FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

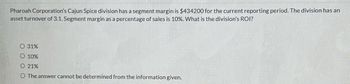

Transcribed Image Text:Pharoah Corporation's Cajun Spice division has a segment margin is $434200 for the current reporting period. The division has an

asset turnover of 3.1. Segment margin as a percentage of sales is 10%. What is the division's ROI?

O 31%

O 10%

O 21%

O The answer cannot be determined from the information given.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Jamison Company has an investment in assets of $960,000 income that is 10% of sales, and an ROI of 16%. From this information the amount of income would be Multiple Choice $153,600. $253,600 $168,600 impossible to determine from the information given.arrow_forwardPo.3.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] King Mattresses sells both mattress sets and bed frames. Last quarter, total sales were $70,000 for mattress sets and $45,000 for bed frames. Return on investment (ROI) was 15% for both divisions, while asset turnover (AT) was 3 for mattress sets and 3 for bed frames. Compute King Mattresses’s total return on sales (ROS) for the quarter.arrow_forward

- Product AG52 has revenues of $748,000, variable cost of goods sold of $640,000, variable selling expenses of $90,000, and fixed costs of $50,000, creating a loss from operations of $32,000. Required: 1. Prepare a differential analysis as of October 7 to determine if Product AG52 should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required. 2. Determine if Product AG52 should be continued (Alternative 1) or discontinued (Alternative 2).arrow_forwardVinubhaiarrow_forwardplease step by step solution.arrow_forward

- A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Do not round your intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ Company A 480,000 156,000 21 % 18 % Company B $ 740,000 GA GA $ 53,000 $ 69 18 % 54.000 % $ $ $ Company C 520,000 155,000 % 12 % 5,000arrow_forwardConcord Company earned a controllable margin of $125000 on sales of $1607000. The division had average operating assets of $1293000. The company requires a return on investment of at least 7%. How much is residual income? O $34490 O $159490 O $90510 O $112490arrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Do not round your intermediate calculations.) Sales Net operating income. Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ Company A 400,000 Company B $ 690,000 $ Company C 670,000 $ 37,000 $ 154,000 $ 142,000 24 % 17% % 13 % % 10 % $ 44,000 $ 5,000arrow_forward

- = Required Supply the missing information in the following table for Zachary Company: Note: Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 shoule Sales ROI Operating assets Operating income Turnover Residual income Operating profit margin Desired rate of return $ 309,600 1.8 % 13 % 19%arrow_forwardLast year, Terrific Copying had total revenue of $548019, while operating at 59% of capacity. The total of its variable cost is $141312. Fixed costs were $228530. What is Terrific's break-even point expressed in dollars of revenue? Enter as dollars and cents without a dollar sign or comma. Answer:arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales Net operating income Average operating assets The company's minimum required rate of return $14,720,000 $1,000,960 $4,000,000 14% Required: a. What is the division's margin? b. What is the division's turnover? c. What is the division's return on investment (ROI)? d. What is the division's residual income?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education