FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

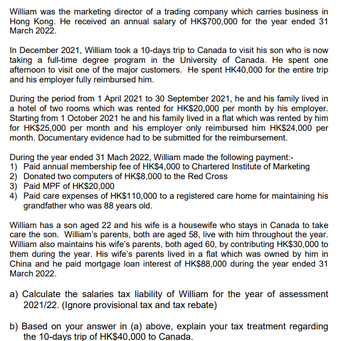

Transcribed Image Text:William was the marketing director of a trading company which carries business in

Hong Kong. He received an annual salary of HK$700,000 for the year ended 31

March 2022.

In December 2021, William took a 10-days trip to Canada to visit his son who is now

taking a full-time degree program in the University of Canada. He spent one

afternoon to visit one of the major customers. He spent HK40,000 for the entire trip

and his employer fully reimbursed him.

During the period from 1 April 2021 to 30 September 2021, he and his family lived in

a hotel of two rooms which was rented for HK$20,000 per month by his employer.

Starting from 1 October 2021 he and his family lived in a flat which was rented by him

for HK$25,000 per month and his employer only reimbursed him HK$24,000 per

month. Documentary evidence had to be submitted for the reimbursement.

During the year ended 31 Mach 2022, William made the following payment:-

1) Paid annual membership fee of HK$4,000 to Chartered Institute of Marketing

2) Donated two computers of HK$8,000 to the Red Cross

3) Paid MPF of HK$20,000

4) Paid care expenses of HK$110,000 to a registered care home for maintaining his

grandfather who was 88 years old.

William has a son aged 22 and his wife is a housewife who stays in Canada to take

care the son. William's parents, both are aged 58, live with him throughout the year.

William also maintains his wife's parents, both aged 60, by contributing HK$30,000 to

them during the year. His wife's parents lived in a flat which was owned by him in

China and he paid mortgage loan interest of HK$88,000 during the year ended 31

March 2022.

a) Calculate the salaries tax liability of William for the year of assessment

2021/22. (Ignore provisional tax and tax rebate)

b) Based on your answer in (a) above, explain your tax treatment regarding

the 10-days trip of HK$40,000 to Canada.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- This year (2022), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $72,600 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) $ 1,200 Interest paid on accumulated student loans 2,820 Cost of purchasing a delivery uniform 1,420 Cash contribution to State University deliveryman program 1,310 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Please post the right solution for this problem, for year 2022. This is for Tax 4001. Thank you.arrow_forwardCook is a teacher. His job at a boarding school requires him to live in a house in the school grounds. The house cost £70000 three years ago and its annual value is £650. In 2020/21 the company pays an electricity bill of £550, a gas bill of £400, a gardener’s bill of £750 and redecoration costs £1800. Cook makes a monthly contribution of £50 for his accommodation. He earns a gross salary of £28850 and £1450 occupational pension contributions. Requirement: Calculate Cook’s taxable employment income for 2020/21.arrow_forwardRasheed works for Company A, earning $404,000 in salary during 2020. Assuming he is single and has no other sources of income, what amount of FICA tax will Rasheed pay for the year? (Round your intermediate and final answer to the nearest whole dollar amount.) Amount of FICA taxarrow_forward

- Carmen SanDiego, a U.S. citizen, is employed by General Motors Corporation, a U.S. corporation. On April 1, 2020, GM relocated Carmen to its Brazilian operations for the remainder of 2020. Carmen was paid a salary of $132,000 and was employed on a 5-day-week basis. As part of her compensation package for moving to Brazil, Carmen also received a housing allowance of $28,000. Carmen’s salary was earned ratably over the 12-month period. During 2020 Carmen worked 260 days, 195 of which were in Brazil and 65 of which were in Michigan.How much of Carmen’s total compensation is treated as foreign source income for 2020? (Do not round intermediate calculations.)arrow_forward7-Ahmed uses his own car for business travel. During 2019/20, Ahmed drove £20,000 miles while performing of his duties. Ahmed's employer paid him 35p a mile. Which one of the following is Ahmed's taxable benefit from mileage allowance as per the UK tax laws? a. £2,500 b. £7,000 c. £4,500 d. None of the optionsarrow_forwardLucy is the Finance Director for Capital Products Pty Ltd. Lucy was previously located at the head office in Adelaide but is currently working from the Canadian office, having relocated there on 1 August 2020. Capital Products anticipate that Lucy will head up the Canadian office for one year with an option to stay for another one year. Paula’s contract with Capital Products entitles her to a salary of $600,000 for 2020/21. This is paid at the rate of $50,000 per month. Lucy sells her shares in Australian companies before she leaves Australia and makes a capital gain of $16,000. She makes another capital gain of $28,000 in January 2021 when she sells shares in Canadian companies. Luc’s husband and two small children will remain in Adelaide. Lucy will rent a studio apartment in Canada and will keep the Adelaide home. Question Discuss Lucy’s status (resident or not) for Australian tax purposes for 2020/21 and the tax implications of the transfer to Canada.arrow_forward

- Carmen SanDiego, a U.S. citizen, is employed by General Motors Corporation, a U.S. corporation. On April 1, 2020, GM relocated Carmen to its Brazilian operations for the remainder of 2020. Carmen was paid a salary of $145,000 and was employed on a 5-day- week basis. As part of her compensation package for moving to Brazil, Carmen also received a housing allowance of $31,250 Carmen's salary was earned ratably over the 12-month period. During 2020 Carmen worked 260 days, 195 of which were in Brazil and 65 of which were in Michigan. How much of Carmen's total compensation is treated as foreign source income for 2020? (Do not round Intermediate calculations) Total foreign source compensationarrow_forwardMio was transferred from New York to Germany. He lived and worked in Germany for 340 days in 2018. Mio's salary for 2018 is $190,000. In your computation, round any division to four decimal places before converting to a percentage. For example, .473938 would be rounded to .4739. If required, round your final answer to the nearest dollar.Assume a 365-day year. Mio's foreign earned income exclusion isarrow_forward40) Jay Z earned $500,000 for a one-night singing gig in Macau, a zero-tax jurisdiction. He immediately wired those funds to Butterfield Bank in the British Virgin Islands as a three-year bank deposit. Mr. Z earns 7% on her money each year. What is the value of her deposit after three years? (42/19) a) $500,000 b) $507,000 c) $535,000 d) $572,450 e) $612,522arrow_forward

- During 2023, Jacob (a self-employed Legal consultant) went from Milwaukee to Hawaii on business. Preceding a five-day business meeting, he spent four days vacationing at the beach. Excluding the vacation costs, his expenses for the trip are: Airfare $3,200 Lodging 900 Meals 800 Entertainment 600 Presuming no reimbursement, deductible expenses are:arrow_forwardMr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not receive an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses. View the expenses. View the additional information. Required Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications. k First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage. Full capital cost allowance Employment-related usage proportion Deductible CCA on automobile Expenses Airline tickets Office supplies and shipping expenses Purchase of laptop computer Client entertainment Cost of new automobile (not zero-emission) Operating expenses of automobile $ 2,380 420 2,095 1,770 47,000 10,700 C X Additional Information Assume that $390 of the…arrow_forward(a) and (b)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education