FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

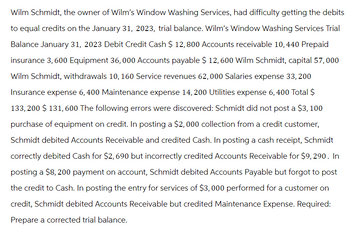

Transcribed Image Text:Wilm Schmidt, the owner of Wilm's Window Washing Services, had difficulty getting the debits

to equal credits on the January 31, 2023, trial balance. Wilm's Window Washing Services Trial

Balance January 31, 2023 Debit Credit Cash $ 12, 800 Accounts receivable 10, 440 Prepaid

insurance 3, 600 Equipment 36,000 Accounts payable $ 12, 600 Wilm Schmidt, capital 57,000

Wilm Schmidt, withdrawals 10, 160 Service revenues 62,000 Salaries expense 33, 200

Insurance expense 6, 400 Maintenance expense 14, 200 Utilities expense 6, 400 Total $

133,200 $ 131,600 The following errors were discovered: Schmidt did not post a $3, 100

purchase of equipment on credit. In posting a $2,000 collection from a credit customer,

Schmidt debited Accounts Receivable and credited Cash. In posting a cash receipt, Schmidt

correctly debited Cash for $2,690 but incorrectly credited Accounts Receivable for $9, 290. In

posting a $8, 200 payment on account, Schmidt debited Accounts Payable but forgot to post

the credit to Cash. In posting the entry for services of $3,000 performed for a customer on

credit, Schmidt debited Accounts Receivable but credited Maintenance Expense. Required:

Prepare a corrected trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- An excerpt from the trial balance of ABC Company shows the following: Accounts Receivable $1,000,000Allowance for Bad debts $10,000Sales $5,000,000Sales discount $3,000Sales returns and allowances $30,000 It is the companys policy to provide 1% of net credit sales as bad debts Cash sales amounted to $2,000,000 Questions: 1) Adjusting entries on December 312) Balance of Bad debts expense as of December 313) Balance of Allowance for Bad debts as of December 314) Should the adjustment was not made, what would be the effect on current assets?arrow_forwardI'm needing help on these questions for my Homework. Can anyone please help me?arrow_forwardWant the Answer please without any failarrow_forward

- i need the answer quicklyarrow_forwardCalculation of Net Realizable Value K. L. Dearborn owns a department store that has a $45,500 balance in Accounts Receivable and a $3,000 credit balance in Allowance for Doubtful Accounts. 1. Determine the net realizable value of the accounts receivable? 2. Assume that an account receivable in the amount of $500 was written off using the allowance method. Determine the net realizable value of the accounts receivable after the write-off?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- In the first year of operations, Ralph's Repair Service recognized $482,000 of service revenue earned on account. The ending accounts receivable balance was $88,900. Ralph estimates that 2% of sales on account will not be collected. During the year, Ralph wrote off a $200 receivable that was determined to be uncollectible. Assume there were no other transactions affecting accounts receivable. Required: a. What amount of cash was collected in Year 1? b. What amount of uncollectible accounts expense was recognized In Year 1? c. What will be Ralph's net realizable value of receivables on the December 31, Year 1 balance sheet? a. Cash collected b. Uncollectible accounts expense c. Net realizable value of receivablesarrow_forwardMukhi Don't upload any image pleasearrow_forwardplease provide correct and complete answer in text form with narration explanation calculation formulaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education