FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

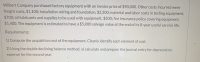

- Find acquisition cost

- using double declining balance method prepare

journal entry for deprecation expense in second year

Transcribed Image Text:Wilbert Company purchased factory equipment with an invoice price of $90,000. Other costs incurred were

freight costs, $1,100; installation wiring and foundation, $2,200; material and labor costs in testing equipment,

$700; oil lubricants and supplies to be used with equipment, $500; fire insurance policy covering equipment,

$1,400. The equipment is estimated to have a $5,000 salvage value at the end of its 8-year useful service life.

Requirements:

1) Compute the acquisition cost of the equipment. Clearly identify each element of cost.

2) Using the double declining balance method: a) calculate and prepare the journal entry for depreciation

expense for the second year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sepreciation Caict ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false MSU login O Digital University .. O Tenant Portal - Login 国Reac eBook Show Me How E Print Item Units-of-Activity Depreciation A truck acquired at a cost of $250,000 has an estimated residual value of $15,000, has an estimated useful life of 47,000 miles, and was driven 3,800 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. a. The depreciable cost b. The depreciation rate per mile c. The units-of-activity depreciation for the year 5:39 AM 36% 4°F A @ O E O 12/17/2021 24 & 4. 6. 7. 81 近arrow_forwardNonearrow_forwardRecording Entries Using Composite Depreciation Method California Utilities owns a power plant that consists of the following assets, all acquired on January 1. Building Machinery Asset 171,000 Other equipment 90,000 a. Cost $540,000 Required a. Compute the total straight-line depreciation for the first year on all items combined. b. Compute the composite depreciation rate (based on cost) and the composite life. Estimated Estimated Residual Value Life (Years) $18,000 30 10 6 c. Provide the entry to record composite depreciation for the first year. d. Assume that all of the Other equipment was sold three years later for $10,800 cash. Prepare the entry for the sale of that equipment. Note: Round answers to the nearest whole dollar. b. Straight-Line Depreciation Expense Building Machinery C. 0 9,000 Other Equipment Total depreciation expense for Year 1 $ Composite depreciation rate $ Composite life (in years) $ tA Numerator Composite depreciation rate x 0 x $ 0 0 0 Denominator 0 / $ 0 / $…arrow_forward

- Subject-accountarrow_forwardtrue or false questionsarrow_forwardIdentify which of the following statement is correct for perpetual inventory system? Under the perpetual Inventory system, on the purchase of Inventory purchase account is debited. When valuing ending Inventory under a perpetual Inventory system, oldest units purchased during the period using FIFO are allocated to the cost of goods sold when units are sold. When valuing ending Inventory under a perpetual Inventory system, weighted average cost method requires that a new weighted average unit cost be calculated after every sale. 09/03/2024 15:01 When valuing ending Inventory under a perpetual Inventory system, valuation using weighted average is the same as the valuation using weighted average under the periodic Inventory system.arrow_forward

- Depreciation under Diminishing Balance Method is calculated on? A. Scrap Value B. Book Value C. Cash Account D. Repair I will downvote for sure if u answer Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardE Print Item Impaired Goodwill and Amortization of Patent On April 1, a patent with an estimated useful economic life of 12 years was acquired for $115,200. In addition, on December 31, it was estimated that goodwill of $56,500 was impaired. a. Record the acquisition of patent. If an amount box does not require an entry, leave it blank. April 1 b. Journalize the adjusting entry on December 31 for the amortization of the patent rights. Do not round intermediate calculations. If an amount box does not require an entry, leave it blank, Dec, 31 c. Journalize the adjusting entry on December 31 for the impaired goodwill. If an amount box does not require an entry, leave it blank. Dec. 31arrow_forwardThe entry to record depreciation includes a debit to the ________ account. A. Depreciation Expense B. Cash C. Equipment D. Accumulated Depreciationarrow_forward

- Account, Labels and amount descriptions _____________________ •According received •Accumulated deprecating- equipment •Cash •Equipment •Finished goods •Materials •Prepaid insurance •Supplies •Work in progress •Labels •August 31 •For the month ended august 31 •Current assets •Inventories •Amount descriptions •Total inventories •Total current assetsarrow_forwardRecording depreciation for a plant asset conforms to which accounting principle/assumption? OA. Matching Principle B. Time Period Assumption OC. Full Disclosure Principle OD. Revenue Recognition Principle***arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2023. During that time, he earned $90,000 of self-employment income. On April 1, 2023, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $198,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Self-employment/FICA taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education