3, what is the budgeted total cost of direct materials purchases? O 183600. O 190800. O 187200. O 194400.arrow_forwardUse the information below for Mandy Corporation to answer the question that follow. Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 643,000 units, estimated beginning inventory is 105,000 units, and desired ending inventory is 84,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A: 0.50 lb. per unit @ $0.61 per poundMaterial B: 1.00 lb. per unit @ $2.37 per poundMaterial C: 1.20 lb. per unit @ $0.86 per poundThe dollar amount of Material C used in production during the year is a.$577,714 b.$770,285 c.$706,094 d.$641,904arrow_forwardZizi plc uses a standard absorption costing system and produces and sells product 8W. The standard cost card is below: Product 8W (€ per unit) Direct material (5 per kg) 15 Direct labour (6 per hour) 12 Fixed manufacturing overhead 10 Total production cost 37 Standard profit 13 Standard selling price 50 * Absorption rate based on standard labour hours Budgeted and actual production and sales units for december 2020 were as follows: Budget Actual Production 1,100 900 Sales 1,000 800 Actual data for December 2020 were as follows € Direct material purchases 1,200 kgs costing 12,000 Direct materials used 1,100 kgs Direct labour hours 500 hours costing 6,000 Fixed manufacturing overhead 5,000 Sales revenue 30,000 An analysis of the Direct labour hours shows that the 500 hours that were paid for 50 were idle time due to a machinery breakdown. There were no inventories of Direct materials or finished products (planned or actual) at the…arrow_forward

- Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 625,000 units, estimated beginning inventory is 109,000 units, and desired ending inventory is 89,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below.Material A 0.50 lb. per unit @ $0.64 per poundMaterial B 1.00 lb. per unit @ $2.33 per poundMaterial C 1.20 lb. per unit @ $0.78 per poundThe dollar amount of Material B used in production during the year is a.$2,114,475 b.$1,127,720 c.$1,691,580 d.$1,409,650arrow_forwardPietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 50,000 units will be produced, with the following total costs: Direct materials ? Direct labor $71,000 Variable overhead 19,000 Fixed overhead 180,000 Next year, Pietro expects to purchase $122,000 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials Inventory Work-in-Process Inventory Beginning $7,000 $11,700 Ending $6,900 $13,700 Required: Question Content Area 1. Prepare a statement of cost of goods manufactured. Pietro Frozen Foods, Inc. Statement of Cost of Goods Manufactured For the Coming Year Direct materials $- Select - - Select - Materials available $fill in the blank 518a60ff502205f_5 - Select - Direct materials used in production $fill in the blank 518a60ff502205f_8 - Select - - Select - Total manufacturing costs added $fill in the blank 518a60ff502205f_13 - Select - - Select - Cost of goods…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education