FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

All I need help with is part b: Fill in the amount that would appear in the

Transcribed Image Text:Windsor, Inc.'s stockholders' equity section at December 31, 2019, appears below:

Stockholder's equity

Paid-in capital

Common stock, $10 par, 60,000

outstanding

Paid-in capital in excess of par

Total paid-in capital

Retained earnings

$600,000

179,000

$779,000

152,000

$931,000

Total stockholder's equity

On June 30, 2020, the board of directors of Windsor, Inc. declared a 15% stock dividend, payable on July 31, 2020, to stockholders of

record on July 15, 2020. The fair value of Windsor, Inc.'s stock on June 30, 2020, was $16.

On December 1, 2020, the board of directors declared a 2-for-1 stock split effective December 15, 2020. Windsor, Inc.'s stock was

selling for $18 on December 1, 2020, before the stock split was declared. Par value of the stock was adjusted. Net income for 2020

was $231,000 and there were no cash dividends declared.

(a)

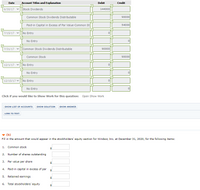

Transcribed Image Text:Date

Account Titles and Explanation

Debit

Credit

6/30/17 v

Stock Dividends

144000

Common Stock Dividends Distributable

90000

Paid-in Capital in Excess of Par Value-Common St

54000

7/15/17

No Entry

No Entry

7/31/17

Common Stock Dividends Distributable

90000

Common Stock

90000

12/1/17 v

No Entry

No Entry

12/15/17 vNo Entry

No Entry

Click if you would like to Show Work for this question: Open Show Work

SHOW LIST OF ACCOUNTS

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

(ь)

Fill in the amount that would appear in the stockholders' equity section for Windsor, Inc. at December 31, 2020, for the following items:

1. Common stock

2.

Number of shares outstanding

3.

Par value per share

4. Paid-in capital in excess of par

5. Retained earnings

6. Total stockholders' equity

%24

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Texas, Inc. has net income for 2019 of $555,000. At January 1, 2019, the company had outstanding 54,000 shares of $75 par value common stock and 10,000 shares of 6%, $150 par value cumulative preferred stock. On September 1, 2019, an additional 18,000 shares of common stock were issued. What is the earnings per share for 2019 (to the nearest cent)? Select one: O O O A. $6.47 B. $9.26 C. $7.75 D. $6.66arrow_forwardCheck my work ! Required information [The following information applies to the questions displayed below.] On January 1, 2019, Metco Inc. reported 268,000 shares of $5 par value common stock as being issued and outstanding. On March 24, 2019, Metco Inc. purchased for its treasury 2,500 shares of its common stock at a price of $39.00 per share. On August 19, 2019, 750 of these treasury shares were sold for $45.00 per share. Metco's directors declared cash dividends of $0.40 per share during the second quarter and again during the fourth quarter, payable on June 30, 2019, and December 31, 2019, respectively. A 3% stock dividend was issued at the end of the year. There were no other transactions affecting common stock during the year. Required: a-1. Use the horizontal model for the treasury stock purchase on March 24, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Income Statement Assets…arrow_forwardAssume that the following quote for the Walt Disney Company, a NYSE stock, appeared on some particular date of 2019 on Yahoo! Finance ( https://finance.yahoo.com/quote/DIS?p=DIS&.tsrc=fin-srch): The Walt Disney Company (DIS) - NYSE 136.55 +2.76 (+2.06%) Prev Close: 133.79 Day's Range: 135.63 - 138.47 Open: 140.22 52wk Range: 104.50 - 143.83 Bid: 136.55 x 800 Volume: 23,891,567 Ask: 137.00 x 1800 Avg Vol (3m): 7,947,016 1y Target Est: 151.04 Market Cap: 247.284B Analyst Recommendation Buy P/E (ttm) 21.01 Next Earnings Date: Feb. 3-7, 2020 EPS (ttm): 6.50 Div & Yield: 1.52 (1.14%) Given this information, answer the following questions. At what price did the stock sell at the time of the quote? $ What is the stock's price/earnings ratio? What does that indicate? Round your answers to the nearest whole number. This means that investors are willing to pay more than $ for every $1 of earnings per share that the company generated…arrow_forward

