FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

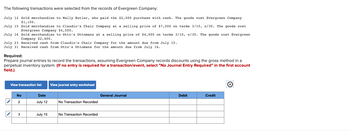

Transcribed Image Text:The following transactions were selected from the records of Evergreen Company:

July 12 Sold merchandise to Wally Butler, who paid the $2,000 purchase with cash. The goods cost Evergreen Company

$1,100.

July 15

Sold merchandise to Claudio's Chair Company at a selling price of $7,000 on terms 3/10, n/30. The goods cost

Evergreen Company $4,500.

July 16

Sold merchandise to Otto's Ottomans at a selling price of $4,000 on terms 3/10, n/30. The goods cost Evergreen

Company $2,400.

July 23 Received cash from Claudio's Chair Company for the amount due from July 15.

July 31 Received cash from Otto's Ottomans for the amount due from July 16.

Required:

Prepare journal entries to record the transactions, assuming Evergreen Company records discounts using the gross method in a

perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account

field.)

View transaction list View journal entry worksheet

No

✓ 2

3

Date

July 12

July 15

No Transaction Recorded

No Transaction Recorded

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When the buyer pays the freight costs, the entry to record the payment under a perpetual inventory system would include a debit to _______. Question content area bottom Part 1 A. Freight In B. Inventory C. Purchases Discounts D. Delivery Expensearrow_forwardUnder a perpetual inventory system, acquisition of inventory is dented to the purchases account. True or false?arrow_forwardWhat is the inventory system called that continuously discloses the amount of inventory? Group of answer choices physical perpetual retail periodicarrow_forward

- Jenbright Incorporated adopted the dollar-value LIFO method last year. Last year's ending inventory was $53,700. The ending inventory for the current year at year-end (FIIFO) costs is $98,000 and on a dollar-value LIFO basis is $76,520. Based on this information, prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. Prepare the journal entry required to adjust Jenbright's ending inventory from a FIFO to a dollar-value LIFO basis. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the adjusting entry for the current year. Account Year-endarrow_forwardWhat is the inventory system called that discloses the amount of inventory on hand ONLY at the end of the accounting period when a physical count is taken? Group of answer choices retail physical periodic perpetualarrow_forwardThe Inventory module window has journal icons for Select one: O a. inventory sales and inventory purchases b. item assembly and inventory adjustments O c. inventory sales and inventory adjustments O d. all of the above Show Transcribed Text You should use the adjustments journal to record - Select one: O a. adjustments to inventory purchase prices from the supplier as an allowance for damages O b. adjustments to inventory sale prices to customers as an allowance for damages c. adjustments to inventory in stock for damaged goods O d. all of the abovearrow_forward

- What are the two journal entries involved when recording the sale of inventory when using the perpetual inventory system?arrow_forwardWhich of the following statements is true for a company that uses a periodic inventory system? a.The purchase of inventory requires a debit to Inventory. b.The return of defective inventory requires a debit to Purchase Returns and Allowances. c.The payment of a purchase within the discount period requires a credit to Purchase Discounts. d.Any amounts paid for freight are debited to Inventory.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education