EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Tpoic about inv

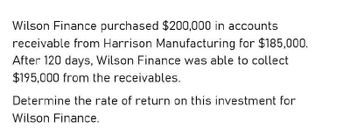

Transcribed Image Text:Wilson Finance purchased $200,000 in accounts

receivable from Harrison Manufacturing for $185,000.

After 120 days, Wilson Finance was able to collect

$195,000 from the receivables.

Determine the rate of return on this investment for

Wilson Finance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please need answer the accounting questionarrow_forwardSummit Holdings has $280,000 in accounts receivable that will be collected within 70 days. The company needs cash urgently and decides to factor them, receiving $260,000. Skyline Factoring Company, which took the receivables, collected $275,000 after 85 days. Find the rate of return on this investment for Skyline.arrow_forwardDe la mare company has $14000 in accountarrow_forward

- Please need answer the general accounting questionarrow_forwardBank Al Ain Islami provides a financing facility based on the Murabaha principle to Seif Construction to purchase specialized Equipment to be used for their construction project. The amount of financing is $15,000,000 at a constant rate of return of 10% for a period of 5 years. Due to some cash flow problems, Seif Construction paid the final installment in Year 6. Required: i. ii. Present a statement showing the amount of Net Receivable, Unearned Murabaha Income, and Murabaha Income for the whole duration of the contract.Prepare journal entries for Bank Al Ain Islami for the above transactions (YO-Y6).arrow_forwardLeven Corporation negotiated a short-term loan of $685,000. The loan is due in 10 months and carries a 6.86 interest rate. Use simple interest to calculate the total amount of thetioan. If necessary, round the answer to the nearest cent.arrow_forward

- To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year. The amount of working capital The current ratio The acid-test ratio The average collection period (The accounts receivable at the beginning of last year totaled $250,000) The average sales period (The inventory at the beginning of last year totaled $500,000) The operating cycle The total asset turnover. (The total assets at the beginning of last year were $2,420,000) The debt-to-equity ratio The times interest earned ratio The equity multiplier (The total stockholder’s equity at the beginning of last year totaled $1,420,000) 2. For both this year and last year A. Present the balance sheet in common-size format B. Present the income statement in common-size format down through net income Could you please help me answer Question 10, 2A, and 2B?arrow_forwardTo assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year. The amount of working capital The current ratio The acid-test ratio The average collection period (The accounts receivable at the beginning of last year totaled $250,000) The average sales period (The inventory at the beginning of last year totaled $500,000) The operating cycle The total asset turnover. (The total assets at the beginning of last year were $2,420,000) The debt-to-equity ratio The times interest earned ratio The equity multiplier (The total stockholder’s equity at the beginning of last year totaled $1,420,000) Could you please help me answer 7-9?arrow_forwardTo assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year. The amount of working capital The current ratio The acid-test ratio The average collection period (The accounts receivable at the beginning of last year totaled $250,000) The average sales period (The inventory at the beginning of last year totaled $500,000) The operating cycle The total asset turnover. (The total assets at the beginning of last year were $2,420,000) The debt-to-equity ratio The times interest earned ratio The equity multiplier (The total stockholder’s equity at the beginning of last year totaled $1,420,000) 2. For both this year and last year A. Present the balance sheet in common-size format B. Present the income statement in common-size format down through net income Could I please have somed help with Question 10 with a breakdown of the explanation?arrow_forward

- Wells Fargo Bank lent a newly graduated engineer $1,000 at i = 5 % per year for 4 years to buy home office equipment. From the bank's perspective (the lender), the investment in this young engineer is expected to produce an equivalent net cash flow of $ 282.01 for each of 4 years.This represents a 5 % per year rate of return on the bank's unrecovered balance. Compute the amount of the unrecovered investment for each of the 4 years using the rate of return, ROR, on: a. the unrecovered balance (the correct basis)arrow_forwardCloud Venture has a line of credit with a local bank of $75,000. The loan agreement calls for interest of 6 percent with a compensating balance requirement of 3 percent that is based on the total amount borrowed. What is the effective interest rate if the firm needs $58,000 for one year to finance a fixed asset purchase?arrow_forwardWhat is the average investment in receivables of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT