FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

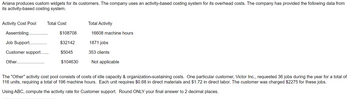

Transcribed Image Text:Ariana produces custom widgets for its customers. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from

its activity-based costing system.

Activity Cost Pool Total Cost

Assembling...

Job Support..

Customer support......

Other.........

$108708

$32142

$5045

$104630

Total Activity

16608 machine hours

1871 jobs

353 clients

Not applicable

The "Other" activity cost pool consists of costs of idle capacity & organization-sustaining costs. One particular customer, Victor Inc., requested 36 jobs during the year for a total of

116 units, requiring a total of 196 machine hours. Each unit requires $0.68 in direct materials and $1.72 in direct labor. The customer was charged $2275 for these jobs.

Using ABC, compute the activity rate for Customer support. Round ONLY your final answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- compute the customer level operating income of this customer for abc corporation using the companys activity based costing systemarrow_forwardimplementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system Driver and guard wages Vehicle operating expense Vehicle depreciation. Customer representative salaries and i expenses office expenses Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses Administrative expenses Total cost The distribution of resource consumption across the activity cost pools is as follows. Pickup and Delivery 35% 5% $1,000,000 510,000 390,000 Driver and guard wages Vehicle…arrow_forwardYKPBNO412 Corp., manufactures and sells two products: Product TOTEMO and Product SUGOI. YKPBNO412 has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: (ID#60553) Activity Cost Pools Labor-related Production orders Order size Multiple Choice O O $535,150 $914,020 $467,602 Activity Measures DLHS orders MHS $1,038,880 Estimated Overhead Cost $ 132,400 62,430 976,450 $1,171,280 (Baruch College Exam) Q) What is YKPBNO412's total overhead applied to Product SUGOI under activity-based costing? (choose the closest answer) (Round your intermediate calculations to 2 decimal places.) Product TOTEMO 1,800 1,000 3,700 Expected Activity Product SUGOI 900 600 3,400 Total 2,700 1,600 7,100 HEarrow_forward

- Helm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhe Selling and administrative expenses Activity Cost Pools Customer Support 85% 20% Order Size 5% 60% S O $348,000 O $188,500 $29,000 O $84,000 S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. 480,000 100,000 580,000 You have been asked to complete the first-stage allocation of costs to the activity cost pools. Total 100% 100% How much cost, in total, would be allocated in the first-stage allocation to the Order Size activity cost pool? Next ▸arrow_forwardYour company uses an activity-based costing system for its overhead costs. Thefollowing data is from its activity-based costing system. Activity Cost Pools Activity Rate Construction ........... $35.50 Per DLH Office support....... $580.00 Per Order Customer Support........ $250.00 Per Customer Revenue related to job $35,000.00 Number of orders 5 Traceable costs........ $7,500 DLH used 635 What is customer margin for this client? (Round to the nearest dollar if necessary.) Group of answer choices $25,693 $1,808 $9,308 $2,058arrow_forwardPlease help me with show all calculation thankuarrow_forward

- The following figure depicts the complete system that Office Inc. uses to estimate the total cost of each office desk and office chair that it produces. How many cost pools does Office Inc.'s 2-stage costing system use for Office Chair objects? A. 7 B. 0 C. 6 D. 5 E. 4 F. 2 G. 1 H. 3 I. 8arrow_forwardA cost driver is used to allocate support department expenses. Match each of the following cost drivers with the appropriate department. Clear All Number of work orders Number of employees Number of payroll checks Number of purchase requisitions Payroll Accounting Maintenance President's Office Purchasing Human Resourcesarrow_forwardA company manufactures and sells two products: Product T8 and Product P4. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:arrow_forward

- 2arrow_forwardArial Company has two products: A and B. The company uses activity-based costing. The total cost and activity for each of the company's three activity cost pools are as follows: Total Activity Activity Cost Pool Total Cost Product A Product B Total Activity 1 $ 38,000 800 500 1,300 Activity 2 $ 29,040 780 600 1,380 Activity 3 $ 26,600 900 650 1,550 The activity rate under the activity-based costing system for Activity 3 is:arrow_forwardHelm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhead Selling and administrative expenses $304,500 $493,000 Activity Cost Pools Customer Support 85% 20% O $116,000 O $428,000 Order Size 5% 60% S S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost 480,000 100,000 580,000 Total 100% 100%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education