- Indicate the amount of annual dividend on each issue of the preferred shares by completing the last column of the above table Assume that there are one year of dividends in arrears at the beginning of 2020, and Essex declared total dividends of $40,000 in 2020. What is the amount of dividends that the common shareholders will receive in 2020?arrow_forwardIf Friday, October 4, 2019, is the record date for ABC Corporation, when must an investor have purchased the stock in order to be entitled to receive a declared dividend? Select one: O a. Thursday, October 3rd Ob. Wednesday, October 2nd c. Tuesday, October 1starrow_forwardLocate and download Gap Inc.’s 2020 Annual Report (for fiscal year 2/2/20-1/30/21) https://investors.gapinc.com/financial-information/default.aspx Shareholder’s Equity At 2/1/20: How many shares of common stock are: (a) authorized _______________ (b) issued _______________ (c) outstanding _______________ How many shares of preferred stock are: (a) authorized _______________ (b) issued _______________ (c) outstanding _______________ What was the amount of dividends paid to shareholders during 2020? _______________arrow_forward

- Please help me with this homework question in the screenshot.arrow_forwardCopley Corporation is preparing their financial statements for the year ending February 28, 2022. Copley Corporation has two categories of stock: Preferred and Common. The preferred stock is structured such that the holders of the preferred stock may convert one share of preferred stocks into one share of common stock if the market price of the common stock is greater than $1,000. As of February 28, 2022, the market price of the common stock had never reached $1,000. In the preparation of the 2/28/22 Income Statement Copley’s staff accountant was calculating the Basic and Diluted EPS. While calculating the diluted EPS the staff accountant is unsure of whether to include the potential impact of the convertible preferred stock since the trigger conversion price had not been met as of 2/28/22. Accounting Issue: In the calculation for Diluted EPS should Copley Corporation include the impact of the convertible preferred stock since the trigger conversion price of $1,000 had not…arrow_forwardIn 2021, Western Transport Company entered into the treasury stock transactions described below. In 2019, Western Transport had issued 200 million shares of its $1 par common stock at $20 per share. Required:Prepare the appropriate journal entry for each of the following transactions: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) On January 23, 2021, Western Transport reacquired 15 million shares at $23 per share. On September 3, 2021, Western Transport sold 1 million treasury shares at $24 per share. On November 4, 2021, Western Transport sold 1 million treasury shares at $21 per share.arrow_forward

- In 2021, Western Transport Company entered into the treasury stock transactions described below. In 2019, Western Transport had issued 130 million shares of its $1 par common stock at $13 per share. Required:Prepare the appropriate journal entry for each of the following transactions: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) On January 23, 2021, Western Transport reacquired 10 million shares at $16 per share. On September 3, 2021, Western Transport sold 5 million treasury shares at $17 per share. On November 4, 2021, Western Transport sold 5 million treasury shares at $14 per share.arrow_forwardRicci Corporation is preparing their financial statements for the year ending September 30, 2021. Ricci Corporation has two categories of stock; Preferred and Common. On September 25, 2021 Ricci Corporation declared dividends on the preferred stock which will be paid on October 18, 2021. In order to calculate EPS the staff accountant had the following information: 2021 Net Income: $4,000,000 Preferred Dividends Declared in September 25, 2021 $ 500,000 but not paid until October 18, 2021 Weighted Average Number of Common Shares Outstanding 125,000 shares The staff accountant has determined that since the preferred dividends were not paid prior to September 30, 2021 the preferred dividend should not be included in the 2021 EPS. Accounting Issue: In the calculation for EPS should Ricci Corporation include the preferred dividends not paid prior to September 30, 2021? Your Interpretation of the Guidance: Should Ricci Corporation include the preferred dividends in the calculation of EPS…arrow_forwardRequired: How much is the Ordinary Share Capital at year end?* How much is the Preference Share Capital at year end?* How much is the TOTAL subscribed share capital (assuming subscriptions receivable is collectible on January 5, 2022)?*arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education