FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

rr

Transcribed Image Text:led

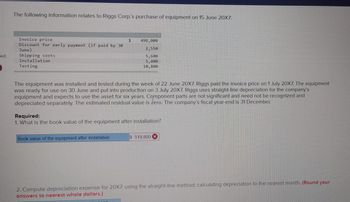

The following information relates to Riggs Corp.'s purchase of equipment on 15 June 20X7:

Invoice price

Discount for early payment (if paid by 30

June)

Shipping costs

Installation

Testing

$

The equipment was installed and tested during the week of 22 June 20X7. Riggs paid the invoice price on 1 July 20X7. The equipment

was ready for use on 30 June and put into production on 3 July 20X7. Riggs uses straight-line depreciation for the company's

equipment and expects to use the asset for six years. Component parts are not significant and need not be recognized and

depreciated separately. The estimated residual value is zero. The company's fiscal year-end is 31 December.

Book value of the equipment after installation

498,000

2,550

5,600

5,400

10,800

Required:

1. What is the book value of the equipment after installation?

2017

$ 519,800 X

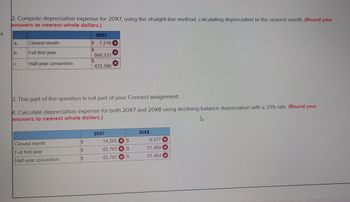

2. Compute depreciation expense for 20X7, using the straight-line method, calculating depreciation to the nearest month. (Round your

answers to nearest whole dollars.)

Transcribed Image Text:d

2. Compute depreciation expense for 20X7, using the straight-line method, calculating depreciation to the nearest month. (Round your

answers to nearest whole dollars.)

a.

b.

C.

Closest month

Full first year

Half-year convention

Closest month

Full first year

Half-year convention

SASS

3. This part of the question is not part of your Connect assignment.

4. Calculate depreciation expense for both 20X7 and 20X8 using declining-balance depreciation with a 33% rate. (Round your

answers to nearest whole dollars.)

4

$

$

20X7

$ 7,219 X

$

$

866,333

433,166

$

20X7

14,295 $

85,767

$

85,767

$

20X8

9,577 X

57,469

57,464

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education