Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

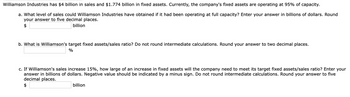

Transcribed Image Text:Williamson Industries has $4 billion in sales and $1.774 billion in fixed assets. Currently, the company's fixed assets are operating at 95% of capacity.

a. What level of sales could Williamson Industries have obtained if it had been operating at full capacity? Enter your answer in billions of dollars. Round

your answer to five decimal places.

$

billion

b. What is Williamson's target fixed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places.

%

c. If Williamson's sales increase 15%, how large of an increase in fixed assets will the company need to meet its target fixed assets/sales ratio? Enter your

answer in billions of dollars. Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to five

decimal places.

$

billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $ 78 38 40 12 14 Year a. Total value b. Laputa's equity 2 $ 98 48 50 15 17 3 $ 113 53 60 18 20 4 $ 118 58 60 18 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 13%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $ 73 33 40 12 19 a. Total value b. Laputa's equity Year 2 $93 43 50 15 22 3 $ 108 48 60 18 25 4 $ 113 53 60 18 27 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 60% by equity and 40% by debt. Its cost of equity is 18%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forwardCCC currently has sales of $28,000,000 and projects sales of $39,200,000 for next year. The firm's current assets equal $9,000,000 while its fixed assets are $8,000,000. The best estimate is that current assets will rise directly with sales while fixed assets will rise by $500,000. The firm presently has $3,600,000 in accounts payable, $1,800,000 in long-term debt, and $11,600,000 in common equity. All current liabilities are expected to change directly with sales. CCC plans to pay $1,000,000 in dividends next year and has a 5.0% net profit margin. Assuming the increase in fixed assets will occur, what is the most sales could equal next year without using discretionary sources of funds? (Round your answer to the nearest dollar.) $30,330,300 $27,300,000 $33,619,950 $24,103,170 $25,721,514arrow_forward

- Assume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and its working capital is $360,000. Answer each of the following questions independently, always referring to the original information. Required: If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? Note: Do not round intermediate calculations. Round "Current ratio" to 1 decimal place. If the firm sells inventory that was purchased for $50,000 at a cash price of $64,000, what will its new acid-test ratio be? Note: Do not round intermediate calculations. Round your answer to 1 decimal place.arrow_forwardThe Western Division of Claremont Company had net operating income of $154,000 and average invested assets of $557,000. Claremont has a required rate of return of 14.75 percent. Western has an opportunity to increase operating income by $48,000 with a $84,000 investment in assets. Compute Western Division's return on investment and residual income currently and if it undertakes the project. Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round your Residual Income (Loss) answers to the nearest whole dollar. Return on Investment (ROI) Residual Income (Loss) Current % Proposed Projectarrow_forwardWilliamson Industries has $3 billion in sales and $2.826 billion in fixed assets. Currently, the company's fixed assets are operating at 90% of capacity. a. What level of sales could Williamson Industries have obtained if it had been operating at full capacity? Enter your answer in billions of dollars. Round your answer to five decimal places. $ billion b. What is Williamson's target fixed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % c. If Williamson's sales increase 13%, how large of an increase in fixed assets will the company need to meet its target fixed assets/sales ratio? Enter your answer in billions of dollars. Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to five decimal places. billion $arrow_forward

- Vishanuarrow_forwardes Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below: Sales Net operating income Average operating assets Required: 1. Compute the margin. Note: Round your answer to 2 decimal places. 2. Compute the turnover. Note: Round your answer to 2 decimal places. 3. Compute the return on investment (ROI). Note: Round your intermediate calculations and final answer to 2 decimal places. 1. Margin 2. Turnover 3. ROI % $ 18,500,000 $ 6,000,000 $ 35,700,000 %arrow_forwardGolden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the profit margin? Part B: What is the investment turnover? Part C: What is the return on investment? Part D: What is the residual income? Part E: Explain each of the calculations you just performed (a-d).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education