Wildhorse's Gift Shop uses a perpetual inventory system and the FIFO cost formula for valuing inventory. The company is now in the process of comparing the cost of its inventory with its net realizable value. The following data are available at Wildhorse's Gift Shop's year end, December 31: Clothing Units Unit Cost 91 $8 76 20 2017 Greeting cards 47 4 60 12 Jewellery Stuffed toys (a) Net Realizable Value per Unit Lower of cost and net realizable value $6 $ 27 5 Determine the lower of cost and net realizable value of the ending inventory assuming Wildhorse's Gift Shop applies LCNRV on individual items. 38

Wildhorse's Gift Shop uses a perpetual inventory system and the FIFO cost formula for valuing inventory. The company is now in the process of comparing the cost of its inventory with its net realizable value. The following data are available at Wildhorse's Gift Shop's year end, December 31: Clothing Units Unit Cost 91 $8 76 20 2017 Greeting cards 47 4 60 12 Jewellery Stuffed toys (a) Net Realizable Value per Unit Lower of cost and net realizable value $6 $ 27 5 Determine the lower of cost and net realizable value of the ending inventory assuming Wildhorse's Gift Shop applies LCNRV on individual items. 38

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 7RE: Uncle Butchs Hunting Supply Shop reports the following information related to inventory: Calculate...

Related questions

Topic Video

Question

Transcribed Image Text:Wildhorse's Gift Shop uses a perpetual inventory system and the FIFO cost formula for valuing inventory. The company is now in the

process of comparing the cost of its inventory with its net realizable value. The following data are available at Wildhorse's Gift Shop's

year end, December 31:

Clothing

Units

Unit Cost

91

$8

76

20

2017

Greeting cards 47

4

60

12

Jewellery

Stuffed toys

(a)

Net Realizable Value

per Unit

Lower of cost and net realizable value

$6

$

27

5

Determine the lower of cost and net realizable value of the ending inventory assuming Wildhorse's Gift Shop applies LCNRV on

individual items.

38

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

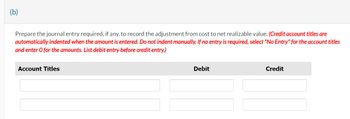

Transcribed Image Text:(b)

Prepare the journal entry required, if any, to record the adjustment from cost to net realizable value. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts. List debit entry before credit entry.)

Account Titles

Debit

Credit

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning