EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I need answer of this question accounting

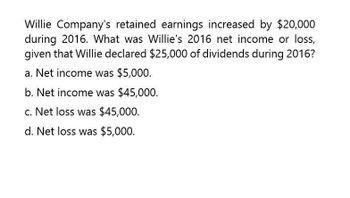

Transcribed Image Text:Willie Company's retained earnings increased by $20,000

during 2016. What was Willie's 2016 net income or loss,

given that Willie declared $25,000 of dividends during 2016?

a. Net income was $5,000.

b. Net income was $45,000.

c. Net loss was $45,000.

d. Net loss was $5,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answer financial Accountingarrow_forwardfor the year 2016, net income of carol company is 20,000 and dividends declared are $6,000; what is the retained earningsarrow_forwardWillie Company's retained earnings increased $13,000 during 2014. What was Willie's 2014 net income or loss given that Willie declared $24,000 of dividends during 2014?arrow_forward

- Please givearrow_forwardDetermine the Retained Earnings balance on December 31, 2015 based on the following: 2014 Revenues: $1,500,000 2016 Revenues: $1,800,000 Retained Earnings Balance (December 31, 2014): $380,000 2015 Expenses: $1,200,000 Total Liabilities: $285,000 Total Current Asset: $900,000 Dividend rate: 20% of net income. A : $620,000 B : $1,280,000 C : $500,000 D : $860,000arrow_forwardStosch Company's balance sheet reported assets of $117,000, liabilities of $30,000 and common stock of $27,000 as of December 31, 2015. If Retained Earnings on the December 31, 2016 balance sheet is $78,000 and Stosch paid a $29,000 dividend during 2016, then the amount of net income for 2016 was which of the following? $47,000 $60,000 $29,000 $18,000arrow_forward

- Blossom Construction Company earned $474,000 during the year ended June 30, 2017. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm's total retained earnings were $846,060 at the end of fiscal year 2017, what were the retained earnings on its balance sheet on July 1, 2016? Balance of retained earnings, July 1, 2016 $enter balance of retained earnings on July 1, 2016arrow_forwardAsure corp earned $339,000 during the year ended June 30, 2017. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm's total earnings were $842,250 at the end of fiscal year 2017, what were the retained earnings on its balance sheet on July 1,2016?arrow_forwardgive answer please teacherarrow_forward

- Strong construction company earned $439,000 during the year ended June 30, 2017. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm’s total earnings were $842,180 at the end of fiscal year 2017, what were the retained earnings on its balance sheet on July 1 ,2016?arrow_forwardBlossom Company has retained earnings of $ 1,540,000 at January 1, 2017. Net income during 2017 was $ 590,000 and cash dividends declared during the year totaled $ 129,000. Prepare a retained earnings statement for the year ended December 31, 2017. (List items that increase retained earnings fırst.) BLOSSOM COMPANY Retained Earnings Statement V : $ %24 %24 >arrow_forwardPortman Corporation has retained earnings of $675,000 at January 1, 2017. Net income during 2017 was $1,400,000, and a cash dividends declared and paid during 2017 totaled $75,000. Compute the retained earnings statement for the year ended December 30, 2017arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning