FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

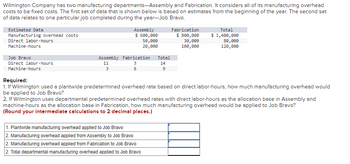

Transcribed Image Text:Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead

costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set

of data relates to one particular job completed during the year-Job Bravo.

Estimated Data

Manufacturing overhead costs

Direct labor-hours

Machine-hours

Job Bravo

Direct labor-hours

Machine-hours

Assembly

$ 600,000

50,000

20,000

Assembly Fabrication

11

3

3

6

Total

14

9

1. Plantwide manufacturing overhead applied to Job Bravo

2. Manufacturing overhead applied from Assembly to Job Bravo

2. Manufacturing overhead applied from Fabrication to Job Bravo

2. Total departmental manufacturing overhead applied to Job Bravo

Fabrication

$ 800,000

30,000

100,000

Total

$ 1,400,000

80,000

120,000

Required:

1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would

be applied to Job Bravo?

2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and

machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo?

(Round your intermediate calculations to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crosshill Company's total overhead costs at various levels of activity are presented below: Month April May June July Machine-Hours 70,000 60,000 80,000 90,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost Total Overhead Cost $200,200 $177,300 $223,100 $246,000 $ 48,000 21,000 108,300 $177,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Maintenance cost in July Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first betermine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.)arrow_forwardCrosshill Company's total overhead costs at various levels of activity are presented below: Month Machine- Hours Total Overhead Cost April 70,000 $ 202,200 May 60,000 $ 180,300 June 80,000 $ 224,100 July 90,000 $ 246,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) $ 52,200 Supervisory salaries (fixed) 21,000 Maintenance (mixed) 107,100 Total overhead cost $ 180,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first determine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.) 2. Using the high-low…arrow_forwardManjiarrow_forward

- Franklin, Inc. estimates manufacturing overhead costs for the Year 3 accounting period as follows. Equipment depreciation. Supplies Materials handling Property taxes Production setup Rent Maintenance Supervisory salaries $190,100. 20,000 33,200 a. Predetermined overhead rate b. Applied manufacturing overhead 13,300 20,100 43,000 39,000 281,300 The company uses a predetermined overhead rate based on machine hours. Estimated hours for labor in Year 3 were 201,000 and for machines were 128,000. Required a. Calculate the predetermined overhead rate. (Round your answer to 2 decimal places.) b. Determine the amount of manufacturing overhead applied to Work in Process Inventory during the Year 3 period if actual machine hours were 143,000. (Do not round intermediate calculations.) per machine hourarrow_forward*COULD YOU ANSWER PARTS D-G?* Bierce Corporation has two manufacturing departments--Machining and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates: Machining Finishing Total Estimated total machine-hours (MHs) 5,000 5,000 10,000 Estimated total fixed manufacturing overhead cost $ 10,000 $ 38,500 $ 48,500 Estimated variable manufacturing overhead cost per MH $ 2.30 $ 3.00 During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow: Job B Job K Direct materials $ 13,900 $ 8,200 Direct labor cost $ 21,400 $ 8,200 Machiningmachine-hours 3,750 1,250 Finishing machine-hours 1,250 3,750 Required: a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2…arrow_forwardWilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Job Bravo Direct labor-hours Machine-hours Assembly $ 1,170,000 65,000 26,000 Assembly Fabrication 14 6 6 9 Fabrication $ 1,430,000 39,000 130,000 Total 20 15 1. Plantwide manufacturing overhead applied to Job Bravo 2. Manufacturing overhead applied from Assembly to Job Bravo 2. Manufacturing overhead applied from Fabrication to Job Bravo 2. Total departmental manufacturing overhead applied to Job Bravo Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If…arrow_forward

- Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $1,337,500 $847,000 Estimated direct labor hours for year 24,200 Estimated machine hours for year 53,500 Actual factory overhead costs for August $108,410 $96,900 Actual direct labor hours for August 2,720 Actual machine hours for August 4,400 Required: a. Determine the factory overhead rate for Factory 1. b. Determine the factory overhead rate for Factory 2. c. Journalize the Aug. 31 entries to apply factory overhead to production in each factory. d. Determine the balances of the factory overhead accounts for each factory as of August 31, and indicate whether the…arrow_forwardcompany's total overhead cost at various levels of activity is presented below: Month March April May June Machine Hours 5,000 4,000 6,000 8,000 Total Overhead Cost $ 38,750 $ 31,000 $ 46,500 $ 55,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 4,000 machine-hour level of activity is as follows: Utilities (considered variable) $8,000 Supervisory salaries (considered fixed) $5,000 Maintenance (considered mixed) $18,000 Total overhead cost $31,000 Suppose the company uses the high-low method to estimate a cost formula for mixed costs. What is the total maintenance cost the company expects to incur at an activity level of 6,900 machine hours? ○ $29,600 $29,200 O $30,400 $29,900arrow_forwardManufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month, manufacturing overhead was $321,600. During that time, the company produced 14,600 units of the M-008 and 2,200 units of the M-123. The direct costs of production were as follows. Direct materials Direct labor M-008 M-123 $116,800 $ 88,000 116,800 44,000 Management determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year were as follows. Cost Driver Number of machine-hours Number of production runs Number of inspections. Total overhead Total $204,800 160,800 Costs $156, 600 70,000 95,000 $321,600 Activity Level M-898 M-123 2,000 8,000 20 30 20 20 Total 10,000 40 50 Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much of the overhead will be assigned to each product if direct…arrow_forward

- Blue Industries has two departments ABC and XYZ and uses a job cost system. In determining manufacturing costs, Blue applies manufacturing overhead to production orders based on direct labor cost during the departmental rates predetermined at the beginning of the year based on the annual budget. The budget for the two departments are as follows: ABC XYZ Direct Materials P630,000 P90,000 Direct Labor 180,000 720,000 Factory Overhead 540,000 360,000 Actual materials and labor costs for Job 678 were: Direct Materials P22,500 Direct Labor Dept ABC P7,200 Dept XYZ 10,800 18,000 What is the total manufacturing costs associated with Job 678?arrow_forwardWilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Assembly Fabrication Total Manufacturing overhead costs $3,200,000 $ 3,600,000 $ 6,800,000 Direct labor hours 100,000 60,000 160,000 Machine-hours 40,000 200,000 240,000 Job Bravo Assembly Fabrication Total Direct labor-hours 21 13 34 Machine - hours 13 16 29 Required: If Wilmington used a plantwide predetermined overhead rate based on direct labor - hours, how much manufacturing overhead would be applied to Job Bravo? If Wilmington uses departmental predetermined overhead rates with direct labor - hours as the allocation base in Assembly and machine - hours as the allocation base in Fabrication, how much manufacturing overhead would be…arrow_forwardAngler Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Assembly 248,888 DLH Finishing 154,000 DLH 68,000 MH 448,800 MH $440,000 Direct labor hours Machine hours Overhead costs Assume that Angler Industries allocates overhead using a plantvide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 1 direct labor hour and 3.90 machine hours in the Assembly Department, and 4.00 direct labor hours and 0.6 machine hours in the Finishing Department? Multiple Chaises O O O $21.50 $17.60 $2.00. $18.10 $ 677,680 $13.20.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education