FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

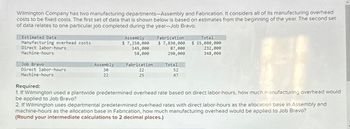

Transcribed Image Text:Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead

costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set

of data relates to one particular job completed during the year-Job Bravo.

Estimated Data

Manufacturing overhead costs

Direct labor-hours

Machine-hours

Job Bravo

Direct labor-hours

Machine-hours

Assembly

30

22

Assembly

$ 7,250,000

145,000

58,000

Fabrication

22

25

Fabrication

Total

$7,830,000 $ 15,080,000

87,000

290,000

Total

52

47

232,000

348,000

Required:

1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would

be applied to Job Bravo?

2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and

machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied to Job Bravo?

(Round your intermediate calculations to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Expo manufacturing has two production departments and two support departments. The number of employees for each department is as follows: $35,378 O $28,940 Human Resources Accounting Machining Producing Assembly Producing Human Resources shows a budget of $21,000 and accounting, $98,000, for the coming year. Support department costs are allocated on the basis of the number of employees. How much in total support costs would be allocated to assembly, using the step method? The Accounting department is allocated first. $119,000 $34,867 5 10 520 220arrow_forwardHijinx Company projected the following overhead costs and cost drivers: Overhead Item Expected Costs Cost Driver Expected Quantity Setup costs $121,500 Number of setups 50 Ordering costs 40,500 Number of orders 30 Maintenance 174,000 Machine-hours 600 Power 27,000 Kilowatt-hours 600 Total overhead cost 363,000 Direct Labor Hours 500 Hijinx contracted for two jobs, both of which were completed during the year. Production managers reported the following data in relation to these jobs: Job 1 Job 2 Direct materials $170,000 $120,000 Direct labor $14,000 $11,000 Direct labor-hours 300 220 Number of setups 25 23 Number of orders 20 13 Machine-hours 410 200 Kilowatt-hours 380 240 If Hijinx uses a company-wide predetermined overhead rate and the allocation basis is machine hour. How much overhead costs should be assigned to Job 1. Show the calculation steps and…arrow_forward*COULD YOU ANSWER PARTS D-G?* Bierce Corporation has two manufacturing departments--Machining and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates: Machining Finishing Total Estimated total machine-hours (MHs) 5,000 5,000 10,000 Estimated total fixed manufacturing overhead cost $ 10,000 $ 38,500 $ 48,500 Estimated variable manufacturing overhead cost per MH $ 2.30 $ 3.00 During the most recent month, the company started and completed two jobs--Job B and Job K. There were no beginning inventories. Data concerning those two jobs follow: Job B Job K Direct materials $ 13,900 $ 8,200 Direct labor cost $ 21,400 $ 8,200 Machiningmachine-hours 3,750 1,250 Finishing machine-hours 1,250 3,750 Required: a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that overhead rate. (Round your answer to 2…arrow_forward

- Assume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following excerpt from the standard cost card of its only product: Fixed manufacturing overhead During the most recent period, the following additional Information was available: • The total actual fixed overhead cost was $275,000. • The budgeted amount of fixed overhead cost was $285,000. • 46,000 direct labor-hours were actually used to produce 24,100 units. What is the standard hours allowed for the actual output? Multiple Choice O 92.000 hours 45,833 hours 48,200 hours Standard Hours. 2 hours. 47,500 hours Standard Rate $6.00 per hour Standard Cost $12.00arrow_forwardHelp [The following information applies to the questions displayed below.] Delph Company uses a job-order costing system and has two manufacturing departments-Molding and Fabrication. Th company provided the following estimates at the beginning of the year: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Molding 24,000 $ 760,000 $ 3.00 Fabrication 33,000 $ 220,000 $ 2.00 Total 57,000 $ 980,000 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs- Job D-70 and Job C-200. It provided the following information related to those two jobs: Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours Total $ 690,000 $ 380,000 24,000 Molding $ 370,000 $ 200,000 15,000 Fabrication $ 320,000 $ 180,000 9,000 Molding $ 200,000 $ 100,000 9,000 $ 200,000 $ 400,000 $ 260,000 24,000 $ 360,000 33,000 Fabrication Total…arrow_forwardBobby Pte Ltd charges manufacturing overhead to products by using a pre-determined overhead rate, computed on the basis of labour hours. The following data pertain to the current year:Budgeted manufacturing overhead $480,000Actual manufacturing overhead $440,000Budgeted labour hours 20,000Actual labour hours 16,000How much is overhead over-applied or under-applied, stating clearly whether it is over or under applied.arrow_forward

- Steel Company uses activity-based costing and reports the following for this year. Allocate overhead costs to a job that uses 40 machine hours and 30 direct labor hours. Activity Budgeted Cost Activity Cost Driver Budgeted Activity Usage Cutting $ 56,000 Machine hours (MH) 2,000 machine hours Assembly 240,000 Direct labor hours (DLH) 6,000 direct labor hours Total $ 296,000arrow_forwardI need help with this problem.arrow_forward[The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period’s estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Molding Fabrication Total Machine-hours 23,000 31,000 54,000 Fixed manufacturing overhead cost $ 760,000 $ 240,000 $ 1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $ 1.00 During the year, the…arrow_forward

- Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Job Bravo Direct labor-hours Machine-hours Assembly $ 600,000 50,000 20,000 Assembly Fabrication 11 3 3 6 Total 14 9 1. Plantwide manufacturing overhead applied to Job Bravo 2. Manufacturing overhead applied from Assembly to Job Bravo 2. Manufacturing overhead applied from Fabrication to Job Bravo 2. Total departmental manufacturing overhead applied to Job Bravo Fabrication $ 800,000 30,000 100,000 Total $ 1,400,000 80,000 120,000 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied…arrow_forwardAssume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following excerpt from the standard cost card of its only product: Standard Hours 2 hours Fixed manufacturing overhead During the most recent period, the following additional information was available: The total actual fixed overhead cost was $275,000. • The budgeted amount of fixed overhead cost was $285,000. 46,000 direct labor-hours were actually used to produce 24,120 units. How much was the fixed overhead volume variance? Multiple Choice $14,440 U Standard Cost $ 12.00arrow_forwardPractice Example 1: White Company has two departments, Cutting and Finishing. The company uses a job-order cost system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate on direct labor cost. At the beginning of the year, the company made the following estimates: Department Direct labor-hours Machine-hours Manufacturing overhead cost Direct labour cost Cutting 6,000 48,000 Rs360,000 Rs50,000 Finishing 30,000 5,000 Rs486,000 Rs270,000 Required: 1. Compute the predetermined overhead rate to be used in each department. 2. Assume that the overhead rates that you computed in (1) above are in effect. The job cost sheet for job 203, which was started and completed during the year, showed the following: Cutting 6 80 Rs500 Rs70 Department Finishing 20 4 Rs310 Rs150 Direct labor-hours Machine-hours Materials requisitioned Direct labor cost Compute the total overhead cost applied to Job…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education